Bitcoin Miner Revenue Reached $106.7 Million On The Halving Day

Key Points:

- Bitcoin miner revenue is skyrocketing post-halving, fueled by increased transaction fees due to Runes protocol activity.

- Viabtc’s block processing yields substantial fees, indicating significant gains for miners in the accelerated fee environment.

- The surge in transaction fees signals a shift in miner compensation dynamics.

Bitcoin miner revenue experienced a significant boost following the recent halving event, driven by a surge in transaction fees.

Read more: What is Bitcoin Halving? Why is this event of interest?

Bitcoin Miner Revenue Surges Post-Halving

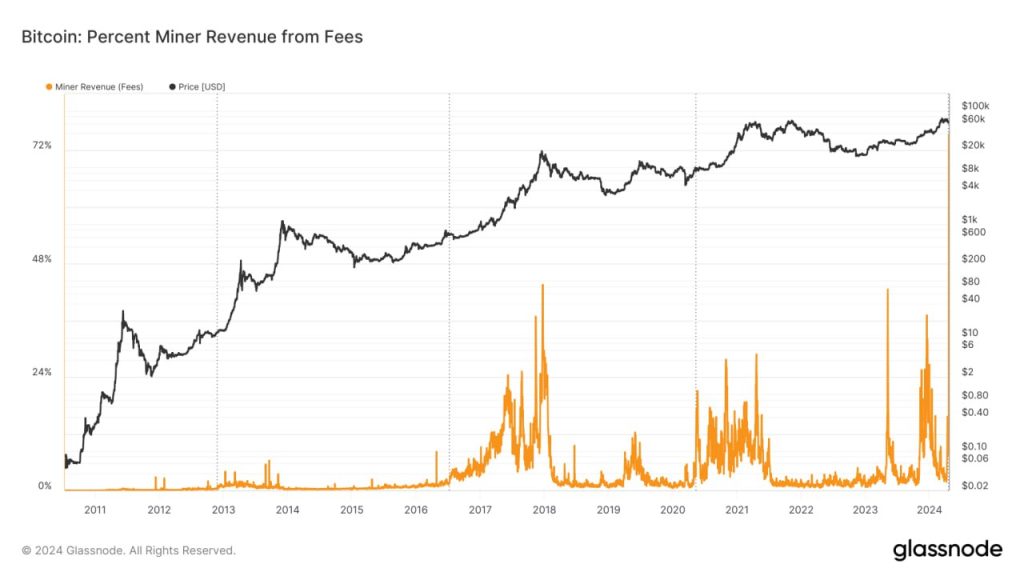

According to data from Glassnode, on April 20, Bitcoin miner revenue hit a record high of $106.7 million, with 75.444% of it stemming from network transaction fees.

The spike in transaction fees was attributed to increased activity on the Runes protocol, particularly in capturing newly minted runes. Viabtc’s processing of block 840,000 resulted in substantial transaction fees totaling 37.625 BTC from 3,050 transactions.

Since the introduction of the Runes protocol, Bitcoin miners have seen substantial gains from the heightened fee environment. Although fees peaked at $240 initially, they have since stabilized in the range of $35 to $75 per transaction.

Key players in securing blocks with significant fees include Foundry, Antpool, Viabtc, Poolin, and F2pool. These developments underscore the dynamic interaction between market forces and technological advancements such as Runes.

Transaction Fee Surge Prompts Shift in Miner Compensation

The rise in transaction fees as a proportion of total block revenue signals a notable shift in miner compensation, potentially impacting miner behavior, particularly in regions where electricity costs may outweigh mining benefits.

These higher fees could drive the development of second-layer solutions like the Lightning Network, aimed at reducing costs and accelerating transactions on the blockchain.

As the cryptocurrency landscape adjusts post-halving, the long-term implications for network security, miner profitability, and transaction fees will become clearer. While miners welcome increased block rewards, the evolving challenges and opportunities within the Bitcoin ecosystem continue to unfold.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |