Bitcoin ETF Inflow Of $60 Million Yesterday Ended The Gloomy Days Of ETFs

Key Points:

- Bitcoin ETFs broke a six-day outflow streak with a $60 million net inflow.

- Concerns arise over GBTC’s consistent losses due to its fee structure, while slower Bitcoin ETF inflows into others.

- Spot Bitcoin ETFs surged ahead of the halving despite six days of negative flows.

Bitcoin exchange-traded funds (ETFs) witnessed a turnaround, with a net inflow of $60 million recorded yesterday.

Read more: Best Bitcoin ETFs To Buy In 2024

New Bitcoin ETF Inflow Recorded After Days of Losses

The streak of outflows mirrors a similar occurrence in March when US spot Bitcoin ETFs bled assets for five consecutive days, amounting to $888 million in total outflows.

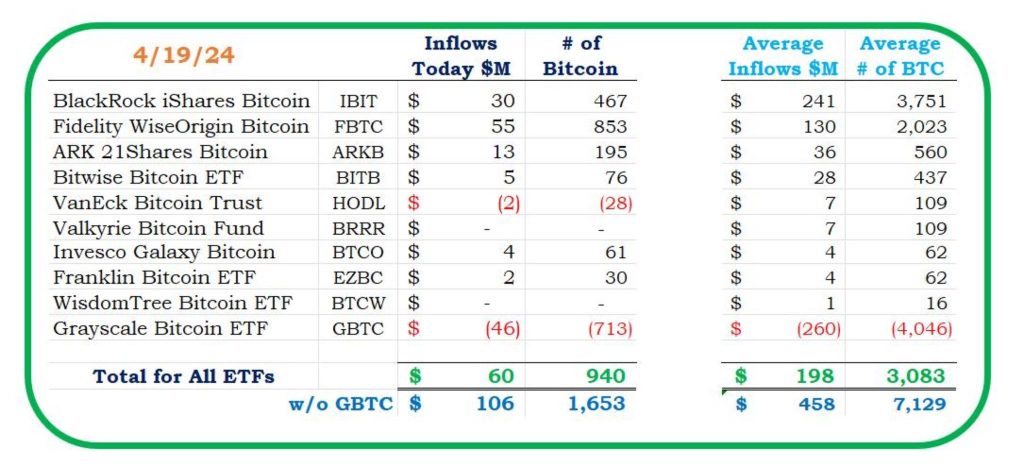

This marks the first Bitcoin ETF inflow following the recent outflows. Notably, the Grayscale ETF GBTC experienced a net outflow of $45.8246 million, contrasting with Fidelity ETF FBTC, which saw a net inflow of $54.7707 million. Additionally, BlackRock ETF IBIT registered a net inflow of $29.2758 million.

According to HODL15Capital monitoring, on April 19, Bitwise BITB attracted a net inflow of $5 million, while Franklin EZBC and ARKB saw net inflows of $2 million and $12.5 million, respectively. Meanwhile, Grayscale GBTC experienced a net outflow of $46 million.

Spot Bitcoin ETFs Surge Ahead of Halving

Trading volume data for spot Bitcoin ETFs on April 19 reveals significant activity, with BlackRock IBIT leading at $1.27 billion, followed by GBTC at $500 million and FBTC at $334 million. Bitwise’s CEO announced approximately $11 million in total net inflows into BITB for the week.

Despite GBTC’s consistent losses attributed to its fee structure, concerns arise from slower Bitcoin ETF inflows into others. Notably, BlackRock IBIT’s trading volume has doubled that of GBTC. However, IBIT’s net inflows hit an all-time low of $18 million on Wednesday and Thursday, whereas FBTC surpassed IBIT with $37 million in net flows on Thursday.

Ahead of the anticipated halving, spot Bitcoin ETFs surged alongside the underlying asset’s price despite six consecutive days of negative flows. Analysts anticipate future price increases, drawing parallels with previous halving events in 2012, 2016, and 2020.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |