Cetus, an effective capital management project powered by a centralized liquidity algorithm, is one of the initiatives assisting Sui in attracting financial flow into this ecosystem. Let’s learn details about this project with Coincu through this article.

Latest News about Cetus Protocol

On May 22, 2025, Cetus Protocol was attacked by a protocol attack, causing all liquidity in the pools to be drained. The hacker withdrew about 11 million USD worth of SUI tokens from the SUI/USDC pool, causing the price of many tokens to plummet by more than 75% and causing liquidity to dry up on Cetus.

The wallet address “0xe28b…e8ff06” is suspected to be owned by the hacker, who withdrew liquidity from many Cetus pools and swapped it to SUI. The hacker currently holds around $260 million in assets, including 12.989 million SUI worth $54 million, and has begun moving assets to other blockchains to launder money.

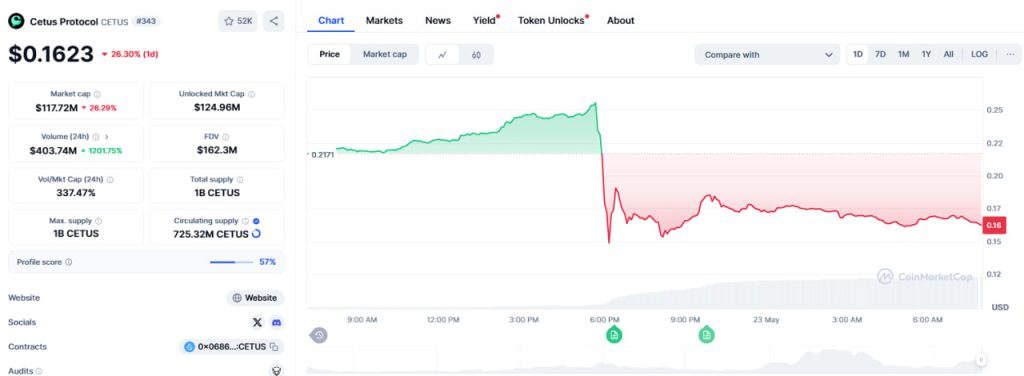

The CETUS token price has dropped nearly 20% in 24 hours, currently trading around $0.1623 after falling from $0.25. The market capitalization is $117.72 million, while the 24-hour trading volume has increased by 1,026% to $196.75 million. CETUS is traded on Cetus, Binance, OKX, Bitget, Gate.io, and many other exchanges.

What is Cetus Protocol?

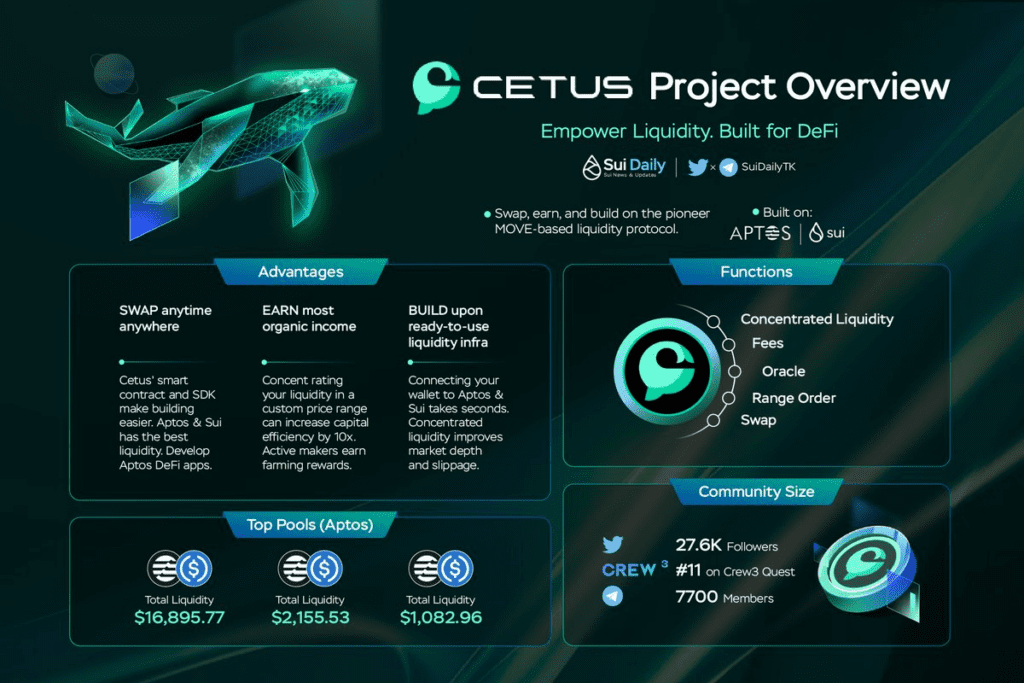

Cetus Protocol is a decentralized exchange (DEX) built on the Sui and Aptos blockchains using Concentrated Liquidity Market Makers (CLMM). Written in Move, it combines features from Uniswap V3 and Trader Joe to support customizable trading strategies. Users can combine swaps, range orders, and limit orders seamlessly.

With its CLMM algorithm, Cetus improves capital efficiency by letting LPs concentrate liquidity in active price zones. Traders benefit from low slippage and optimized pricing. Developers can build products easily via open SDKs and smart contracts.

As a trustless, frictionless DEX, Cetus powers digital asset trading on Sui. LPs can earn rewards, use leverage, and enhance returns by managing liquidity effectively. Cetus aims to deliver top-tier DeFi experience through innovation and flexibility.

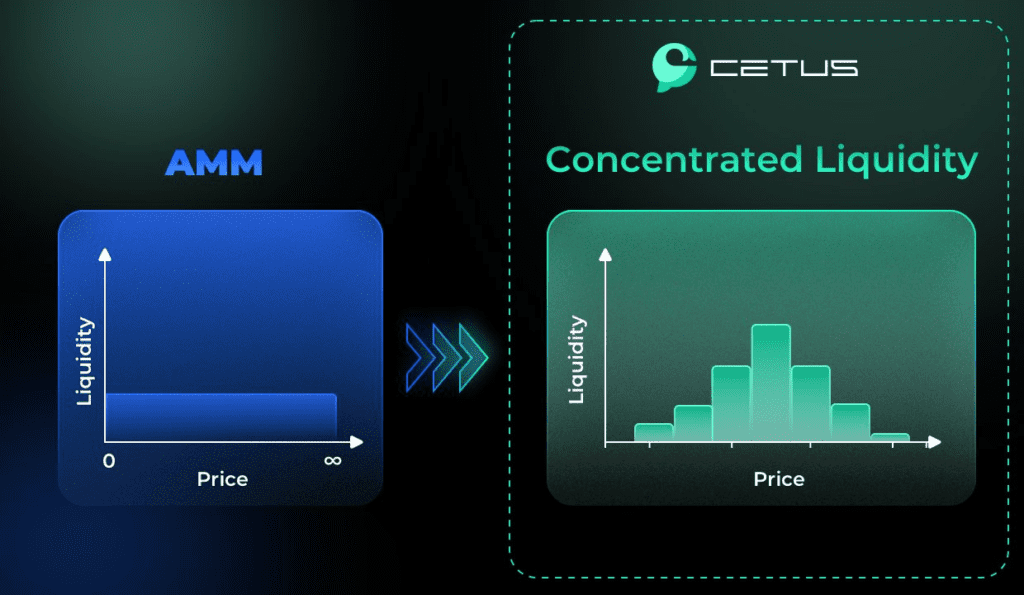

What is concentrated liquidity?

Concentrated liquidity is Cetus’ core feature, allowing users to provide liquidity within a specific price range. This mechanism helps reduce slippage and increase trading efficiency compared to traditional AMMs. Users can customize their liquidity position to optimize returns.

Cetus enables users to trade directly with each other, without a centralized order book. This mechanism reduces trading costs, increases speed, and simplifies the experience. However, liquidity providers may face risks if prices move outside the chosen range.

That’s reason it’s important to track LP behavior to anticipate price trends. If LPs start buying or selling aggressively, it might signal a potential reversal. Thanks to this new mechanism, Cetus offers a more efficient way to trade crypto.

Read More: Top Sui Wallets You Can Trust in 2025

Key features of Cetus Protocol

Active Liquidity

If the price of a trading pair rises or falls in one direction, liquidity providers will earn more than one token in their position since it indicates more demand for another token from swap participants. When the price hits the higher or lower limit of their position, their whole liquidity becomes one asset, and when the price returns to the original price zone, their liquidity becomes two assets and continues. continue to work

Range Order

LPs may create liquidity with a one-sided asset by constructing a liquid position with a price range defined on one side of the spot price. This enables liquidity providers to replicate limit orders, which are prevalent in the order book or CEX markets. A limit order is made with a precise pre-determined buy or sell price and may be executed at any time in the future, while a liquidity position order is one side of the protocol.

Concentrated liquidity has a price tag. When the spot price reaches the position’s predefined range, a continuous token swap is initiated in the position. If the price has totally broken out of the price range of the position, all of the original assets will be swapped for the target assets, which the LP may withdraw to end the position.

Range holders are considered producers since they operate as liquidity providers rather than swappers when a range order is executed. By establishing adequate liquidity positions, LPs may simply purchase when the price falls and sell when the price increases, much like professional traders, while also earning trading fees.

Oracle

Cetus’ centralized liquidity pool may also be utilized as an oracle, granting access to the pool’s historical pricing and liquidity data to developers or other platforms. This is a novel alternative to conventional oracles based on offline data in the DeFi ecosystem. The prices and data offered by the oracle based on Cetus are real market outcomes established by actual buyers and sellers.

Cross-Chain Bridge

Cetus incorporated the Wormhole SDK into its own user interface to provide a cross-chain bridging interface. Wormhole’s service completely powers this capability, enabling customers to shift their assets across blockchain networks at their leisure.

Price Ticks

A couple of ticks separate the price line of intense liquidity. There is a gap between each check mark and the check mark next to it. As we move the Tick up and down, we see a 0.01% gain or reduction (1 basis point) in price at any position in the pricing area.

Tick Spacing

Each pool is separated into many liquidity portions, each with its own set of predetermined bounds known as “Ticks.” A tick distance of 8 implies that each tick equals 0.08%, whereas a tick distance of 128 means that each tick equals 1.28%. To provide a more comprehensive pricing range, the stable team will employ a narrower tick distance.

Only liquidity in positions with an active price range may be utilized by transactions in a centralized liquidity protocol, producing transaction fees. A liquid position’s transaction fee performance shows its efficiency and contribution to the protocol.

Consequently, one of the most distinguishing elements of Cetus liquidity mining is that mining incentives will be distributed to users based on their real fee performance rather than their liquidity. If the liquidity provider wants to earn higher fees and mining incentives, he or she must participate more actively.

Read More: Top SUI Ecosystem Tokens to Watch in 2025

How does it work?

The Cetus maximizes profits for liquidity suppliers (specifically, the more liquidity is used, the more liquidity providers will benefit from the fees it provides). by centralizing liquidity providers’ money inside a single operational area under a consolidated liquidity protocol on the platform.

From then, the protocol’s operating mechanism may considerably increase the efficiency of liquidity providers’ capital utilization when compared to other standard AMM DEXs (which typically employ the characteristic model x * y = z).

Users may deposit liquidity and choose a pricing zone for effective liquidity, as with other centralized liquidity AMMs. Moreover, Cetus has four modes to accommodate investors with varying risk tolerances:

- Conservative: This setting is appropriate for people who monitor the market on a regular basis. This model provides a somewhat broad and narrow range based on the last 7 days of market data. Conservative mode may be more suited to emerging mainstream tokens (strong but still very volatile) like APT, SOL, SUI, and so on.

- Active: Similar to Conservative, this option is appropriate for people who monitor the market on a frequent basis. This model provides a somewhat broad and narrow range based on the last 7 days of market data. But, significant time-tested currencies like BTC and ETH may be used in Active mode.

- Full Range: If you are a lazy LP who seldom checks your liquidity or doesn’t have time to go into CLMM, you may just add your liquidity to Full Range. In this instance, the CLMM model effectively becomes a generic AMM.

- Custom: If you have the leisure to monitor market developments every few days, you may use Custom options to concentrate your liquidity a little more. You might begin with a sufficiently broad pricing range to establish your viewpoint.

Read More: Best Sui Meme Coins to Buy

Technology & Ecosystem Potential

Cetus uses a centralized liquidity algorithm to help LPs collect fees more efficiently and traders reduce slippage when trading. Developers can easily build products through Cetus’s open smart contracts and SDK. This is a breakthrough in capital optimization for the ecosystem.

The protocol was first developed on Aptos, and will expand to other blockchains using the Move language. Move is a new, open-source, Rust-based programming language designed to create secure, cross-chain smart contracts.

Move helps mitigate common security issues in Web3 such as improper authorization, malicious data reuse. Together with the Move Prover tool, it enhances programming safety. Currently, Aptos and Sui are both developed based on Move, part of the expanding MoveVM ecosystem.

Previously, Solana was considered a fast public chain but lacked sustainable development due to limitations in the permissionless pool building process. Cetus allows users to create their own liquidity pools and projects to issue their own tokens without permission, helping to attract new projects and increase the pricing power of less popular assets.

Fee

Swap Fees

- Swap fees are distributed proportionally to all liquidity positions whose price ranges include the current spot price.

- Positions outside the active price range become inactive and earn no fees.

- Swap fees are accumulated separately; LPs can claim fees without withdrawing liquidity.

- Cetus operates as autonomous smart contracts on Aptos and Sui, with no centralized control or custody of user assets.

Fee Tiers

- Multiple pools for the same token pair can have different fee tiers: 0.01%, 0.05%, 0.1%, 0.25%, 1%, and 2%.

- Different fee tiers serve varied trading pairs and encourage natural market liquidity distribution.

- Stablecoins typically cluster in low-fee pools due to low risk and stable value, while volatile or rare assets may have higher fees reflecting higher risk.

Protocol Fees

- Cetus charges a protocol fee of 20% (default) on swap fees to support long-term project sustainability and treasury development.

Read More: How Suiplay0x1 differs from existing Gaming Handheld

Tokenomics

It is the native cryptographically-secure fungible protocol token of Cetus. The token is a transferable representation of the protocol’s ascribed governance and utility functions and is intended to be used purely as an interoperable utility token thereupon. Users may earn it by mining liquidity on Cetus.

Key Metrics

- Name: Cetus Token

- Ticker: CETUS

- Chain: Sui

- Total Supply (Max): 1,000,000,000

Allocation

Investors and Partners

Investors

Seed round on May 2, 2023, led by OKX Ventures and Kucoin Ventures with participation from numerous funds including Animoca Brands, NGC Ventures, Jump Crypto, Adaverse, Coin98 Ventures, Comma3 Ventures, IDG Capital, AC Capital, and Leland Ventures for an unknown sum.

Partners

The project cooperates with many partners such as: Hippo Labs, Port3, omniBTC, LayerZero, Tortuga, Port3 Network, x Celer, Fewcha, MoveMarketCap…

Conclusion of Cetus Review

Cetus drew influence from Uniswap and Trader Joe to create a more comprehensive offering since it was born later. The protocol, on the other hand, has a very intelligent development strategy when selecting a destination, Sui and Aptos, in these two new networks the DEX CLMMs have not been developed and utilized strongly, so it is extremely competitive. Hopefully the Cetus Review article has helped you understand more about the project.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |