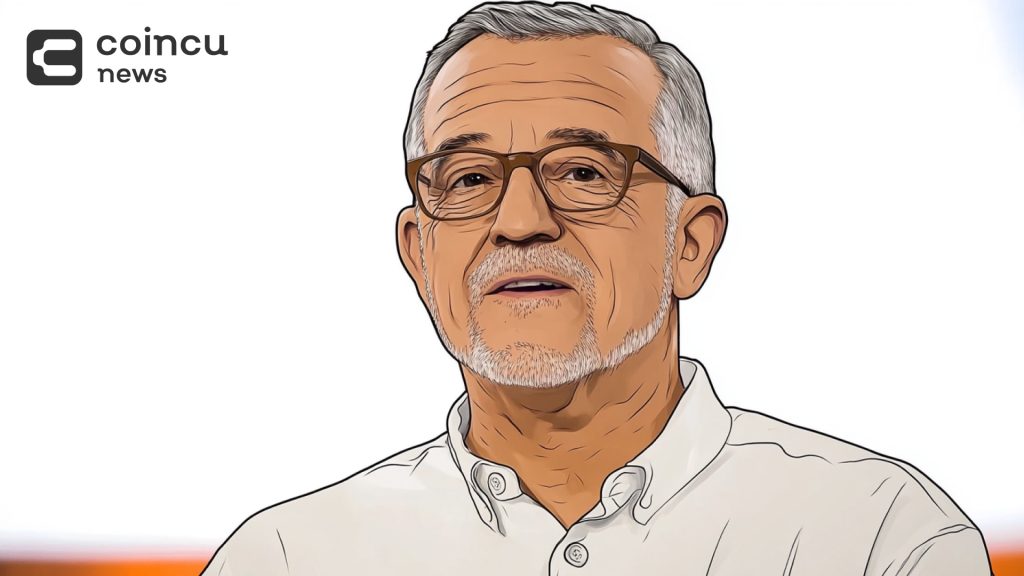

Mexican Billionaire Ricardo Salinas Now Holds 70% of Wealth in Bitcoin

Key Points:

- Mexican billionaire Ricardo Salinas has allocated 70% of his investment portfolio to Bitcoin-related assets and 30% to gold and gold mining stocks.

- Salinas is contesting a $3 billion tax dispute with the Mexican government, arguing that the alleged debt stems from an accounting error.

Mexican billionaire Ricardo Salinas has revealed that roughly 70% of his investment portfolio is tied to Bitcoin-related assets, while the remaining 30% consists of gold and stocks in gold mining companies.

The billionaire, known for his strong advocacy of decentralized finance, has openly promoted Bitcoin on social media.

Ricardo Salinas Allocates 70% of Portfolio to Bitcoin

Ricardo Salinas, the founder and chairman of Grupo Salinas, stated that he does not invest in bonds or stocks outside of his own companies. His preference for what he calls “the hardest assets” reflects a deep skepticism toward traditional financial instruments.

The latest disclosure marks a significant shift from 2020 when he reported allocating just 10% of his portfolio to Bitcoin. However, he did not specify the exact value of his holdings.

Beyond his investment strategy, Salinas is currently embroiled in a legal dispute with the Mexican government over alleged unpaid taxes. Authorities claim that he owes approximately 63 billion pesos ($3 billion), a matter that has escalated into a court battle.

However, Salinas insists that the tax liability stems from an accounting error that resulted in double billing. He has expressed willingness to pay what he truly owes but refuses to settle duplicate charges.

Grupo Salinas Chairman Expands Influence in Business and Crypto

Ricardo Salinas, whose net worth is estimated at $4.6 billion by Forbes, has long been a vocal supporter of Bitcoin. Four years ago, he sought to position his bank as the first in Mexico to accept the cryptocurrency. His influence extends across various sectors, as Grupo Salinas controls businesses in telecommunications, media, financial services, and retail.

He also runs Grupo Elektra, a retail giant founded by his grandfather in the 1950s. The company primarily serves lower-middle-class consumers who finance purchases through Banco Azteca, its banking division. With a presence in Mexico, Guatemala, and Honduras, Elektra operates over a thousand stores.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |