Digital Asset Investment Products Saw $1.18B Inflows Thanks to Bitcoin ETF Effect

Key Points:

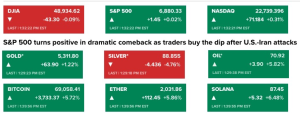

- Last week, digital asset investment products surged to $1.18 billion, indicating strong market momentum.

- ETP trading volumes hit a record $17.5 billion, comprising almost 90% of daily volumes on reliable exchanges.

- Bitcoin attracted $1.16 billion in inflows, constituting 3% of total assets.

In the past week, digital asset investment products witnessed substantial growth, attracting inflows totaling $1.18 billion.

Digital Asset Investment Products Saw $1.18 Billion Inflows

Although this figure falls short of the record-breaking $1.5 billion observed at the launch of futures-based Bitcoin ETFs in October 2021, it underscores the continued momentum in the market.

Notably, Exchange-Traded Product (ETP) trading volumes reached unprecedented heights, hitting $17.5 billion—marking the highest on record. This surge contrasts sharply with the 2022 weekly average of $2 billion and accounted for nearly 90% of daily trading volumes on reputable exchanges last Friday, a notable deviation from the typical 2%-10% range.

The United States led the influx, with digital asset investment products totaling $1.24 billion, while Switzerland recorded $21 million in inflows. Conversely, Europe and Canada experienced outflows, with Canada at $44 million, Germany at $27 million, and Sweden at $16 million. Analysts suspect these outflows were driven by basis traders transitioning from Europe to the U.S.

Bitcoin remained a primary focus, attracting $1.16 billion in inflows, constituting a significant 3% of total assets under management (AuM). Conversely, short-Bitcoin products saw minor inflows amounting to $4.1 million. Ethereum and XRP also saw positive traction, with inflows of $26 million and $2.2 million, respectively. However, Solana lagged behind, garnering only $0.5 million in inflows last week.

In parallel, blockchain equities experienced robust investor interest, accumulating significant inflows of $98 million. This surge contributed to a cumulative inflow of $608 million over the past seven weeks, reflecting the enduring appeal of blockchain-related assets in the digital asset investment products landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |