- Hyperliquid responds to market manipulation with updated risk mechanisms and liquidation process.

- Risk management optimizations enhance liquidation handling post-incident.

- Community response mixed with concerns over decentralization authenticity.

Hyperliquid, a decentralized exchange, faced a market manipulation incident with its liquidity provider pool on July 3, 2023. The incident revealed structural vulnerabilities, prompting Hyperliquid to enhance its risk management protocols to limit exposure and prevent future manipulation.

Hyperliquid revealed enhanced risk management protocols after an incident exposed platform vulnerabilities. The exchange clarified that its margin design is robust, limiting losses within HLP treasury. Despite this, the need for intervention highlighted inherent risks, prompting protocol refinements to handle backup liquidations more effectively.

Hyperliquid Enhances Risk Management Post-Incident

In the aftermath, Hyperliquid imposed new collateral limits, improving the platform’s resilience to market manipulation. These changes aimed to curb exposure and reinforce liquidation mechanisms, reducing risks. The exchange remains committed to its original operation methods despite these refinements.

The incident sparked debate over centralized decisions akin to FTX’s interventions, affecting trust. Critics called for transparency in decentralized claims.

“Hyperliquid’s margin design ensures platform solvency via mathematical mechanisms, and losses from HLP are limited to its treasury.” – Jeff, Co-founder, Hyperliquid

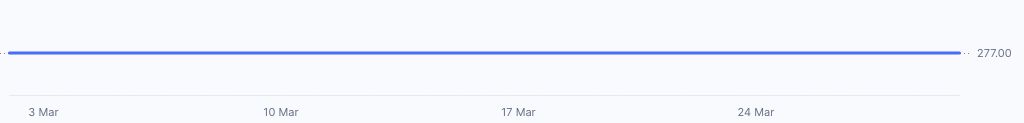

Market Reaction: JELLY Falls 70% Over 90 Days

Did you know? The Hyperliquid event highlighted vulnerabilities in decentralized financial systems akin to the Mango Markets exploit in 2022, leading to renewed scrutiny on oracle-dependent platforms.

CoinMarketCap data reveals JELLY’s price fell significantly after the incident. Though its 7-day change marked a 8.35% rise, longer-term metrics indicated a 70.32% drop over 90 days. This underscores fluctuating market sentiment.

Coincu researchers suggest potential regulatory changes may arise as markets respond to ongoing centralization concerns in DeFi platforms. Enhanced risk strategies reflect broader industry moves towards transparency and stability. The need for robust governance mechanisms in decentralized systems remains critical for industry trust.