Key Points:

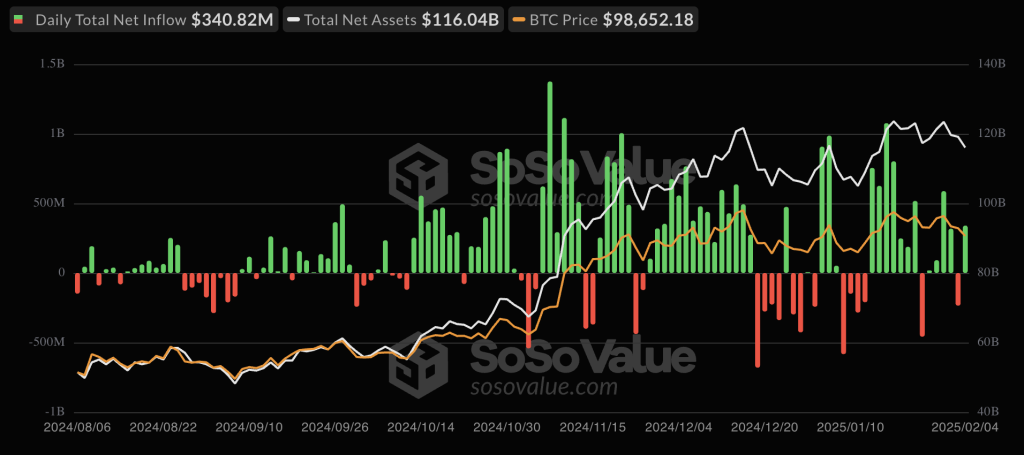

- Bitcoin Spot ETF inflows hit $341M, with BlackRock’s IBIT contributing $249M.

- Ethereum Spot ETF sustained inflows for four days, totaling $308M.

Bitcoin Spot ETF inflows reached $341M on February 4, with BlackRock’s IBIT leading at $249M. Ethereum Spot ETF saw $308M inflows, marking four consecutive days.

Bitcoin Spot ETF Inflows Surge as BlackRock Leads

Bitcoin Spot ETF inflows surged to $341 million on February 4, signaling strong institutional demand. BlackRock’s IBIT led with $249 million, reaffirming its dominance in the sector. This trend highlights increasing investor confidence in Bitcoin ETFs as a mainstream financial product.

These consistent inflows are a sign of a growing appetite for regulated Bitcoin investment vehicles. As market adoption grows, Bitcoin Spot ETFs will likely be even more integral to the future of institutional crypto exposure and continue to narrow the gap between traditional finance and digital assets, according to Sosovalue.

Read more: Bitcoin Mining Revenue Plunges to $1.4B in January

Ethereum Spot ETFs Maintain Four-Day Inflow Streak

Ethereum Spot ETFs logged a $308 million net inflow on February 4, extending the four consecutive trading days of an upward performance. The consistent demand reflects the rising confidence of investors in Ethereum, as the discussion for regulatory approval of ETH-based ETFs slowly develops.

This is an extremely consistent inflow trend and shows the growth of Ethereum in institutional portfolios. With strong use cases, especially in the field of DeFi and smart contracts, Ethereum is increasingly looked upon as a valuable asset with its ETFs a key door to institutional crypto investment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |