Key Points:

- The top five Bitcoin mining firms are holding onto their Bitcoin reserves despite the upcoming halving, signaling a significant shift in strategy.

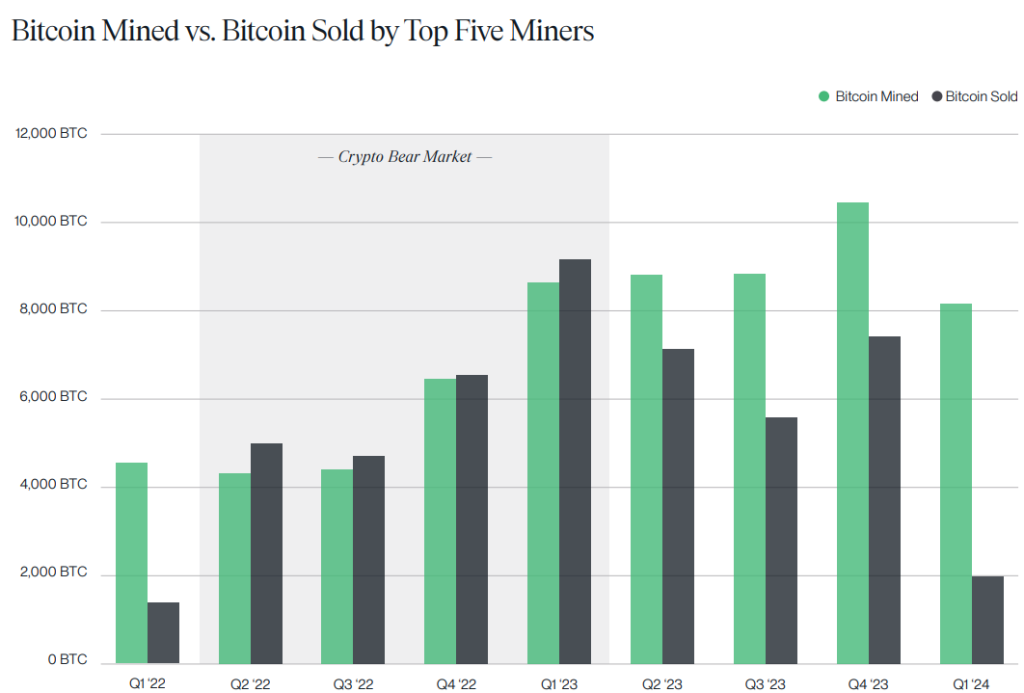

- Bitcoin selling by these firms has hit a two-year low, with only approximately 2,000 BTC sold in Q1 2024, down from over 7,000 BTC in Q4 2023.

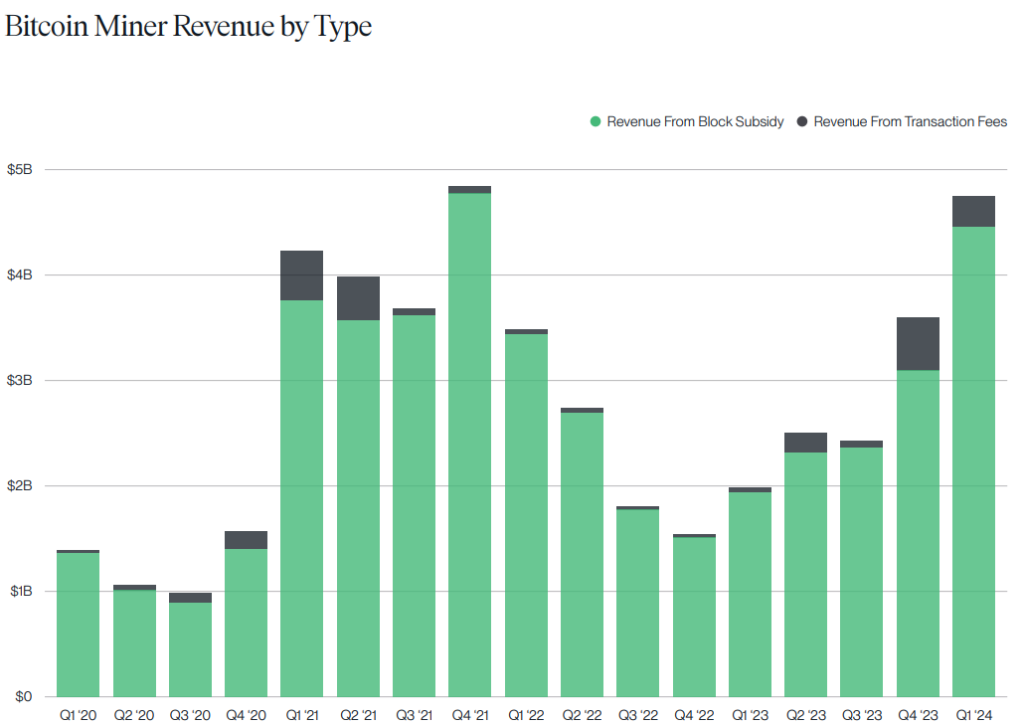

- Despite concerns about profitability post-halving, Bitcoin miner revenue surged by 30% quarter-over-quarter, exceeding $4.5 billion, with potential offsets in rising network fees.

The five largest Bitcoin miners firms are bucking the trend by holding onto their Bitcoin reserves, refusing to sell despite the anticipated reduction in supply issuance.

According to a recent report by Bitwise, Bitcoin selling by these top mining firms hit a two-year low in the first quarter of 2024, with approximately 2,000 BTC sold. This contrasts sharply with the over 7,000 BTC sold in the fourth quarter of 2023.

The impending Bitcoin halving, set to slash block issuance rewards from 6.25 BTC to 3.125 BTC, coupled with the ongoing increase in Bitcoin’s hash rate, could potentially dent mining profitability.

However, despite concerns, Bitcoin miners revenue saw a substantial 30% quarter-over-quarter increase, exceeding $4.5 billion, according to Bitwise. CEO of Acheron Trading, Laurent Benayoun, suggests that the decrease in mining rewards might be offset by rising network fees, potentially maintaining or even increasing mining revenue in dollar terms.

Read more: Fetch.AI Review: Don’t Miss AI Coin Storming FET In 2024

Top Miners Hold Strong Amid Supply Reduction

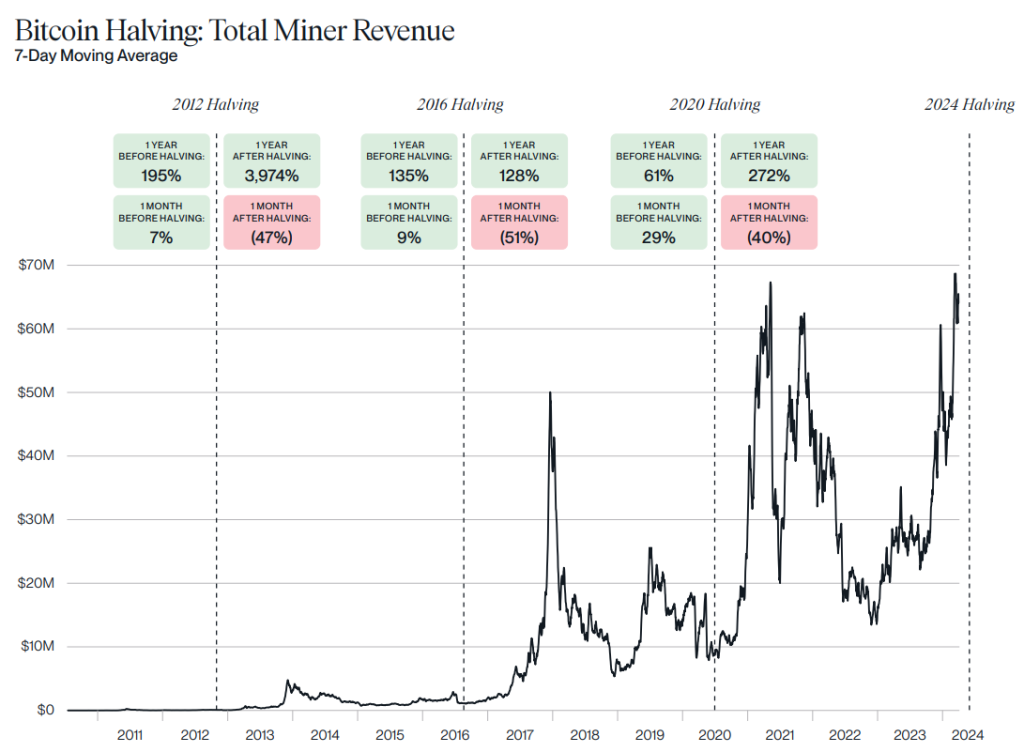

Nevertheless, historical data indicates that post-halving, Bitcoin mining revenue typically experiences a significant decline. After the 2020 halving, revenue plummeted by 40%, while the 2016 halving saw a drop of over 51%.

Marathon Digital emerged as the leading Bitcoin miner, generating over 2,500 BTC in Q1 2024. However, its mining costs were notably higher than competitors, with an average of $22,249 per BTC compared to Cipher Mining’s $8,626 per BTC.

Bitcoin miners globally hold over 700,000 BTC, constituting 3.4% of the total supply. Meanwhile, individuals hold the lion’s share of Bitcoin supply, accounting for 57% (12 million BTC).

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |