Market Overview (Feb 19–Feb 25): Ethereum Staking Trend and StarkWare’s Vesting Schedule Change

Key Points

- The Federal Reserve’s recent meeting showed cautious optimism about the economy, indicating no rush to lower interest rates.

- Ethereum staking has emerged as a significant trend in the crypto market, with the ETH stake rate doubling since the beginning of 2023.

- StarkWare has changed the vesting schedule for $STRK tokens, aiming to reduce selling pressure by vesting a small amount each month until 2027.

Dive into a comprehensive recap of the crypto market, with insights on Ethereum staking, Binance’s latest launchpool, StarkWare’s vesting schedule change, and more!

Last week’s highlights big news (Feb 19–Feb 25)

In South Korea, both major political parties are ramping up their efforts to encourage public investment in ETFs ahead of the parliamentary elections on April 10, 2024. They are also advocating for financial organizations to deploy BTC ETF funds.

In other news, Tether has printed an additional 1 billion USDT. The explanation from the CEO remains the same: they are pre-printed but not yet issued. This move shows the increasing demand for stablecoins in the crypto market.

Investment fund a16z has made a significant investment of $100 million in EigenLayer, a leading Ethereum restaking protocol in terms of total locked value (TVL). This investment underscores the increasing interest in Ethereum and its associated protocols.

Meanwhile, Kraken is pushing back against the SEC. They’ve submitted a request to dismiss the SEC’s lawsuit, arguing that the SEC is overstepping its boundaries and does not have congressional authority to manage crypto.

In a significant shift, Circle will stop supporting USDC on TRON. While existing USDC on TRON can still be sent and traded until the end of February 2025, no new USDC will be issued on the platform.

In legal news, the Supreme Court of Podgorica in Montenegro has ordered Do Kwon to be extradited to the United States. The House Financial Services Committee has also passed a bill to prohibit the U.S. government from issuing a national digital currency (CBDC), citing concerns that it could be used as a financial surveillance tool.

Despite sanctions from the U.S., BitRiver, a leading Bitcoin mining company in Russia, continues to implement new projects. Their CEO is confident in the profit potential from mining Bitcoin in Russia, especially after the upcoming halving event.

Positive news from Bitwise: their Bitcoin ETF has been approved for financial advisors at a nationwide consultancy managing $30 billion. This is a sign of the growing acceptance of crypto assets among traditional financial institutions.

Japan is also moving closer to allowing venture capital (VC) firms to hold crypto assets, signaling a potential boom in crypto-related startups in the country.

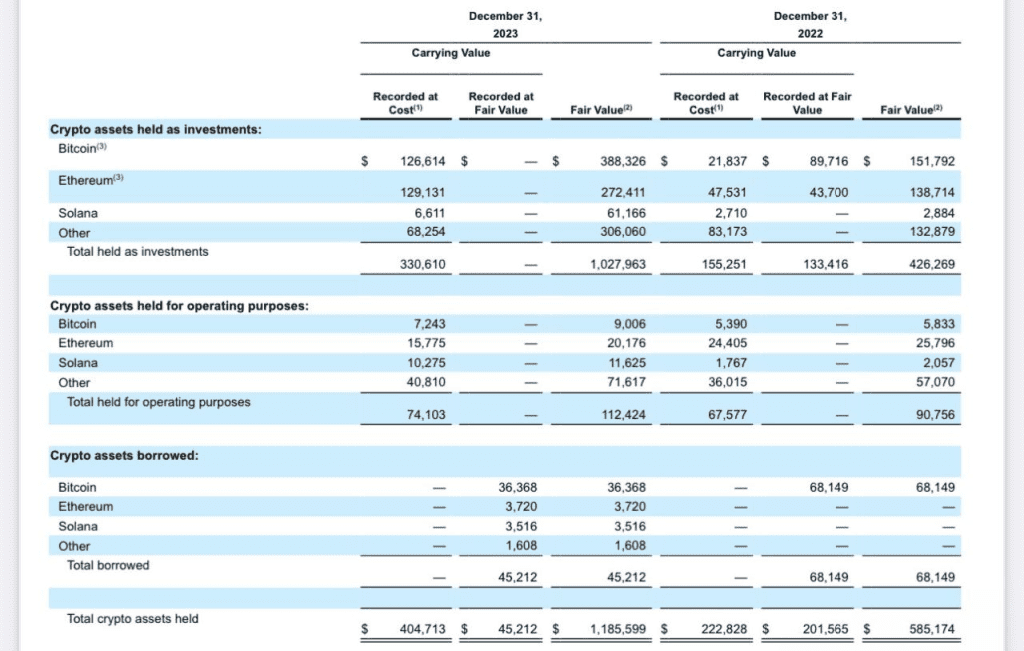

In earnings news, Coinbase’s Q4 report shows a significant increase in the company’s own crypto holdings, from ~$426 million at the end of 2022 to over $1 billion at the end of 2023.

However, it’s not all positive news. The National Banking and Securities Commission of Honduras (CNBS) has issued a ban on domestic financial organizations trading or holding digital assets, citing a lack of regulations on crypto. In addition, Binance has announced its 47th project on Binance Launchpool: Portal (PORTAL).

Read more: Bitcoin Spot ETF Explained: All Things You Need To Know!

Macroeconomics (Feb 19–Feb 25)

In the recently published minutes of the Federal Reserve’s (FED) meeting, officials expressed a cautious optimism about the state of the economy. They stated that they are not in a hurry to lower interest rates, indicating a sense of confidence that inflation is cooling down.

The FED’s stance represents a delicate balance between optimism and caution. This balance is evident in the officials’ desire to see more evidence before initiating interest rate cuts. They also suggested that the interest rate hike cycle may have come to an end.

These observations align with the comments made by FED Chairman Powell, reinforcing the consistency in the Federal Reserve’s approach to managing the economy.

Tuesday, February 27

- S&P Case-Shiller Home Price Index (20 cities)

Wednesday, February 28

- GDP (first revision): This is the second version of Q4 GDP after collecting more details but the estimate is still kept at 3.3%

- Fed Atlanta Chairman Raphael Bostic speaks

Thursday, February 29

- PCE Inflation: Estimate: 2.4% | Last month: 2.6%

- Core PCE: Estimate: 2.8% | Last month: 2.9%

- Fed Atlanta Chairman Raphael Bostic speaks

- Fed Chicago Chairman Austan Goolsbee speaks

- Fed Cleveland Chairman Loretta Mester speaks

- Fed Kansas City Chairman Jeff Schmid speaks

Friday, March 1

- Fed Dallas Chairman Lorie Logan speaks

- Fed Governor Chris Waller speaks

- Fed Atlanta Chairman Raphael Bostic speaks

- Fed San Francisco Chairman Mary Daly speaks

Read more: Bitcoin Price Prediction For 2024, 2025, 2026, and 2030: Super Crypto Bull Run

Prediction Market Crypto (Feb 19–Feb 25)

Ethereum Staking and the Emerging Ponzi Game

The biggest Ponzi game in this cycle is Ethereum staking. LSD, LST, retaking, and LRT all contribute to this. Since the beginning of 2023, the ETH stake rate has doubled, reaching an impressive 26%. Aside from staking ETH on protocols, there’s also a safer option – airdrop farming.

We’re also eagerly awaiting the Decun update, which is expected to enhance the power of ETH. The event is expected to mainnet on March 13. Notably, ARB, OP, and other famous Layer 2s stand to benefit from this. Among the undervalued L2s currently is Metis. You can also farm airdrops from other Layer 2s like Linea and zkSync.

Binance’s Latest Launchpool and the Gaming Narrative

$PORTAL is the latest launchpool from Binance, with a strong narrative in gaming. The preceding Launchpool was $PIXEL, also catering to the gaming realm. Recently, $MAVIA’s future and $RON, both from the same field, have been listed.

The $PORTAL project operates like Web2’s Garena, creating a platform where users only need one account to play various games, trade, buy, sell, and exchange through many different networks, including $ETH, $SOL, and $MATIC.

This project is in its early stages, being less than a year old. Most of the features are still in the planning phase, and the services and products are not yet available. Despite this, the community has garnered over 500k members, but currently, it only has a website and X as the primary social channels.

StarkWare’s Vesting Schedule Change

StarkWare recently announced a change in the vesting schedule for $STRK tokens, affecting the payment schedule for the two groups, Early Contributors & Investors. On April 15, it will only pay 64m $STRK tokens (0.64% supply), a significant decrease from the original 1.34b (13.4% supply).

The method is to vest a small amount each month until 2027, which will help reduce selling pressure. By March 15, 2027, a total of 3.86b $STRK (38.6% supply) tokens will be paid to both groups. The remaining 54.2% is allocated for grants/eco funds, Treasury, and foundations.

The team holds all these tokens and allocates them flexibly according to the project’s operation plan. On April 15, there will be the first unlock, so keep an eye on the price around mid-March.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |