Key Points:

- El Salvador plans to sell or discontinue its Chivo Bitcoin wallet after reaching a $1.4 billion loan deal with the IMF.

- Despite the changes, El Salvador Bitcoin investment will continue at a faster pace.

According to Reuters, the government of El Salvador reportedly plans to either sell or discontinue its official digital Bitcoin wallet, Chivo, following a new agreement with the International Monetary Fund.

Read more: El Salvador President: Strategy to Promote BTC Still Not Widespread

El Salvador to Discontinue Chivo Wallet After IMF Loan Deal

Stacy Herbert, the director of the country’s national Bitcoin office, said Thursday that though the wallet will be phased out, Bitcoin is still a legal tender in the nation, and El Salvador Bitcoin investment will continue, maybe at an even faster pace, to build strategic reserves.

This announcement comes a day after the country sealed a deal for a $1.4 billion loan package with the IMF, which is partially conditional upon scaling back El Salvador Bitcoin investment.

IMF Agreement Means Change in Approach to El Salvador Bitcoin Investment

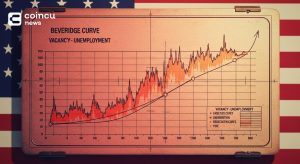

In 2021, El Salvador went ahead and became the first country in the world to grant Bitcoin its status as legal tender, the most daring move that had drawn not only global attention but also some criticism. While Bitcoin surged recently to a record high above $108,000, the IMF has raised its concerns regarding the potential risks related to cryptocurrencies.

Under the new deal, the IMF has called for El Salvador to reduce the risks associated with Bitcoin as part of broader efforts to upgrade its economy. The agreement is pending approval from the IMF’s executive board and marks a dramatic about-face for the IMF’s stance on cryptocurrency regulation.

It clearly reflects a growing flexibility at the IMF, possibly in light of more crypto-friendly policies about to come under the Trump regime, according to Alejandro Werner, former director of the International Monetary Fund’s Western Hemisphere Department.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |