Key Points:

- Fidelity, managing $4.5 trillion, files for spot Ethereum ETF with staking.

- ETF promises exposure to Ethereum market with lucrative staking opportunities.

- Move signals mainstream acceptance of crypto, potential for institutional investment influx.

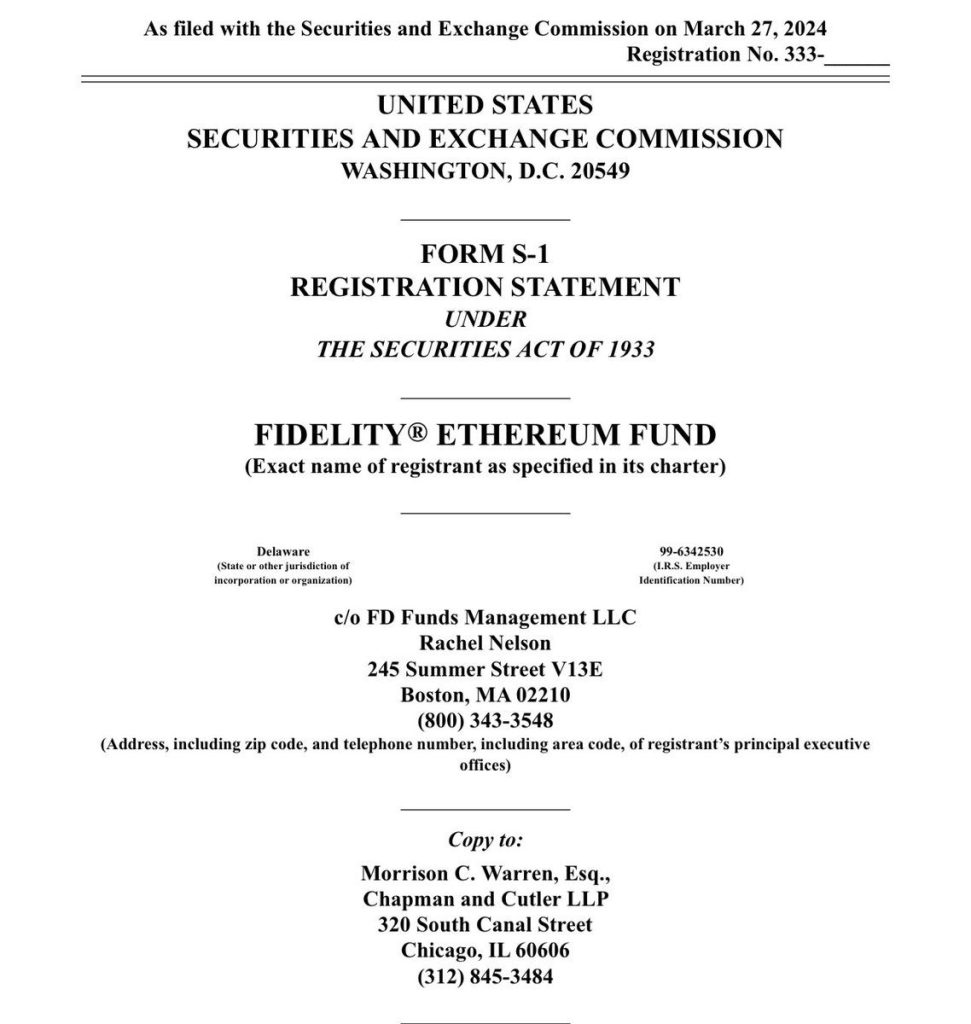

Fidelity Investments, a colossal asset manager with assets totaling $4.5 trillion, has set its sights on the cryptocurrency market by filing an S-1 form for a Spot Ethereum ETF.

This move signifies a significant leap into the crypto space by one of the world’s largest financial institutions.

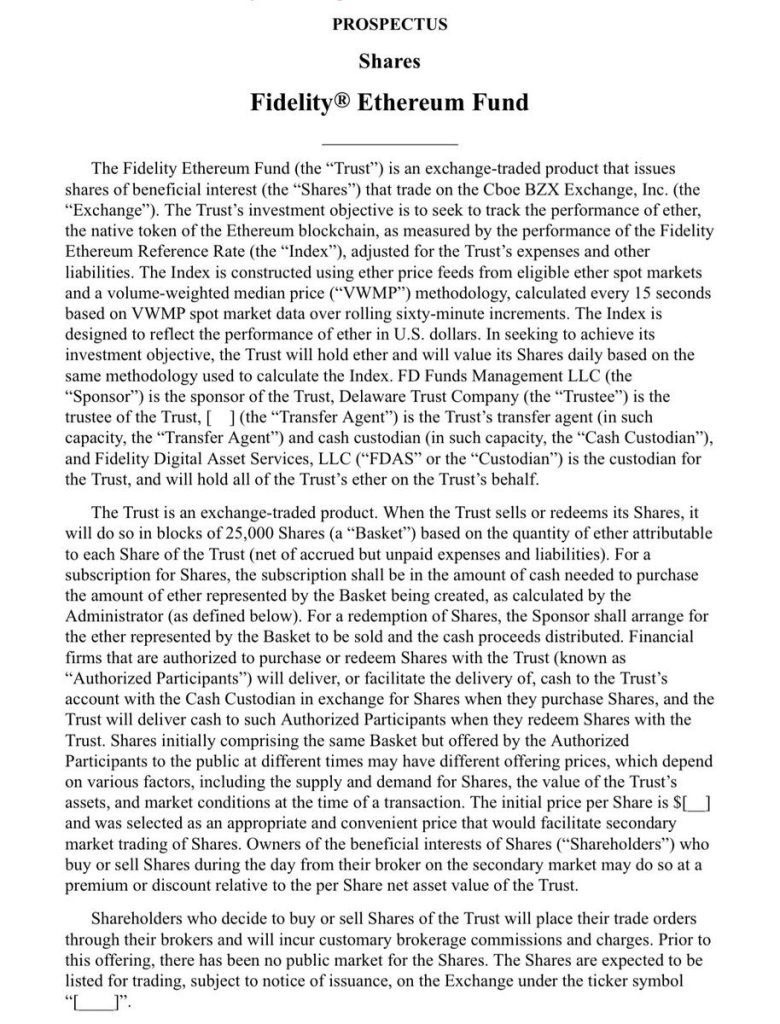

The proposed Spot Ethereum ETF by Fidelity promises to provide investors with exposure to the booming Ethereum market while incorporating staking opportunities. Staking allows investors to earn rewards by participating in the validation process of transactions on the Ethereum network, thereby potentially enhancing their investment returns.

$4.5 Trillion Giant Files for Ethereum ETF!

Fidelity’s decision to include staking in its Spot Ethereum ETF aligns with the growing popularity of staking as a means of generating passive income in the cryptocurrency realm. By offering staking features, Fidelity aims to attract investors seeking innovative investment opportunities in the digital asset space.

The filing of the S-1 form represents a significant step in the regulatory approval process for Fidelity’s Ethereum ETF. Once approved, the ETF will enable investors to gain exposure to Ethereum’s price movements without needing to directly hold the underlying cryptocurrency.

Read more: What is Bitcoin Halving? Why is this event of interest?

Fidelity’s Innovative Approach to Staking in ETF!

Fidelity’s foray into the cryptocurrency ETF market underscores the increasing institutional interest in digital assets and their potential as investment vehicles. As traditional financial institutions like Fidelity embrace cryptocurrencies, it signals a broader acceptance of digital assets within the mainstream financial ecosystem.

Fidelity’s entry into the Spot Ethereum ETF space could further legitimize Ethereum as a valuable asset class and contribute to its adoption and price appreciation. The combination of Fidelity’s reputation, extensive resources, and the inclusion of staking features is likely to attract a broad range of investors looking to capitalize on Ethereum’s growth potential.

However, it’s worth noting that the approval process for cryptocurrency ETFs can be complex and subject to regulatory scrutiny. Fidelity will need to navigate regulatory requirements and address any concerns raised by regulatory authorities before its Ethereum ETF can be launched to the public.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |