Key Points:

- U.S. equities surged, but Bitcoin and Ethereum stayed stable.

- Long-term options suggest a potential year-end rally.

- Mt. Gox repayments may cause a cautious Q3 for BTC.

Q3 Bitcoin price prediction shows mixed signals. Despite U.S. market optimism, BTC hovers around $60K. Options suggest a year-end rally, but concerns over Mt. Gox and a recent 4.77% drop add caution.

The U.S. equity market surged to new highs immediately after Powell’s statement that the U.S. economy is following its disinflationary path. This optimism hasn’t seemed to seep into Bitcoin and Ethereum, hovering just above $60,000 and $3,300, respectively.

U.S. Equity Market Reaches New Highs After Powell’s Statement

The options market is still very one-sided to the topside, despite the sell-off, and it holds a lot of expectations for a year-end rally. This is supported by significant buying interest in longer-term options at $100,000 and $120,000 strikes.

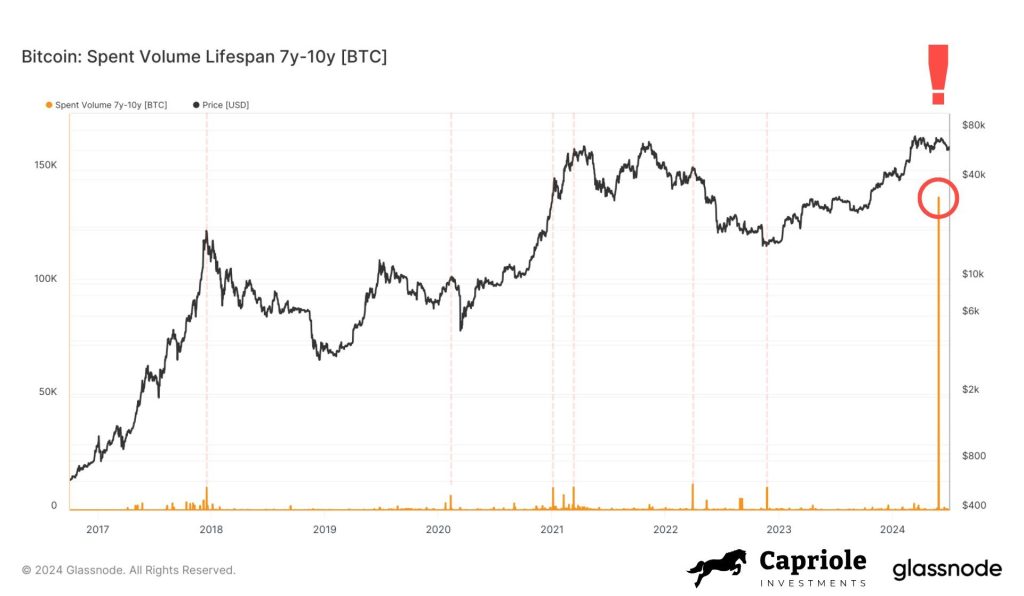

This might put a muted Q3 ahead for BTC as the market remains cautious over the supply implications from the Mt. Gox release. Charles Edward, founder of digital asset hedge fund Capriole Investments, commented that Mt. Gox may have begun with creditors’ repayment processes. Data disclosed a huge movement of Bitcoin on-chain, with the volume tenfold higher than the previous highest point.

Readmore: Circle EU EMI License Ushers In New Era For 450M Customers

Q3 Bitcoin Price Prediction: Market Cautious Over Mt. Gox Release

According to QCP, a trade idea for investors looking to produce a 15% annual yield on BTC with the underlying coin maturity due on September 27, 2024, a weekly coupon rate of 15% p.a. is available if BTC/USD fixes above $58,000.

The strike price used is $70,000, with protection at $80,000. Only if the spot price stays above $80,000 at expiry will BTC convert to USD at the $70,000 strike. As per CoinMarketCap data, BTC recently fell below $60,000 USDT with a 24-hour drop of 4.77%.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |