- Securitize acquires MG Stover’s fund management business, expanding services.

- Securitize now manages $38 billion in digital assets.

- BlackRock’s tokenized U.S. Treasury fund included.

Securitize announced the acquisition of MG Stover’s fund management business on April 16, enhancing its position in the digital asset fund management sector. The acquisition includes managing $38 billion across 715 funds, significantly broadening its service reach. This marks a pivotal step in consolidating digital asset fund administration, with Securitize offering comprehensive institutional services like fund management, token issuance, and brokerage. Immediate reactions highlight the expanding policy implications of blockchain on traditional financial systems.

Securitize has expanded its services by acquiring MG Stover’s fund management business, adding $38 billion in asset management across 715 funds. Securitize’s subsidiary, SFS, now operates with enhanced capabilities, including tokenized funds like BlackRock’s $2.45 billion U.S. Treasury bond fund. This acquisition strengthens Securitize’s position as a major digital asset manager, with improved fund administration and token issuance capabilities tailored for institutional clients. It’s a strategic move to mirror traditional finance on blockchain.

Securitize Expands with $38 Billion Asset Management Acquisition

Market reactions unanimously acknowledge this growth, with Carlos Domingo, CEO of Securitize, stating:

The acquisition aligns with the broader industry trend toward blockchain-based financial systems.

“Securitize’s acquisition of MG Stover’s Fund Administration business cements our role as the most comprehensive platform for institutional grade real-world asset tokenization and fund administration. This is a significant step in our growth, reinforcing our commitment to expanding our capabilities as we serve an ever-expanding cohort of asset issuers and investors.”

Tokenization’s Growth and Market Volatility Insights

Did you know? The global tokenized asset market is projected to reach $18 trillion by 2033, as reported by BCG and Ripple, showcasing the potential growth avenue for platforms like Securitize.

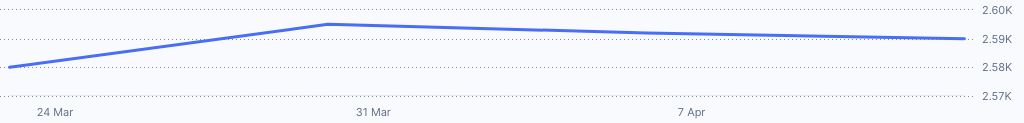

DFOhub (BUIDL) shows marked price fluctuations with a notable 7-day increase of 17.62% despite a 24-hour decline of 0.72%, according to CoinMarketCap data. Current figures include a fully diluted market cap at $21,250,817.83, with zero trading volume in recent records.

The Coincu research team’s analysis suggests that while financial markets adapt to blockchain integration, asset tokenization is accelerating, yet regulatory uncertainty looms. Such moves push traditional finance to explore blockchain, sparking debate over systemic risks and the operational landscape.