TON has seen significant growth in overall network activity. With the increasing adoption of projects, including DEXs, the TON ecosystem is gradually attracting potential TVL from DeFi. Let’s explore the top TON DEXes with Coincu in this article.

Overview of TON DEXes

TON is more than blockchain. It boasts deep integration with the popular messaging platform Telegram and offers an all-in-one ecosystem comprised of users, validators, and app developers.

Decentralized finance, in general, is the keystone that maintains economic activity and liquidity within TON’s ecosystem. In simple terms, the DeFi protocols of TON enable access to quick capital movements that are less expensive. Hence, both the consumers and the enterprises will benefit. The consequences of such is the improved fluidity that encourages use cases ranging from asset management to trading on TON DEX.

In 2024, TON’s DeFi sector began to grow significantly, particularly with the hype around meme coin speculation. Speculative trading gave a great boost to on-chain activity and inflated DeFi metrics, such as TVLs. Thus, the TON DEXes demonstrated an ability to process considerable financial activity.

Further integrating its ecosystem, TON uses Telegram’s mini-apps so users can control their assets and interact directly with decentralized exchanges through the messaging app. The great transaction speed provided by TON will likely change everything for decentralized trading. High-frequency trading with very low slippage will finally be possible, thus making it interesting to traders.

Read more: The Open Network Review: The Most Potential Layer 1 Today

Top TON DEXes

DeDust

DeDust is a DEX powered by the TON network, which launched its mainnet back in November 2022. This AMM-based DEX allows trading with assets given to liquidity pools by the users. According to DefiLlama, DeDust represents the second largest decentralized application on the TON ecosystem, having $160 million of total value locked.

Providing decentralized trading, DeDust also offers quite a large number of other functions. One of them is a cross-chain bridge for transferring assets between the TON network and other supported blockchains.

A decentralized portfolio tracker is also available on the platform, wherein users can track all their assets stored in their wallets. For those looking to earn some passive income, DeDust has options for single-sided staking and giving rewards to liquidity providers. The farm program of the platform gives up to 150% APR return, depending on the liquidity pool, to participants.

SCALE is DeDust’s native token. In order to fund the staking scheme, DeDust repurchases SCALE and distributes it to stakers using the protocol’s earnings.

Read more: DeDust Review: Top Growth Exchange on TON

STON.fi

STON.fi has grown into one of the largest DeFi players in the TON blockchain since its release in 2022. It is the most extensive DeFi protocol on the blockchain, along with DeDust. STON.fi is a permissionless decentralized exchange based on AMM that allows users to have an easy flow of trading assets around the TON ecosystem.

STON.fi is basically a decentralized swap facility for swapping TON coins and jettons with a wide range of available assets on the platform. Integration into popular TON wallets, such as Tonkeeper, provides seamless and easily accessible user interfaces for most users. The platform also supports creating a liquidity pool to its fullest, meaning one can create market makers for new and existing tokens.

STON.fi gives their users an opportunity to conduct a cross-chain swap, which means that one is able to trade assets between different networks without using bridges.

Apart from swap and trade, STON.fi provides passive income through liquidity farming and single-sided staking. The participants in the liquidity farming program will receive APR, which is dependent on the asset provided for liquidity. Further, STON.fi enables single-sided staking of its native token, the STON token, for additional streams of passive income in users’ pockets.

Read more: STON.fi Review: AMM DEX On The TON Blockchain.

TON Diamonds

TON Diamonds is a TON-based DeFi platform. The platform aggregates decentralized exchanges, therefore, making the trading of tokens by its users very easy.

Through the aggregation of liquidity across numerous DEXes, such as Ston.fi and DeDust, it will allow users to perform token swaps against the best market prices that are available in the market at that particular moment.

Besides offering token trading, the rest of TON Diamonds extend into greater Web3, hosting a curated marketplace for digital artists, having a native NFT collection, and having its own governance token called Glint Coin. This allows users to access a wide array of services within the TON ecosystem, both DeFi and NFT-related activities.

Designed with the user in mind, TON Diamonds DEX is committed to Gas efficiency and seamless functionality. Users will be able to interact with the platform through the TON Diamond App, interacting with the DEX via a mini-app on Telegram, which is a versatile and far-reaching solution for the fast-increasing numbers in the DeFi community.

Read more: Overview of TON Ecosystem: Targeting Web3 Users with Huge Potential

Megaton Finance

Megaton Finance is a TON DEX which is the powerhouse that will change the course of DeFi. It is one of the independently operated financial protocols on TON, combining key features like an AMM and a scalable multi-chain system for seamless trading by its users.

At the very core, Megaton Finance’s governance token is MEGA, and for this reason, it plays a somewhat vital role in bringing changes to the protocol through governance decisions for every MEGA token holder. In addition to this, users will be rewarded after giving liquidity to different trading pairs, hence gaining more value on the platform.

One of the high points of Megaton Finance is bridging over the TON blockchain to some other Layer 1 blockchain, like Ethereum. In this regard, it relies on the WTON Gateway, which wraps TON into WTON. Besides, it interacts with Orbit Bridge for seamless cross-chain asset movements, thereby further enhancing the flexibility of users.

Megaton Finance drew in $1.5 million in seed funding from TONcoin.The fund is the leading incubator and accelerator of the TON ecosystem, ensuring a tremendous growth catalyst.

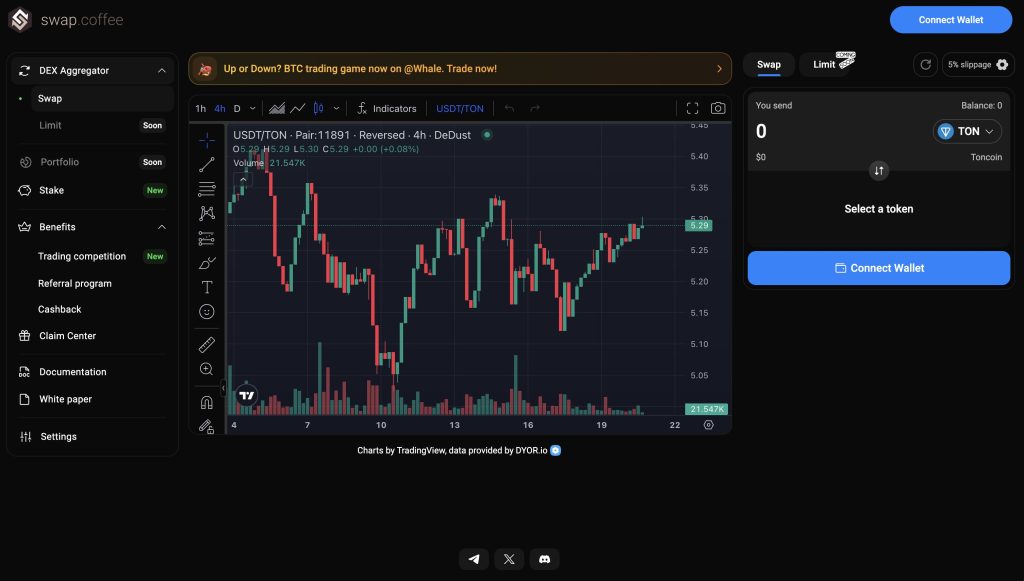

Swap.coffee

Swap.coffee is a decentralized exchange on the TON blockchain, created to support users in token trading efficiently. It takes care of making liquidity reliable by aggregating liquidity from most decentralized exchanges, including DeDust and Stone.Fi.

Among various features, Swap.coffee may be considered rather impressive, as it allows cross-chain transactions: the process of trading tokens between different blockchain networks. This will increase the adjustability of a platform to the wide audience of cryptographic traders.

Besides what is already provided, Swap.coffee has great plans for further development. Intended advanced features include limit orders on AMM DEXes and DCA orders. Further ahead, Swap.coffee is going to introduce its own token launchpad and earning platform, hence extending the scope of its work.

Swap.coffee wished to make life easy for their users, as declared by them, a “one-stop shop” for all token-related activities on the TON blockchain, from swapping and liquidity management to even token creation.

This TON DEX introduces the token economy in which the holders of the token have the right to claim profits that are generated by the protocol. Firstly, it is essential to point out that some portion of the tokens was distributed according to the model of a fair launch when 0% of the tokens were given to the team for more decentralization.

The project also deeply participates in TON through engaging in competitions like Token Minor League and App League. More recently, the project partnered with DYOR.ninja, a data provider, to enhance user experience but is still currently onboarding via Telegram as a mini-app.

Read more: Best TON Staking Protocols You Should Know

How to Choose the Best TON DEXes

Security Features

One thing you want most is security. Compare the different security features of each and every TON DEX and invest in those that truly value the safety of the assets being traded. Among others, look out for multi-sig wallets, cold storage facilities, and sophisticated levels of encryption.

Moreover, the DEX should have undergone audits of smart contracts and should have a history related to reliable security features. In other words, a sound security framework has to protect your investment.

Fee Structures

Different fee structures are employed by the various TON DEXes, which can make all the difference in your trading costs. Some charge per trade, a percentage of the trade, while others charge flat fees. It is very important to compare these against one another in hopes of finding the perfect DEX that fits your trading style and budget. Know what costs are involved to avoid unexpected expenses.

Liquidity Levels

High liquidity is important to undergo the process of efficient trading. A well-liquidized TON DEX allows you to fulfil your buying and selling orders faster, hence allowing you to execute trades closer to the market price. This reduces the risk of slippage, which, in turn, provides you with the best price possible for your trade.

Asset and Blockchain Supports

Multi-chain support will increase the number of trading cases by several times. When choosing a TON DEX, pay attention to the kinds of blockchain networks and tokens the website supports. More variety means more trading options and servicing of many investment strategies.

User Experience

Once again, an intuitive UI makes a world of difference to the beginner trader. It’s very important to employ a TON DEX right now with a user-friendly interface design that allows the trader to concentrate on an intuitively clear layout and clear instructions while reducing the learning curve to a minimum.

Read more: Top TON NFT Marketplaces For You In 2024

Conclusion

The integration of TON-based DeFi, Telegram, and recent infrastructure enhancements offers a streamlined experience for both advanced DeFi users seeking interoperability and newcomers from emerging markets who require simple access to the TON ecosystem. Hopefully, with the TON DEXes we recommend, you can explore the TON ecosystem in the easiest way.

FAQs

Which TON DEX has the largest TVL right now?

STON.fi is currently the TON DEX with the largest TVL at the time of writing with over $186 million, according to DefiLlama.

Do TON DEXes use Toncoin for transaction fees?

Yes. Most TON DEXes use TON as transaction fees.

Can I use Telegram to trade on DeDust?

Yes. You can currently trade this TON DEX on the Telegram mini app.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |