RedStone – The Novel Oracle Brings 40M RED Tokens to Binance

RedStone is bringing modular oracle solutions to a wider audience through Binance Launchpool, offering users a chance to farm RED tokens by staking BNB, FDUSD, and USDC.

Unlike traditional oracles, the next-gen Oracle network optimizes gas costs by keeping data off-chain and only delivering it when required. Its support for both EVM and non-EVM blockchains makes it a versatile solution for developers.

Through Binance Launchpool, users can participate in the RED token distribution, gaining early access to a project that is already integrated with 130+ protocols across 70+ chains.

| Key Takeaways – Supporting EVM and non-EVM blockchains, RedStone integrates with 130+ projects across 70+ chains. – RedStone minimizes gas fees by keeping data off-chain until needed. – Binance Launchpool enables users to farm RED tokens by staking BNB, FDUSD, and USDC. |

What is RedStone Oracle?

RedStone Oracle is a next-generation, modular blockchain oracle that provides customizable, cost-efficient, and high-frequency data feeds for decentralized applications (dApps).

Unlike traditional Oracle networks such as Chainlink and Pyth, RedStone is built from the ground up to address inefficiencies in existing Oracle solutions, offering a scalable, flexible, and secure way to deliver off-chain data to smart contracts.

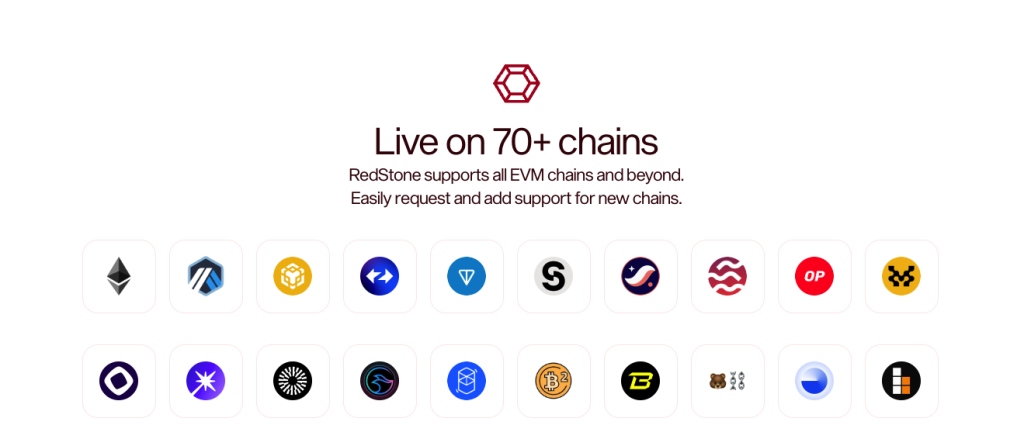

Trusted by 100+ dApps across 70+ blockchain networks and securing billions of dollars in value, RedStone supports a wide range of blockchain ecosystems, including both EVM and non-EVM networks.

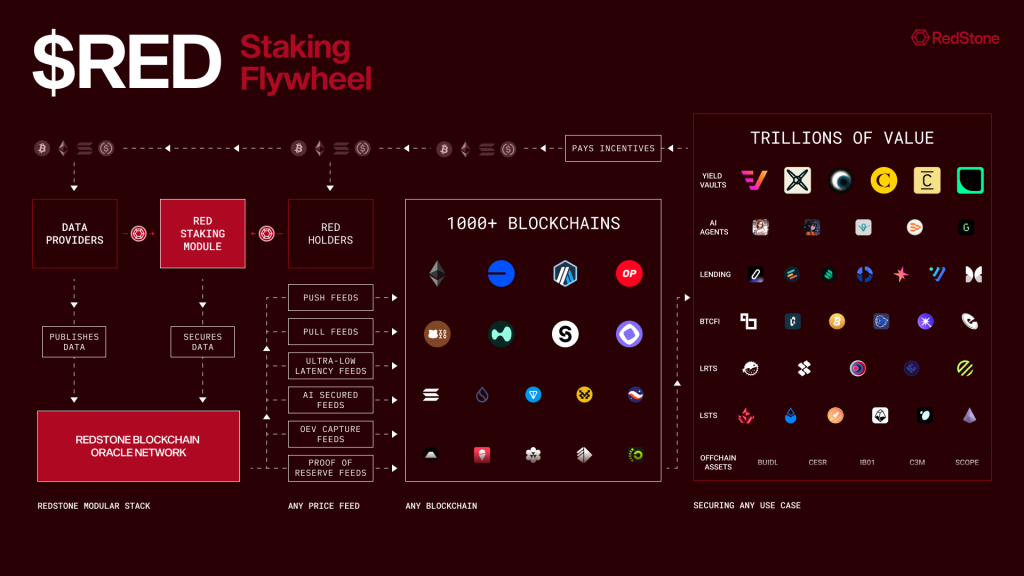

By leveraging on-demand (Pull) and continuous (Push) models, the Modular Oracle ensures cost-effective data availability, making it an ideal solution for DeFi protocols, gaming applications, and cross-chain projects.

Key Features and Ecosystem

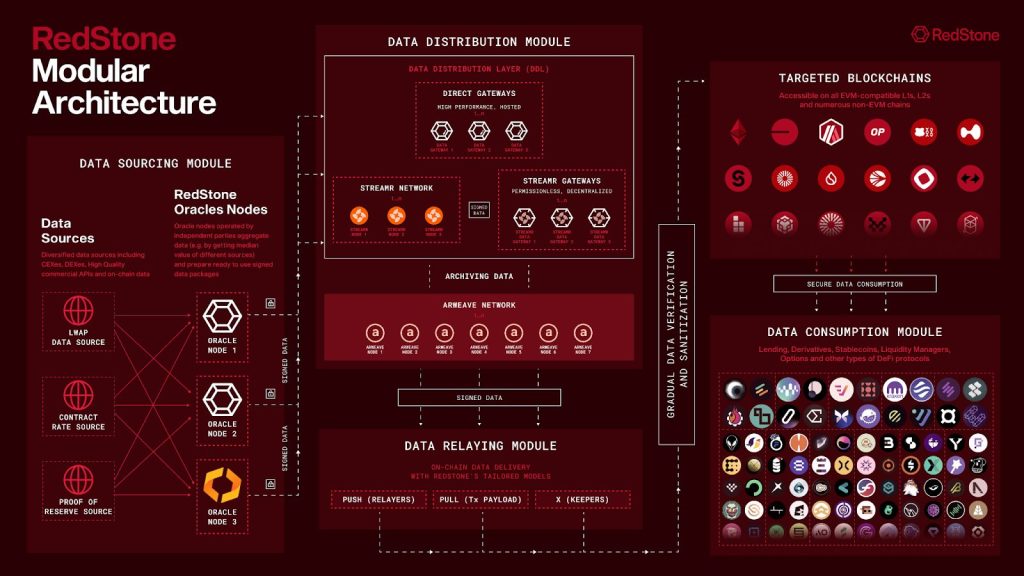

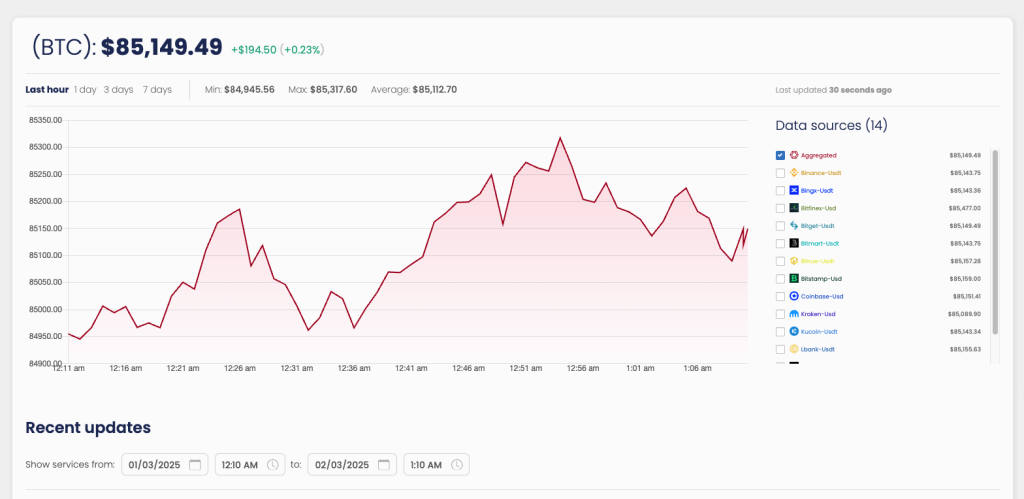

RedStone’s core technology includes a modular architecture where data is stored off-chain and only brought on-chain when needed. Data sources range from centralized exchanges like Binance and Coinbase to decentralized ones like Uniswap, plus traditional finance, real-world assets, NFTs, and AI data.

Key Features

1. Modular Architecture for Scalable Multi-Chain Data Delivery

Unlike traditional oracles that require separate infrastructure per blockchain, RedStone’s modular approach separates data collection from data delivery, allowing a single price feed to be used across multiple networks without additional setup.

- Supports over 70 blockchain networks, including Ethereum, L2s, and non-EVM chains.

- No need for redundant nodes per chain, making integration faster and more cost-effective.

- Optimized for DeFi, perpetuals, and liquid staking markets.

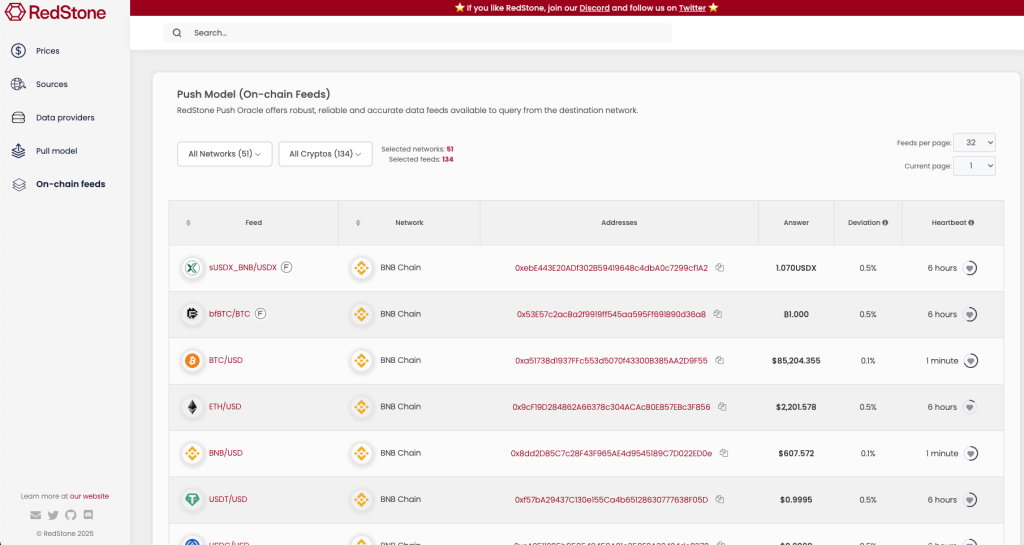

2. Cost-Efficient & Flexible Data Delivery Models

RedStone offers three different data delivery models, making it gas-efficient and adaptable to various dApp needs:

- Pull Model (On-Demand Data Injection) – Injects real-time data into transactions, saving gas by only fetching data when required.

- Push Model (Continuous Data Updates) – Periodically updates on-chain price feeds, ideal for protocols needing constant availability.

- Hybrid Model (ERC7412 Standard) – A combination of both Push and Pull models, first introduced by Synthetix and optimized by RedStone.

Why It Matters?

- Reduces gas costs significantly compared to traditional oracles like Chainlink.

- Enables dApps to choose the best model based on their requirements.

3. High Security & Data Integrity

RedStone ensures data accuracy, reliability, and security through multiple validation layers:

- Cryptographic Signing & Attestation – Every data point is signed by independent providers, ensuring authenticity and tamper-proof data.

- On-Chain Aggregation & Medianization – Price feeds are aggregated using median-based or liquidity-weighted models, filtering out anomalies.

- Anomaly Detection & Timestamp Validation – Automated price monitoring prevents inaccurate or manipulated data from being recorded.

- Economic Security Model – Providers must stake collateral, which can be slashed for incorrect data submissions.

Results?

- Zero mispricing incidents since inception.

- Audited by leading security firms like ABDK, Halborn, and AuditOne.

4. Diverse & Customizable Data Feeds

RedStone supports a wide range of data types, making it more versatile than traditional oracles:

- Market Feed – Traditional price feeds from centralized (Binance, Coinbase) and decentralized (Uniswap, Balancer) exchanges.

- Contract Rate Feed – On-chain exchange rates from protocols like Lido (wstETH/stETH) and EtherFi (weETH/eETH).

- Real World Feed – Off-chain financial data like SOFR interest rates and stock indices.

- Proof of Reserve Feed – Real-time monitoring of collateralized assets, such as BlackRock’s BUIDL token reserves.

- Protocol Native Oracle – Custom price feeds designed for specific blockchain ecosystems (e.g., LBTC/BTC for Lombard Protocol).

5. Broad Blockchain Support & Cross-Chain Compatibility

RedStone operates across a wide variety of blockchain ecosystems, including:

- Ethereum & Layer 2s – Arbitrum, Optimism, Base, Starknet, Fuel, Sei.

- Non-EVM Chains – Sui, Solana, Bitcoin layers.

- Rollup-as-a-Service (RaaS) Networks – EigenLayer.

The Ecosystem

RedStone is deeply integrated with some of the biggest DeFi, staking, and trading protocols, enabling secure and cost-effective data feeds across the Web3 space.

RedStone Core

- Designed for DeFi applications that require on-demand pricing.

- TVL secured: Over $100M+.

RedStone Classic

- Push-based model for protocols that need constant price updates.

- Used by lending markets, stablecoins, and automated vaults.

RedStone X

- Optimized for perpetual contracts, options, and derivatives.

- Eliminates front-running risks and enhances trading security.

Why Choose RedStone Over Other Oracles?

| Feature | RedStone | Chainlink | Pyth |

|---|---|---|---|

| Oracle Model | Push & Pull | Push | Pull |

| Mispricing Events | No | $11.2M lost in Terra, 25% wstETH mispricing | 87% BTC mispricing, Drift & Mango failures |

| Blockchains Supported | Modular (Pull, Push, Hybrid) – Push Model = 38 – Pull Model = 70 | Push Model = 18 | Pull Model = 70+ |

| Non-EVM Chains Support | TON, Starknet, Fuel, Radix, Movement, Sui | None (Work in Progress) | Solana, Aptos, Sui, Fuel, Injective |

| Price Feed Sources | CEX, DEX, Custom Sources | Aggregators | Publishers (Market Makers) |

| Oracle Extractable Value (OEV) | RedStone OEV (Cross-Chain) | Smart Value Recapture (Ethereum-only) | Express Relay (Cross-Chain) |

| PoR Product | Yes | Yes | No |

| Bitcoin Liquid Staking PoR Oracle Support | Yes | No | No |

| Native Support for RaaS and L2 Stacks | Yes | No | Yes |

| Restaking Oracle Module (AVS) | EigenLayer & Symbiotic Testnets | No | No |

| Tokenized Vault Support | Veda, Nucleus, Dinero | No | No |

| Institutional Clients | CoinFund, CoinDesk Indices, CESR, Soneium | SWIFT, ANZ Bank, Soneium | Soneium |

| VRF Support | Verifiable Randomness (Testnet) | Chainlink VRF | Pyth VRF |

Token Details

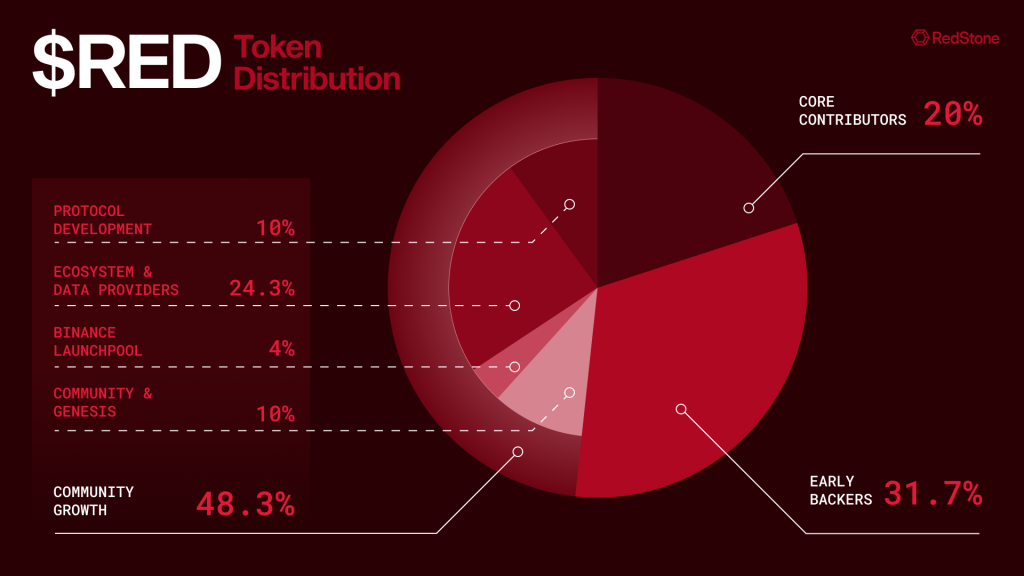

The RED token is the native utility and governance token of the RedStone network. With a total supply of 1 billion tokens, RED is designed to support the long-term sustainability and expansion of oracle services.

| Metric | Details |

|---|---|

| Ticker | RED |

| Token Contract | 0xc43c6bfeda065fe2c4c11765bf838789bd0bb5de [Ethereum Mainnet] |

| Max Supply | 1,000,000,000 RED |

| Float at TGE | 28% (280,000,000 RED) |

| Percentage to Community Growth | 48.3% |

| Token Standard | ERC-20 (Ethereum) |

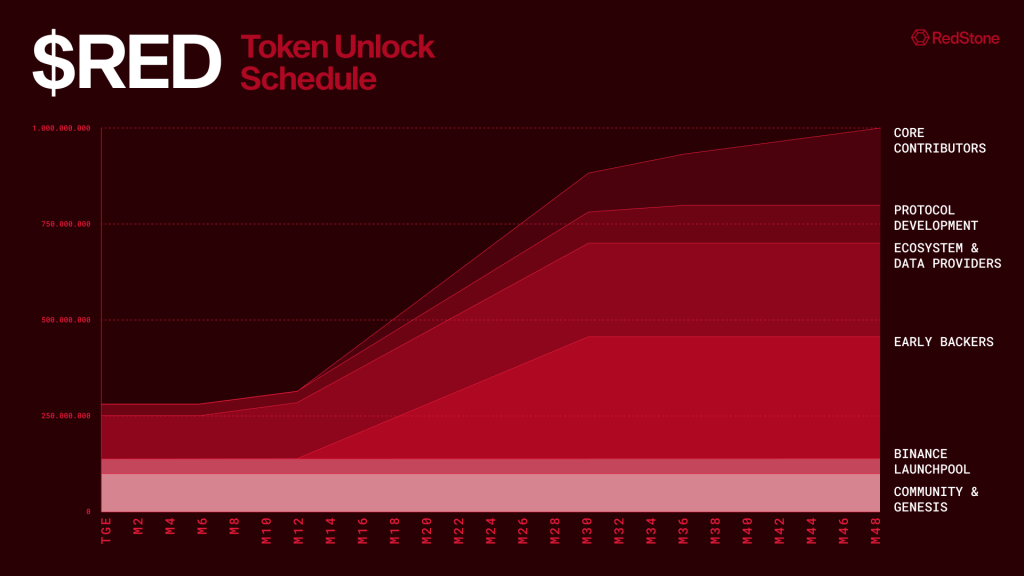

| Lock-Up Period | 72% of RED initially locked, unlocking over 4 years |

Token Allocation Breakdown

| Category | Allocation |

|---|---|

| Community & Genesis | 10.00% |

| Protocol Development (Partially Locked) | 10.00% |

| Core Contributors (Locked) | 20.00% |

| Binance Launchpool | 4.00% |

| Ecosystem & Data Providers (Partially Locked) | 24.30% |

| Early Backers (Locked) | 31.70% |

| Total | 100% |

Key Unlocking Facts:

- RED Max Supply is hardcoded at 1,000,000,000 in a non-upgradeable contract.

- Initial Circulating Supply (Binance Pre-Market): 40,000,000 RED

- Circulating Supply at TGE: 280,000,000 RED

- The total supply will gradually unlock over four years post-TGE.

RED Token Utility – Staking for Security

RED powers RedStone’s sustainable oracle ecosystem, ensuring long-term security for DeFi.

- Staking via EigenLayer AVS enhances RedStone’s Oracle security, leveraging billions in staked assets.

- Data Providers & Token Holders can stake RED to strengthen the network.

- Rewards are earned from data users across multiple blockchains, paid in ETH, BTC, SOL, and USDC.

Recent Launchpool Event

RedStone (RED) was officially launched on Binance Launchpool as its 64th project, marking a significant milestone in RedStone’s journey toward wider adoption and decentralization. The Launchpool event allowed users to earn RED tokens by staking their assets in designated pools.

Binance Launchpool Details

- Start Date: February 26, 2025, at 00:00 UTC

- End Date: February 27, 2025, at 23:59 UTC

- Total Token Rewards: 40,000,000 RED (4% of total supply)

- Initial Circulating Supply: 280,000,000 RED (28% of total supply)

- Network: Ethereum (ERC-20)

- Contract Address: 0xc43c6bfeda065fe2c4c11765bf838789bd0bb5de

Staking Pools & Rewards Allocation

| Pool | Rewards Allocated | Percentage |

|---|---|---|

| BNB Pool | 32,000,000 RED | 80% |

| FDUSD Pool | 4,000,000 RED | 10% |

| USDC Pool | 4,000,000 RED | 10% |

Hourly Hard Cap per User

| Pool | Max Tokens per Hour |

|---|---|

| BNB Pool | 66,666 RED |

| FDUSD Pool | 8,333 RED |

| USDC Pool | 8,333 RED |

Binance Pre-Market & Trading Details

Following the Launchpool event, Binance listed RedStone (RED) in its pre-market trading segment on February 28, 2025.

- Opening Price: 0.4 USDT

- Price Performance: Hit the daily limit on the first day, with no selling orders available

To manage volatility, Binance introduced a Price Cap Mechanism for RED:

- Day 1: 200% cap on opening price

- Day 2: 300% cap

- Day 3: 400% cap

- After 72 hours: No price restrictions

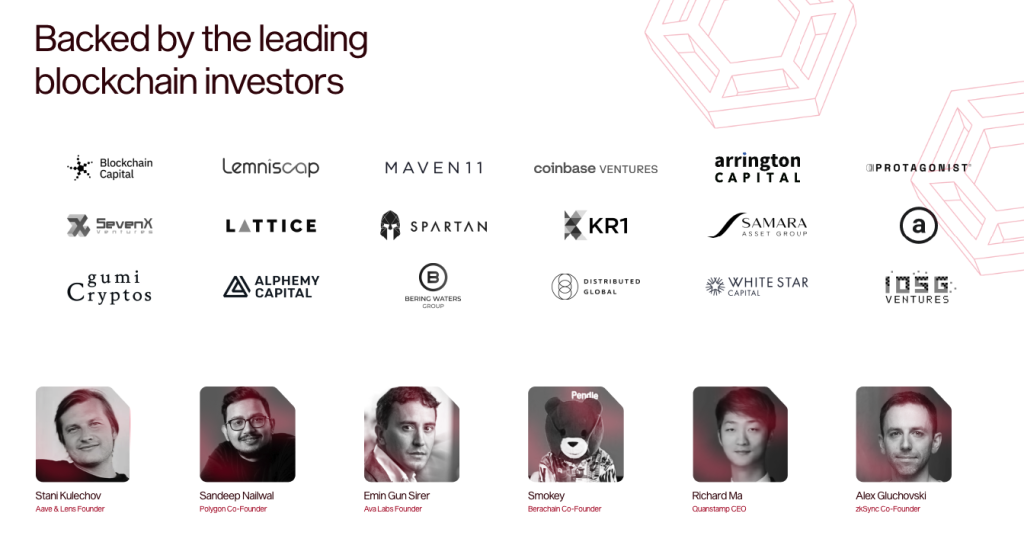

Funding and Partnerships

RedStone has raised around $23 million across three rounds, including a $7 million seed round in August 2022 and a $15 million Series A in July 2024, backed by investors like Coinbase Ventures and Arrington Capital. The firm partnered with major players like Lido, EigenLayer, and Sei Network, enhancing its credibility.

Funding Rounds & Investors

| Round | Amount Raised | Date | Lead Investors & Participants |

|---|---|---|---|

| Seed Round | $7 million | August 2022 | Coinbase Ventures, Arrington Capital |

| Series A | $15 million | July 2024 | Kraken Ventures, White Star Capital, Spartan Group, Amber Group, SevenX Ventures, IOSG Ventures |

Angel Investors

- Smokey the Bera & Homme Bera (Berachain)

- Mike Silagadze (Co-Founder, Ether.Fi)

- Jozef Vogel & Rok Kopp (Ether.Fi)

- Amir Forouzani, Jason Vranek & Christina Chen (Puffer Finance)

| Category | Partners |

|---|---|

| Blockchain & Infrastructure Partners | EigenLayer, Sei Network, Fuel Network, Sui, Berachain, Story, Unichain, TON, Monad, MegaETH |

| DeFi & Liquid Staking Integrations | Lido, Swell Network, Pendle, DeltaPrime, Morpho, Lombard Protocol (LBTC), Uniswap, Curve Finance |

| Data Aggregation & Institutional Feeds | Binance, Coinbase, Kraken, OKX, Bybit, Kaiko, CoinMarketCap, Trading Platforms, Real World Assets (RWA), ETFs |

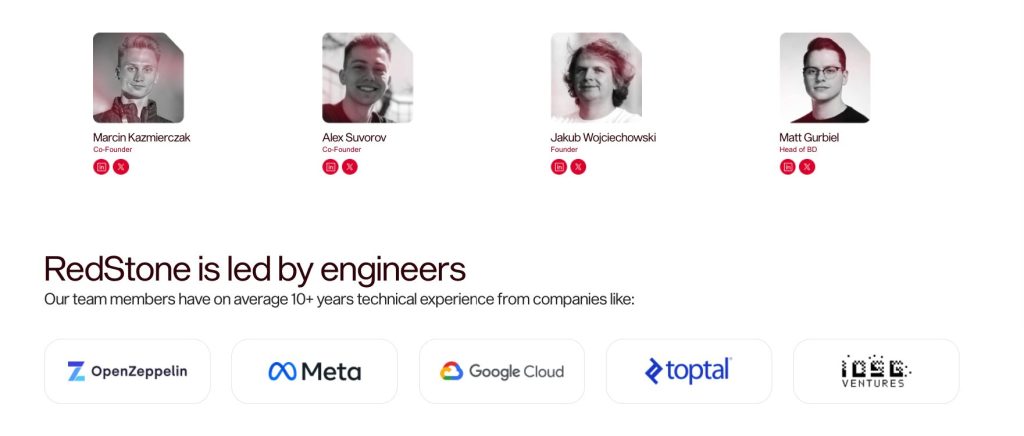

RedStone Team

RedStone has been building a world-class team of blockchain engineers, developers, and business leaders to revolutionize the Oracle sector. The team members bring extensive experience from leading tech companies and are committed to scalability, security, and innovation in decentralized data solutions.

- Marcin Kazmierczak – Co-Founder

- Alex Suvorov – Co-Founder

- Jakub Wojciechowski – Founder

- Matt Gurbiel – Head of Business Development

At RedStone, we are building a rock-solid team to become one of the global leaders in the blockchain oracle sector. We emphasize high ownership, continuous learning, and exceptional quality—because we build tools by builders, for builders.

The RedStone team said in an introduction video published on Youtube.

The team members have worked at top technology companies, including OpenZeppelin, Meta, Google Cloud, Toptal, and ICB Ventures, bringing deep expertise in DeFi security, decentralized systems, and large-scale cloud infrastructure.

Conclusion

RedStone Oracle’s launch on Binance Launchpool is a meaningful step for DeFi, which offers cost-effective and flexible Oracle solutions. With its robust ecosystem and strong backing, it seems likely to become a key player in the Oracle space. For more details, check RedStone’s website or BINANCE’s announcement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |