Mt Gox Payout Date Revealed, Potential Bitcoin Selling Pressure In July 2024

Key Points:

- Mt. Gox plans to start repaying creditors in BTC and BCH in early July 2024.

- The repayments could increase selling pressure in the Bitcoin markets.

- The release of the announcement coincided with a drop in Bitcoin prices.

Mt Gox payout date is set for early July 2024, repaying creditors in BTC and BCH. The repayments may affect Bitcoin markets.

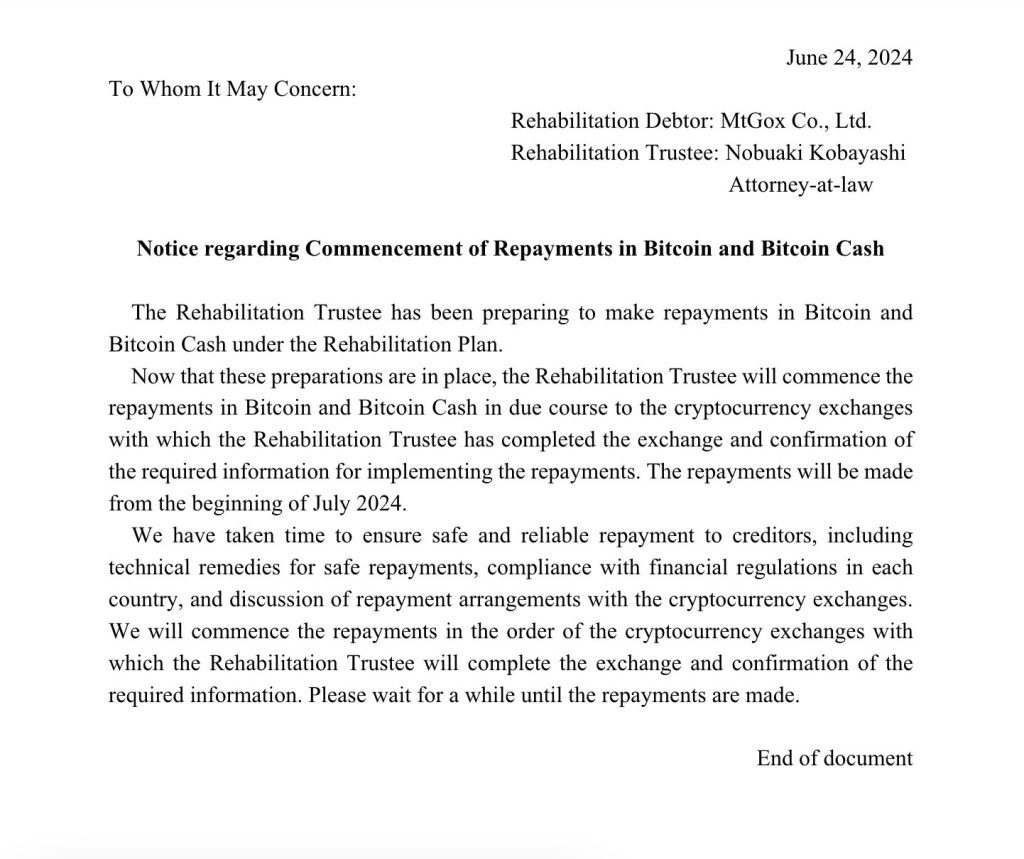

Mt. Gox announced its intention to start repaying creditors in BTC and BCH in early July 2024. The exchange has been defunct since the major hack in 2014 caused it to lose customers’ assets.

Nobuaki Kobayashi, the appointed trustee, confirmed this in a statement on Mt. Gox’s website, saying that repayments are being made using a rehabilitation plan that started years ago.

Mt Gox Payout Date and the Impact on Bitcoin Markets

The pay-outs in BTC and BCH will probably inject more selling pressure into the Bitcoin markets. More so, everyone who invested before 2013 is likely to get back their assets of incredible value relative to their initial investment, which may give them a reason to sell off a portion.

The Tokyo-based exchange was once at the pinnacle of the crypto world, processing over 70% of all Bitcoin transactions. Then, a spate of attacks culminated in a significant hack in 2014, which cost an estimated 740,000 Bitcoin, or about $15 billion at today’s price rate.

In May, Mt. Gox moved over 140,000 BTC out of the cold wallets, which accounts for $9 billion across 13 separate transactions, to an unknown wallet address.

Readmore: Mt Gox Creditors Face Further Delays In Repayment ProcessReadmore:

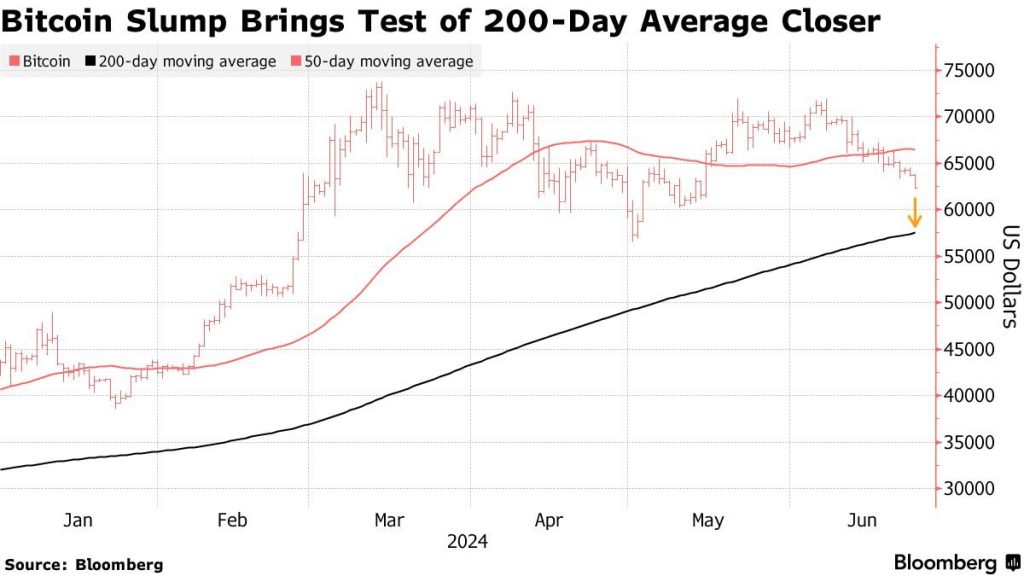

Bitcoin’s Performance and Potential Support Zones

Added to this is the fact that this was the first action on-chain wallets had seen in five years. These movements coincided with a drop in Bitcoin prices from over $62,300 to under $62,100.

Bitcoin reached its all-time high of $73,798 in March but has underperformed traditional assets lately, such as stocks, bonds, and gold. According to Bloomberg, Market Analyst Tony Sycamore of IG Australia Pty suggests a possible support zone for Bitcoin at the 200-day moving average of about $57,500.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |