Texas Bitcoin Reserve Bill Clears Senate, Paving Way for State Crypto Fund

| Key Points: – The Texas Senate passed SB-21 to establish a state-managed Bitcoin reserve, pending approval from the House and the governor. – The Texas Bitcoin Reserve will operate outside the state treasury and require assets with a market capitalization of at least $500 billion. |

The Texas Senate has approved Senate Bill 21 (SB-21), paving the way for the creation of a Texas Bitcoin Reserve.

The bill, introduced by Senator Charles Schwertner, now moves to the House of Representatives for consideration before it can be signed into law by the governor.

Texas Senate Advances Bill to Establish Texas Bitcoin Reserve

Lieutenant Governor Dan Patrick announced the Senate’s decision on March 6, highlighting bipartisan support for the initiative. He described the Texas Bitcoin Reserve as a crucial step in reinforcing the state’s role in the digital economy.

Patrick also emphasized that the bill aligns with his commitment to advancing Texas’ leadership in emerging financial technologies:

“I promised to make a Texas Bitcoin Reserve a priority to solidify Texas’ leadership in the digital age,” he said.

The legislation establishes a dedicated fund outside the state treasury, granting flexibility in investment strategies. The Texas Bitcoin Reserve will be funded through legislative appropriations, revenue sources, cryptocurrency purchases, investment returns, and donations. To ensure stability, any digital asset acquired must have maintained a market capitalization of at least $500 billion over the past year.

Federal Government Strengthens Cryptocurrency Holdings

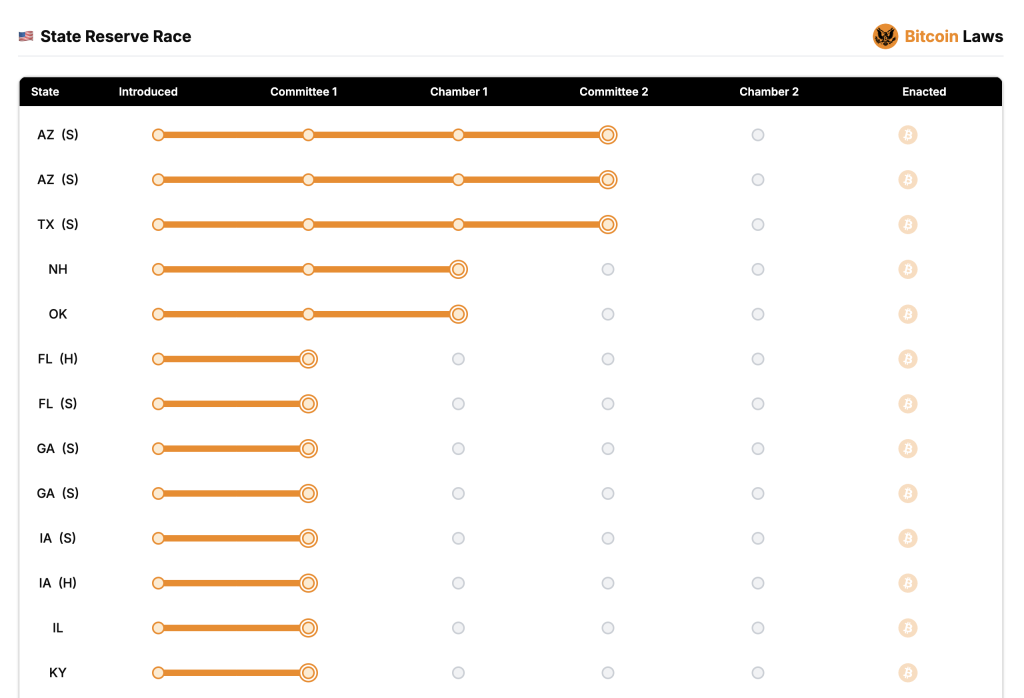

Texas joins a growing number of states exploring the use of Bitcoin as a reserve asset, trailing only Arizona in legislative progress on the issue.

The bill’s passage comes amid heightened market fluctuations for Bitcoin. The cryptocurrency has recently entered a bear market, with its value dropping over 20% from a January peak of $109,300 to approximately $85,100.

Meanwhile, on the federal level, cryptocurrency policies are also evolving. President Donald Trump recently signed an executive order establishing a Strategic Bitcoin Reserve and Digital Asset Stockpile.

The development aims to centralize Bitcoin holdings derived from seized assets and civil penalties, managed by the U.S. Treasury. It coincides with the Crypto Summit at the White House, where industry leaders have discussed the future of digital assets in the economy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |