Zeus Network Review: The Solution To Connect Solana With The Bitcoin Network

Zeus Network is a blockchain infrastructure that operates at the communication layer, connecting the Solana and Bitcoin networks. Focusing on interoperability, Zeus Network aims to enable seamless interaction between these two leading blockchain ecosystems, enhancing connectivity and functionality for users and developers.

What is Zeus Network?

Table of Contents

Zeus Network is a blockchain infrastructure situated at the communication layer, linking the networks of Solana and Bitcoin. The communication layer, or network layer, facilitates communication between nodes. With Zeus Network, assets in Bitcoin and Solana can seamlessly interact. Users can use BTC to buy SPL tokens without a bridge. This structure resembles Cosmos‘ Interchain.

The Zeus Network is more than just a bridge; the liquidity on one chain doesn’t automatically transfer to the other. Zeus tackles the interaction challenge between Bitcoin and Solana, opening up a world of possibilities, from high-performance decentralized applications to efficient and secure financial services.

Read More: Backpack Review: What Makes Solana’s First CEX Project Stand Out?

How Does Zeus Network Work?

Zeus Network’s primary offering is its cross-chain infrastructure that connects Solana with other networks. The architecture comprises three main components: Zeus Verifier, Zeus Node, and Zeus Consensus. Let’s delve into each of these components below.

Zeus Verifier

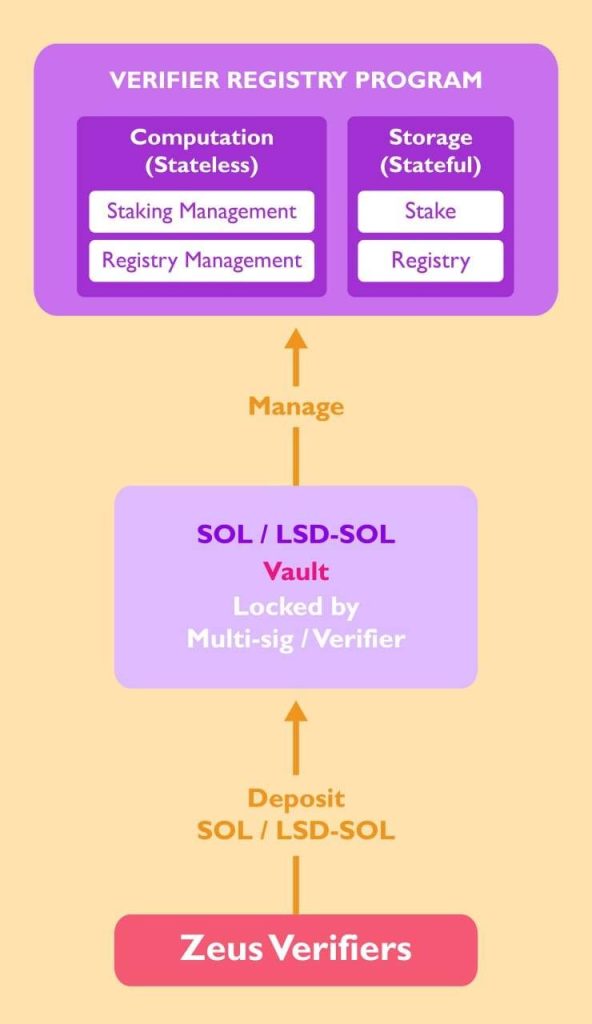

The initial component in Zeus’s architecture is the Verifiers. To become one, individuals must operate a Zeus Node and stake SOL or LSD-SOL (the liquid staking token of SOL). After this, they must enroll in the Verifier Registry Program to begin operating on the network. The verifier’s staking amount is crucial in Zeus’s operational mechanism, imposing economic penalties on Verifiers who engage in malicious activities.

Zeus Node

Zeus Node is a system that facilitates Zeus’s operation. It manages both on-chain and off-chain service groups, such as registry services (transaction registration), signing services (signature aggregation), broadcast services (transaction broadcasting), and peer-to-peer services (connecting nodes in the peer network). The division into functional groups enhances Zeus’s flexibility, enabling seamless interaction with networks like Bitcoin Layer 2, EVM Chain, and MoveVM, among others. Additionally, Zeus supports various programming languages, including Solidity, Move, and more.

Zeus Consensus

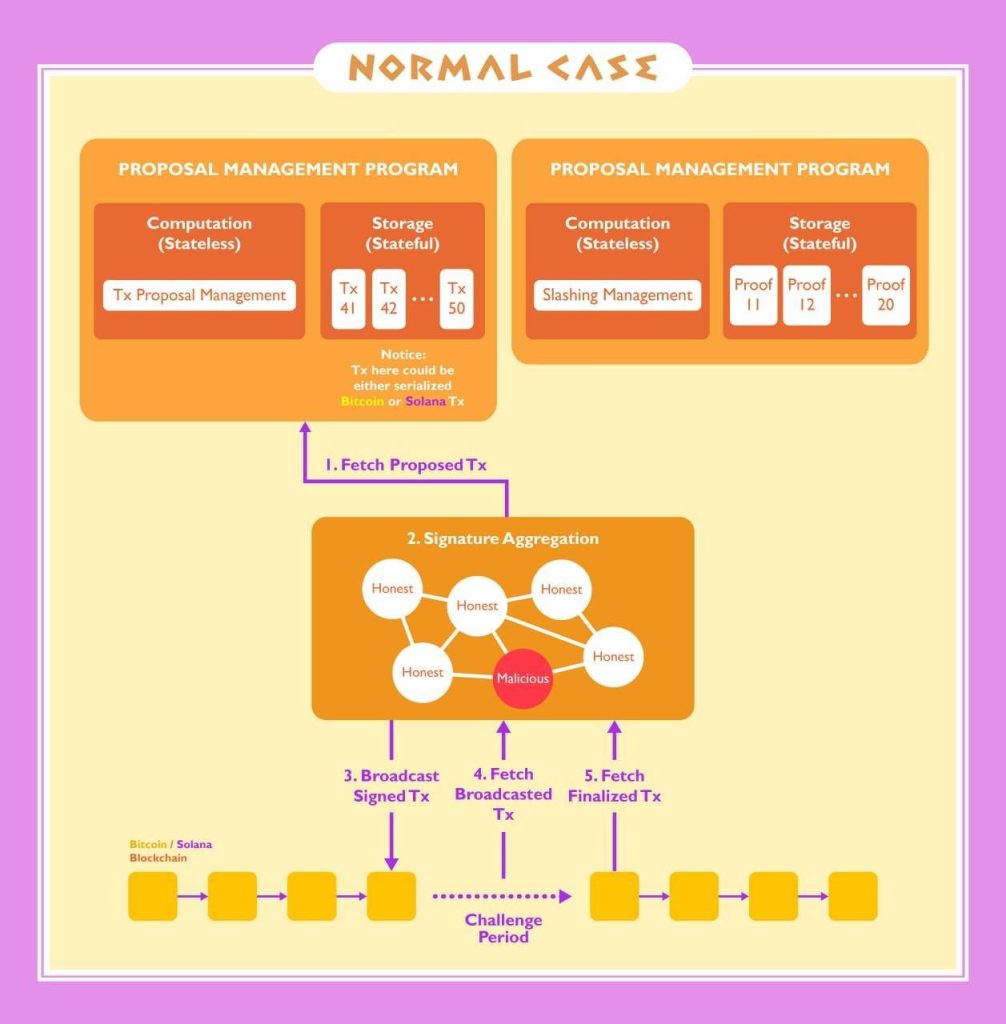

The Zeus utilizes a Proof-of-Stake consensus mechanism managed by the Verifiers mentioned earlier. It implements a network protection model similar to Optimistic Rollup with Fraud Proof. During the challenge period of transaction packets, if errors are found, anyone can create fraud-proof and challenge the network. When the fraud-proof is validated, the prover receives a reward, while the Verifiers face an economic penalty through a reduction in their initial staking amount for their involvement in verifying the transaction packet.

Regarding operational mechanisms, Zeus distinguishes between the Proposal and Verification processes. The Proposal Management Program sequentially processes and stores transactions on Bitcoin and Solana independently. Verifiers subsequently retrieve and process these transactions.

Read More: Solana Presale Meme Coins Abandoned After Raising 180,000 SOL

Zeus Network Ecosystem

- Native Stake offers a way to wrap Bitcoin with Solana DeFi Yield. This allows users to deposit Bitcoin and receive a “Wrapped Bitcoin” version on Solana, enabling participation in DeFi projects and earning yields.

- Bribery System’s Liquidity Tranche: Offers a flexible liquidity system to support transactions and projects within the ecosystem.

- Native Bitcoin Collateral Stablecoin on Solana: This initiative aims to create a stablecoin pegged to Bitcoin on the Solana blockchain, boosting liquidity and expanding access to financial services.

- Native & Cross-Chain NFT tools between Bitcoin and Solana: Providing unauthorized NFT tools and communication between Bitcoin and Solana, facilitating the development and management of decentralized assets.

- Native & Borrow / Lending from Bitcoin layers to Solana: Allows borrowing and lending of assets from Bitcoin layers to Solana, enhancing flexibility and financial usability between the two blockchains.

Read More: Bitcoin Mining: How Long Does It Take to Mine 1 Bitcoin?

Tokenomics and Use Case

Token metrics

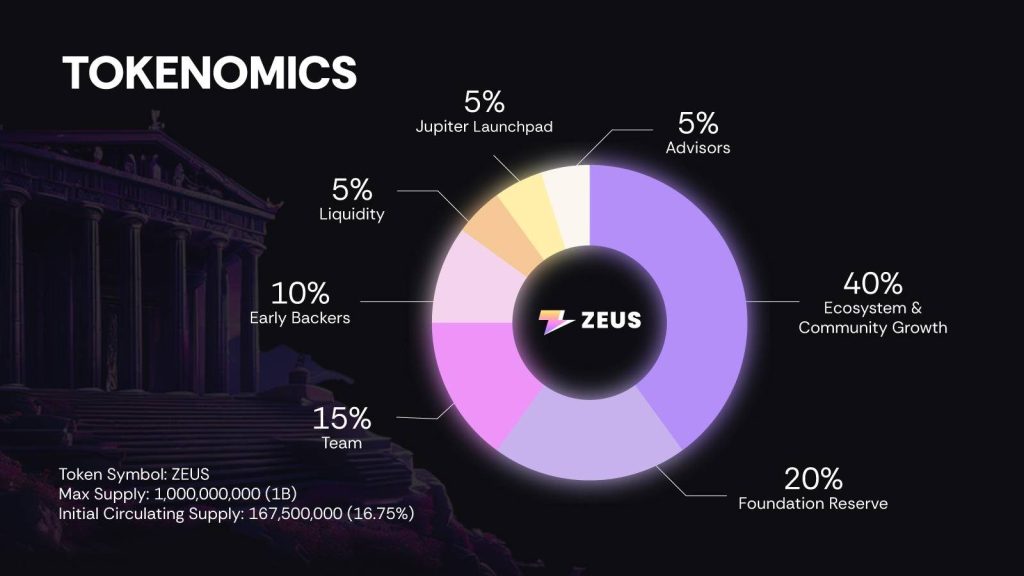

- Token token: Zeus Network

- Ticker: ZEUS

- Maximum supply: 1,000,000,000 $ZEUS

Token Allocation

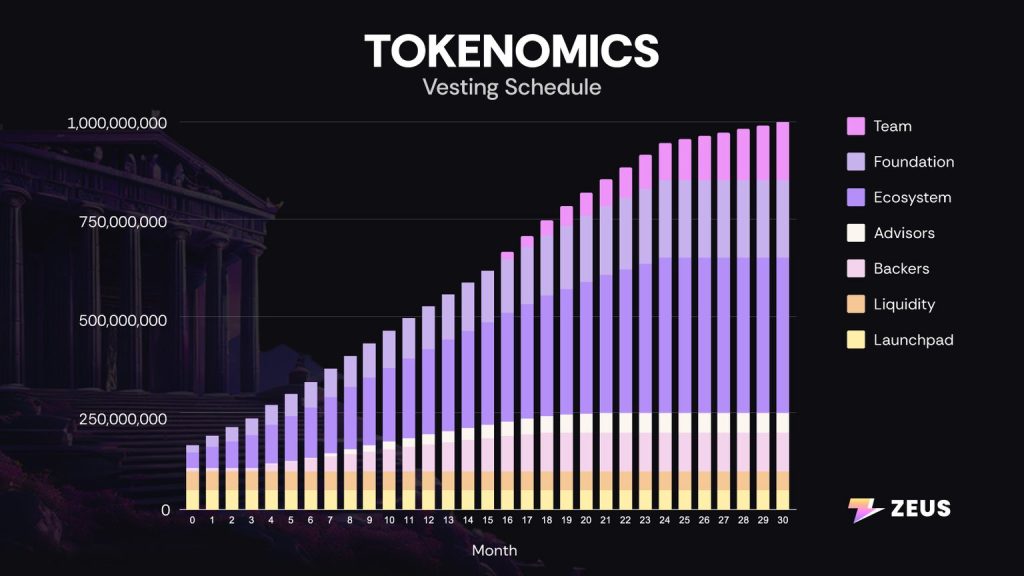

- Ecosystem and Community Growth: 40%, linear unlock each month over 24 months.

- Foundation Reserve: 20%, linear unlock each month over 24 months.

- Team: 15%, locked for 15 months, then linear unlock each month over 15 months.

- Early Backers: 10%, locked for 3 months, then linear unlock each month for over 15 months.

- Advisors: 5%, locked for 6 months, then linear unlock each month over 15 months.

- Liquidity: 5%, 100% at TGE.

- Launchpad: 5%, 100% at TGE.

Use Case

- Staking and securing the network.

- These are used as transaction fees on the Zeus network.

- Used for incentive programs on the Zeus network.

- Rights to participate in protocol governance.

Where to Buy Zeus Network?

The ZEUS token of the Zeus Network project is traded on the following exchanges:

- CEX: OKX, Gate, Kucoin, BingX, MEXC,…

- DEX: Orca, Raydium, Meteora, Jupiter.

Team and Investors

Team

Jim Chiu (Co-Founder): He founded DappioLab and currently leads Gen3, as well as spearheading the Zeus Network project.

Che Wei Kuo (Growth Lead): I graduated from Chinese Culture University with a bachelor’s degree in French language and literature. I have gained extensive marketing experience through my work at companies like 88JOBS, KiFF CYCLING CLUB, and xareGroup.

Letitia Lee (HR-Ops Manager): She holds a Master’s degree in Chinese language and has worked in human resources management roles at Volkswagen Financial Services and TREVI.

Investor and partners

- 09/03/2024: The funding round secured investments from Anatoly Yakovenko (Co-Founder of Solana), Andrew Kang (Founder of Mechanism Capital), and Muneeb Ali (Co-Founder of Stacks).

- 03/04/2024: Mechanism Capital led the funding round, which raised 8 million USD and valued it at 100 million USD. Other participating funds included The Spartan Group, Animoca Brands, OKX Ventures, Big Brain Holdings, and Lemniscap.

- 04/04/2024: The project completed its token sale on the Launchpad Jupiter platform, generating over 28.75 million USD from the community.

Roadmap

2024 Q2: Muses Upgrade

In this phase, we are focusing on developing Zeus Node to ensure the network’s operation while also advancing APOLLO for seamless utilization of $BTC.

Zeus Layer Mainnet Beta

- Singleton Mode implementation

- Zeus Explorer development initiation

- Auditing process initiation

Apollo Testnet V0.3

- $tBTC deposit and withdrawal

- $zBTC custodianship

- Bitcoin Wallet Connect integration

- Auditing process initiation

2024 Q3: Gaia Upgrade

This phase introduces two staking options on Zeus Network: $ZEUS staking and native $BTC staking to earn yields on Solana.

$ZEUS Staking

- Launch $ZEUS Staking Program

Zeus Layer Mainnet Beta

- Support Schnorr and EdDSA Threshold Signature

- Zeus Node initiation through $ZEUS staking

Apollo Mainnet

- Enable $BTC staking

- Delegate & Stake $SOL on Zeus Node

2024 Q4: Athena Upgrade

Zeus Network aims to foster a permissionless cross-chain ecosystem, releasing the Zeus Programming Library (ZPL) for project development.

Zeus Layer Mainnet Beta

- ZPL release for Programmable MPC

- Fee Relayer implementation

- Zeus Explorer integration

Conclusion

Zeus Network aims to bring Bitcoin liquidity to Solana, creating a seamless environment for users and developers. This project is highly anticipated, given Solana’s rapid growth and Bitcoin’s untapped potential.

CoinCu rates this project as extremely promising for investment, considering the current popularity of the Solana and Bitcoin ecosystems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |