Surge In DeFi Exit Scams: CertiK Report Reveals Losses Of $313 Million In Q2 2023

Key Points:

- Malicious actors drained $313 million from decentralized finance (DeFi) in the second quarter of 2023, according to a report by security firm CertiK.

- The report highlights a surge in exit scams, commonly known as “rug pulls,” doubling the losses to investors.

- However, the decline in flash loan and oracle manipulation exploits suggests that the DeFi industry is making progress in protecting investors and their assets.

Malicious actors drained $313M from DeFi in Q2 2023; CertiK report shows decline in some attacks, but surge in exit scams.

According to a recent report by security firm CertiK, malicious actors drained $313 million from decentralized finance (DeFi) in the second quarter of 2023. While this figure is similar to the losses incurred in the previous quarter, it reflects a 58% decline from the massive $745 million lost in the same period last year. The CertiK report also revealed a surge in exit scams, commonly known as “rug pulls,” doubling the losses to investors. However, other types of attacks, such as flash loan and oracle manipulation exploits, experienced a decline.

DeFi protocols have implemented stronger security measures, such as decentralized oracles and built-in protections, to mitigate flash loan and oracle exploits, potentially decreasing the success rate of these attacks. As these attacks become harder to succeed at, digital thugs turn to other strategies, such as rug pulls. Different blockchains experienced varying degrees of security incidents, with the BNB Chain suffering the most losses.

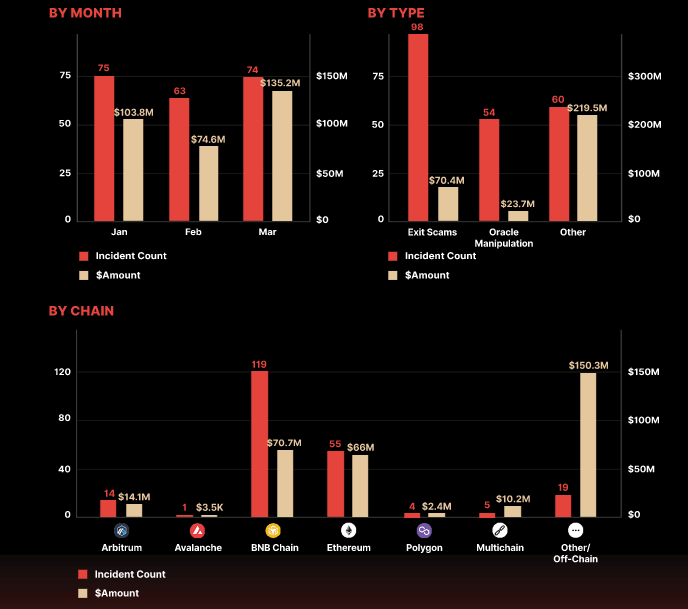

It is important to note that CertiK’s report sheds light on 212 distinct security incidents identified in the second quarter of 2023, with an average loss of about $1.5 million per incident. April saw 75 incidents resulting in a total loss of approximately $103.8 million. May saw 63 incidents and losses of around $74.6 million, while June had 74 incidents with losses amounting to approximately $135.2 million.

While rug pulls led to a loss of about $70 million for unsuspecting investors, a dramatic jump from the $31 million lost through rug pulls in the first quarter, security researchers noted a decline in flash loan and oracle manipulation exploits. CertiK’s report finds that attackers only managed to net about $24 million through 54 such attacks in the second quarter, a notable drop from the previous quarter’s 52 oracle manipulation attacks, which amounted to $222 million.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News