SEC Clarifies Stablecoin Regulatory Exemption Under U.S. Securities Law

- The SEC exempts covered stablecoins from being classified as securities.

- This move is likely to boost market confidence and adoption.

- Stablecoins see increased utility in decentralized finance ecosystems.

Market response has been positive. Circle’s President Heath Tarbert underscored, “The SEC’s differentiation between stablecoins backed by liquid reserves and others with more opaque structures is crucial”, while SEC Commissioner Hester Peirce continues to champion a more transparent approach towards cryptocurrency regulations. These reactions point to increased faith in stablecoins, energizing the sector.

This clarification is set to enhance market confidence, driving adoption among financial institutions. The SEC’s emphasis suggests reduced regulatory intervention for these stablecoins, promoting their utility in payments and value storage rather than investment purposes.

SEC’s Exemption Fuels Stablecoin Market Growth

The U.S. Securities and Exchange Commission (SEC) announced that Covered Stablecoins are exempt from being classified as securities. These stablecoins, pegged to USD, and backed by liquid reserves, were defined by the SEC’s Division of Corporation Finance. Major players like Tether and Circle fall under this category, potentially benefiting from the newly clarified regulatory framework.

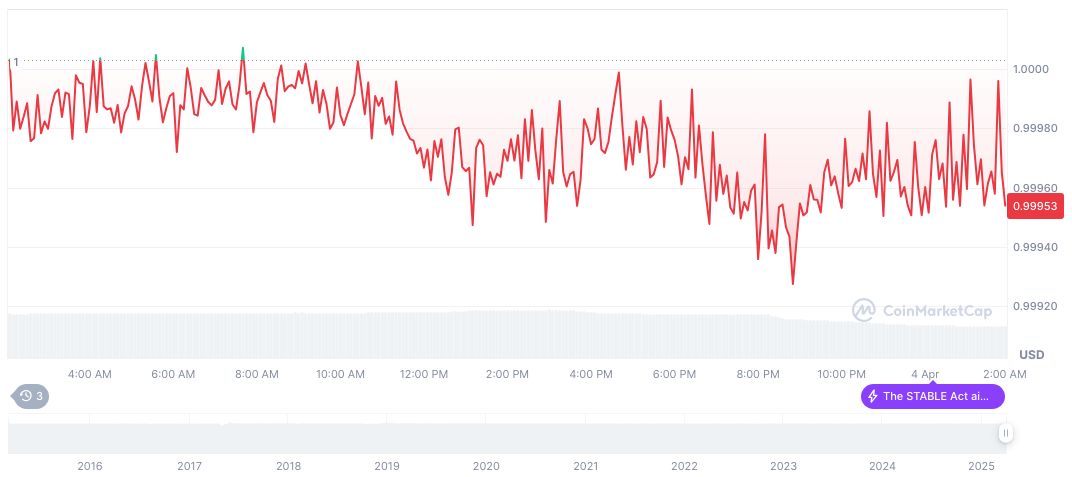

Based on CoinMarketCap data, Tether (USDT) maintains a stable price of $1.00, with a market cap of $144.04 billion and daily trade volume of $78.21 billion. USDT’s market dominance stands at 5.37%. Price movement is minimal over recent periods, showing stability.

Insights from the Coincu research team suggest that the SEC’s decision could lead to increased utilization of stablecoins within decentralized finance ecosystems, mitigating previous regulatory hesitations. Expert analysis highlights the potential for technological advancements, which might further integrate stablecoins into everyday financial activities.

Stablecoin Pricing Stability and Regulatory Perspectives

Did you know? The SEC’s classification of stablecoins marks a shift towards reducing oversight for select crypto assets, a strategy reminiscent of previous rulings on non-securities like memecoins and mining activities.

Market response has been positive. Circle’s President Heath Tarbert underscored, “The SEC’s differentiation between stablecoins backed by liquid reserves and others with more opaque structures is crucial”, while SEC Commissioner Hester Peirce continues to champion a more transparent approach towards cryptocurrency regulations. These reactions point to increased faith in stablecoins, energizing the sector.

Insights from the Coincu research team suggest that the SEC’s decision could lead to increased utilization of stablecoins within decentralized finance ecosystems, mitigating previous regulatory hesitations. Expert analysis highlights the potential for technological advancements, which might further integrate stablecoins into everyday financial activities.