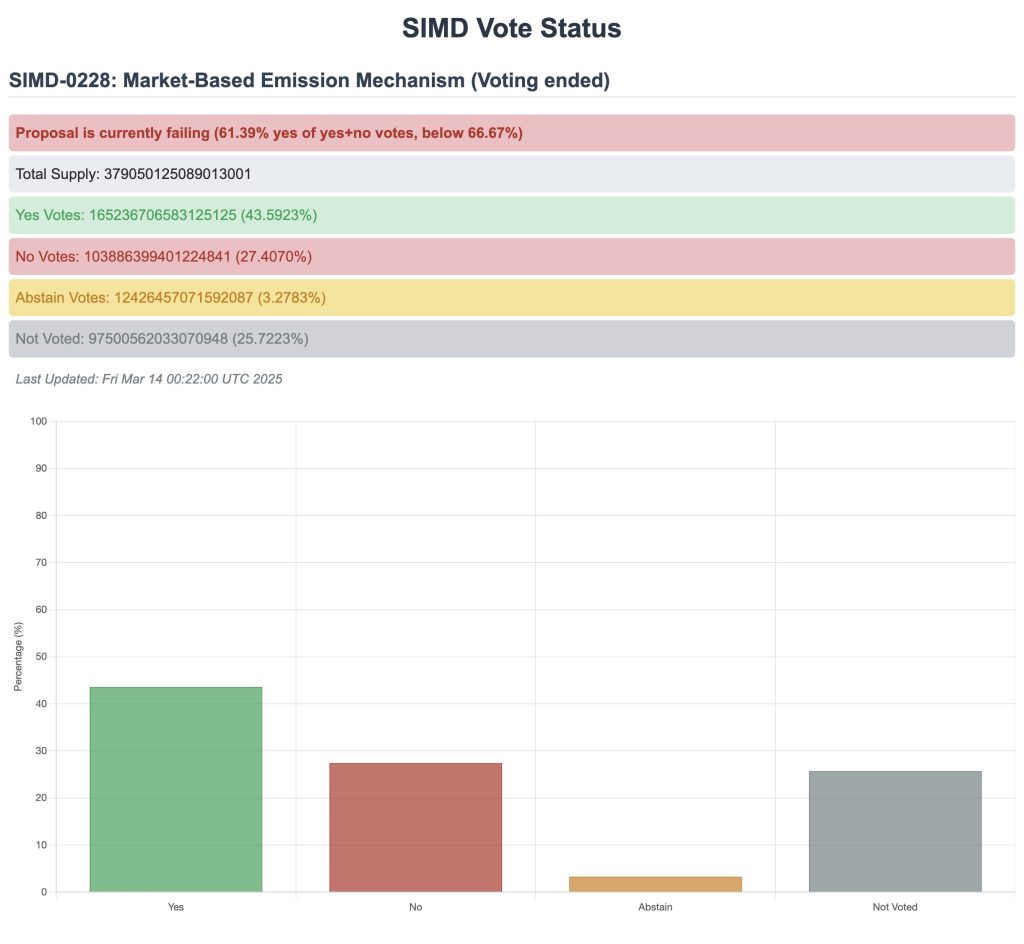

| Key Points: – Solana’s SIMD-0228 proposal to cut SOL inflation by 80% did not pass, receiving only 38.61% support instead of the required 61.39%. – Critics argue that high inflation encourages excessive staking, while supporters believe reducing emissions could help attract institutional investors and support SOL-based ETFs. |

A Solana governance proposal aimed at significantly reducing the blockchain’s inflation rate has failed to gain sufficient support from validators.

The SIMD-0228 proposal, introduced by Multicoin Capital and led by Anza economist Max Resnick, sought to cut Solana’s SOL issuance by 80%, bringing the current 4.5% inflation rate down to below 1% under present staking conditions.

SIMD-0228 Proposal Fails to Gain Approval

Despite receiving 38.61% support from validators, it fell short of the required 61.39% approval threshold during Epoch 755.

SIMD-0228 proposed a shift from Solana’s existing pre-set emissions model to a market-driven mechanism that adjusts inflation based on the percentage of SOL being staked.

The proposal aimed to set a 50% staking target, compared to the current 63%, in an effort to optimize staking incentives and enhance network security while preventing overpayment for security. Solana’s current issuance model gradually decreases inflation from an initial 8% at a rate of 15% per year until it stabilizes at 1.5%. The current inflation rate of SOL token is 4.661%.

The Solana’s model contrasts with Ethereum’s near-zero inflation, making SOL’s higher inflation rate a concern for long-term token value preservation.

Market Struggles as SOL Price and DeFi Activity Decline

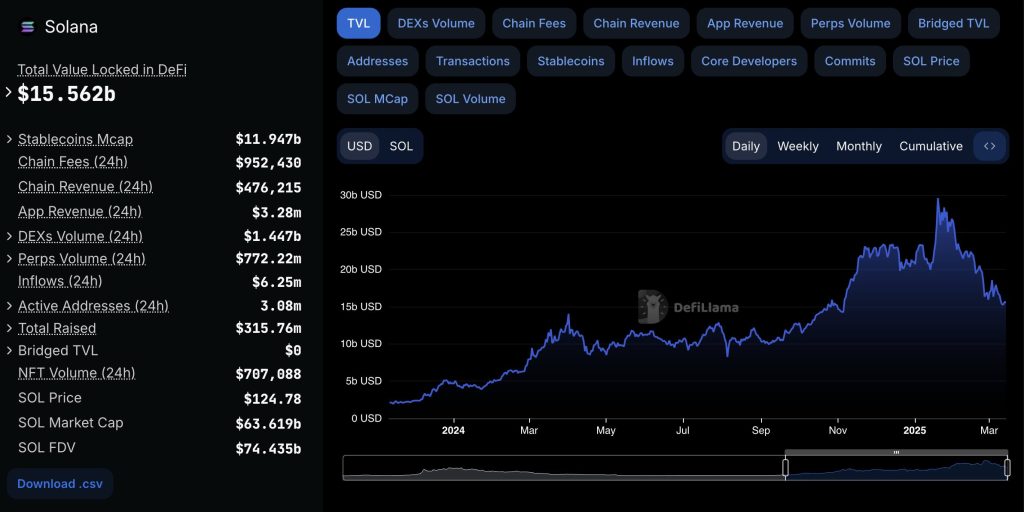

Solana’s recent market performance has also reflected broader concerns. As of March 14, SOL is trading at $125, significantly down from its January peak of $294.

DeFi activity on the network has declined, with Solana’s total value locked (TVL) dropping from $29.6 billion in January to $15.5 billion, according to DefiLlama data.

Critics argue that high inflation encourages excessive staking, which may hinder the development of Solana’s decentralized finance (DeFi) ecosystem by locking up liquidity.

The proposal initially received positive feedback when introduced in January but has faced increasing opposition. Among the skeptics is Solana Foundation President Lily Liu, who cautioned that unpredictable staking rewards could deter institutional investors.

Despite its failure, SIMD-0228 saw the highest level of community participation in Solana’s governance history.

Meanwhile, supporters of SIMD-0228 proposal claim that reducing emissions would improve institutional adoption, particularly with the potential approval of SOL-based exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). Howerver, the SEC has yet to approve staking ETFs for Ethereum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |