| Key Points: – Circle plans to integrate its recently acquired Hashnote TMMF under Bermuda’s regulatory framework to enhance compliance and transparency. – The company aims to merge USYC, the largest tokenized treasury fund, with USDC stablecoin. |

Circle Internet Group, Inc., the company behind the USDC stablecoin, announced plans to bring its recently acquired Hashnote Tokenized Money Market Fund (TMMF) under Bermuda’s regulatory framework.

According to a press release on Thursday, the Hashnote TMMF, which manages nearly $1 billion in assets, will be incorporated into Circle’s Digital Assets Business Act (DABA) license in Bermuda.

Circle Brings Hashnote TMMF Under Bermuda’s Regulatory Oversight

Hashnote is the issuer of USYC, the world’s largest tokenized treasury and money market fund, with approximately $1 billion deployed as of March 6, 2025.

Circle acquired Hashnote earlier this year with the goal of expanding USYC’s role as a collateral option for institutional investors. The company aims to fully integrate USYC with USDC, one of the most widely used stablecoins, to facilitate seamless transactions between tokenized money market collateral and digital currency settlements.

Jeremy Allaire, Circle’s co-founder and CEO, emphasized Bermuda’s regulatory appeal, citing the Bermuda Monetary Authority’s progressive stance on digital assets.

“Bermuda is the natural choice as regulator and home for USYC and our tokenized money market operations,” he said.

For Hashnote users, this development means continued access to USYC as a trading collateral on DeFi platforms, with enhanced flexibility to convert assets into USDC for settlements or transfers.

Growing Interest in Tokenized Treasuries Amid Circle’s Expansion

Circle’s move reflects a broader industry trend of bringing real-world assets onto blockchain networks, particularly in tokenized treasuries and money market funds.

The growing market for tokenized financial instruments has attracted major asset managers. Franklin Templeton introduced its OnChain US Government Money Fund (FOBXX) in 2021, while BlackRock launched a competing product, BUIDL, last year.

Meanwhile, Circle’s expansion efforts come amid its ongoing IPO plans. In early 2024, the company confidentially filed an S-1 form with the Securities and Exchange Commission, a necessary step for going public. Last October, Allaire confirmed the company’s plans were still moving forward.

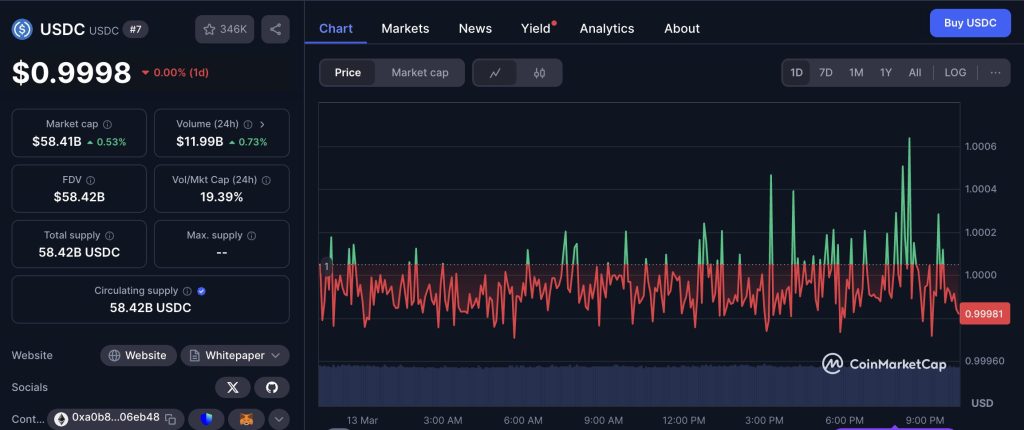

While details remain undisclosed, the rising market capitalization of USDC—now exceeding $58 billion—could strengthen Circle’s position as it navigates regulatory and market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |