Millennium Management Bets Big on Bitcoin ETFs as Institutional Investments Surge

Key Points:

- Millennium Management disclosed $2.6 billion in Bitcoin ETFs and $182.1 million in Ethereum ETFs, with BlackRock’s IBIT being its largest position.

- Goldman Sachs increased its Bitcoin ETF holdings by 88% to $1.5 billion, while Barclays and Abu Dhabi’s sovereign wealth fund also made significant investments.

Millennium Management has disclosed substantial cryptocurrency holdings in its latest 13F filing with the U.S. Securities and Exchange Commission (SEC), with $2.6 billion in Bitcoin ETFs and $182.1 million in Ethereum ETFs.

Read more: Millennium Management Bitcoin ETF Accounts For 3% Of Its Portfolio

Millennium Management Expands Crypto ETF Holdings

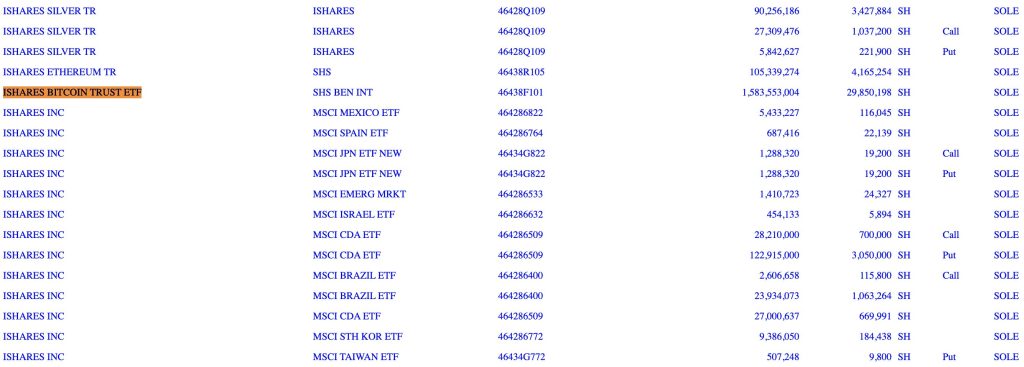

The hedge fund’s Bitcoin ETF investments span multiple funds, with BlackRock’s IBIT accounting for the largest share at over $844 million, followed by Fidelity’s fund at approximately $806 million. Additional holdings include the ARK 21Shares Bitcoin ETF, the Bitwise Bitcoin ETF, and the Grayscale Bitcoin Trust.

Millennium Management’s filing also reveals a growing trend of institutional engagement with cryptocurrency ETFs. Goldman Sachs significantly increased its Bitcoin ETF exposure, boosting holdings by 88% quarter-over-quarter to 24.07 million shares.

The investment bank’s total Bitcoin ETF holdings now stand at $1.5 billion, making it the third-largest holder of IBIT, trailing Brevan Howard Capital and Millennium Management. Additionally, Barclays reported a new stake in IBIT, acquiring 2.47 million shares valued at $131 million.

Growing Adoption of Digital Assets Among Large Funds

Institutional interest in Bitcoin ETFs extends beyond hedge funds and banks. Abu Dhabi’s sovereign wealth fund made its first purchase of BlackRock’s spot Bitcoin ETF, acquiring $436.9 million worth of shares.

In May 2024, Millennium Management’s Bitcoin ETF investments reached nearly $2 billion across five funds, representing just 3% of its total assets.

Not only Millennium but the Wisconsin State Pension Fund has more than doubled its stake in IBIT to 6.06 million shares, now valued at $321.5 million. However, the pension fund currently allocates all of its BTC investments to IBIT and no longer holds any GBTC shares.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |