Liquid Restaking plays a pivotal role within the EigenLayer ecosystem and the broader landscape of decentralized finance (DeFi). Today, let’s join Coincu to learn about notable Liquid Restaking tokens in the near future.

Overview of Liquid Restaking

Restaking and Native Restaking

Restaking

EigenLayer introduces the concept of Restaking as a fundamental element where users stake LST Tokens within its platform, signifying their secondary stake in the system.

Native Restaking

Moreover, Native Restaking represents the actions undertaken by Validators within the EigenLayer network. Typically, Validators operating within the Ethereum network solely earn profits through Ethereum. However, EigenLayer’s Native Restaking model allows Ethereum network Validators to amplify their earnings potential by actively participating in EigenLayer operations.

Nonetheless, Native Restaking comes with its inherent challenges, thereby paving the way for the emergence of Liquid Restaking. These challenges include:

- High entry barriers exist for deploying a Validator on the Ethereum network, encompassing both hardware and financial prerequisites. Notably, users must commit a minimum of 32 ETH, valued at approximately $70,000 (at the time of writing). Additionally, hardware poses a significant obstacle for prospective participants.

- Deploying a Node entails numerous concerns surrounding security vulnerabilities and the potential for slashing penalties.

Liquid Restaking

Liquid Restaking represents a strategic solution devised to address the challenges associated with Native Restaking within the EigenLayer ecosystem. Its emergence aims to mitigate several outstanding issues, offering enhanced accessibility and functionality to Node Operators and developers alike.

Key features and benefits of Liquid Restaking include:

Liquid Restaking initiatives facilitate the deployment of a Node on the Ethereum network with a mere 2 ETH requirement. This is significantly lower compared to the direct stipulation on the Beacon Chain network, offering a more accessible pathway for participation.

Leveraging Distributed Ledger Technology (DVT) alongside other advanced technologies, the Liquid Restaking platform enables developers to operate a Node without the necessity of hardware infrastructure. This integration not only streamlines operational processes but also enhances overall security measures.

Liquid Restaking solutions contribute to addressing decentralization concerns within the Ethereum network. By integrating DVT technology and other complementary mechanisms, these solutions work towards fostering a more decentralized network architecture.

The advantages of Liquid Restaking projects are apparent:

- Firstly, Node Operators can initiate multiple Nodes with minimal investment; with just 2 ETH required to start one Node, Node Operators can potentially establish up to 16 different Nodes using 32 ETH.

- Secondly, the accompanying technological integrations effectively tackle expansion, security, and decentralization challenges commonly encountered by Nodes operating within the Ethereum network.

How Liquid Staking works

- Deposit ETH into Liquid Restaking Protocols

- Becoming a Node Operator

- Operating on EigenLayer and Ethereum

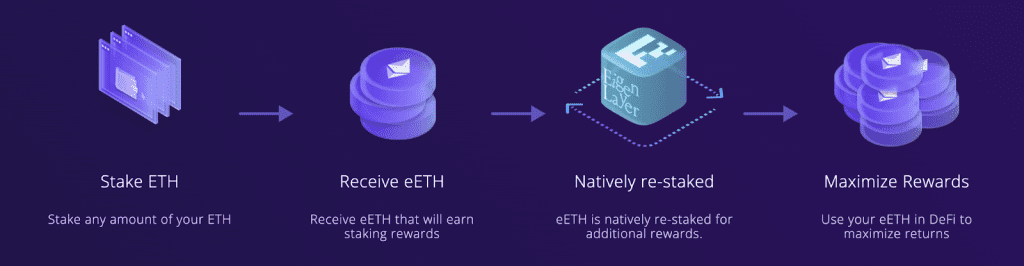

Users initiate the process by depositing Ethereum (ETH) into Liquid Restaking protocols. In return, they receive LST Tokens, which represent profits derived from two sources: ETH staking on the Ethereum network and profits generated by Node Operators engaged in activities on EigenLayer.

Individuals aspiring to become Node Operators must adhere to a specific set of requirements. They are mandated to deposit a minimum of 2 ETH to participate in the network. The remaining ETH necessary for operation is sourced from the coordination protocol established in Step 1, facilitating seamless participation for Node Operators.

Node Operators embark on a dual-pronged approach, engaging in operations across both the EigenLayer and Ethereum networks. This strategy is designed to optimize profits and maximize efficiency.

Furthermore, as part of the operational framework, Node Operators integrate additional technologies provided by the Liquid Restaking protocol. These technologies are aimed at bolstering security measures and enhancing decentralization within the ecosystem.

Read more: List Of 10 Liquid Staking Protocols In 2024

Top Potential Tokens In The Liquid Restaking Array

1. Kelp DAO

Overview

Kelp DAO is a novel protocol created by the Stader Labs team, aiming to enhance liquidity within the Eigenlayer ecosystem, a prominent Restaking protocol. Termed as a Liquid Restaking protocol, Kelp DAO operates within the Eigenlayer environment, primarily focusing on the rsETH token, which represents restaking ETH.

rsETH, a synthetic token derived from the ETH token LSTs, lies at the core of Kelp DAO’s functionality. Presently, Kelp DAO exclusively accommodates two categories of LSTs: ETHx (Stader ETH) and stETH (Lido ETH).

One of the notable highlights of Kelp DAO is its ability to empower users by enabling them to engage in DeFi activities while holding rsETH. This includes the opportunity to earn augmented profits from LST and undertake Restaking of tokens, thereby optimizing capital utilization efficiency.

Features

At the heart of Kelp DAO lies the Deposit Pool, where all Retake users’ LST (Liquidity Staking Tokens) find a common repository. In return, users receive rsETH, fostering a dynamic circulation within the system. These funds further fuel the Node Delegator mechanism.

Analogous to entrusting funds to a seasoned investment team, the Node Delegator segment empowers users by enabling them to delegate their assets. These delegated assets are then utilized to fortify the system’s security infrastructure. Users, in turn, stand to gain a proportionate share of the resultant profits, thus fostering a symbiotic relationship.

Within the Reward Market, community input thrives as Kelp DAO facilitates administrative voting. Here, stakeholders wield influence in determining the distribution mechanics of rewards within the Restaking system. The democratic ethos underscores the DAO’s commitment to inclusivity and decentralized decision-making.

Providing seamless access to funds, the Withdrawal Manager enables Restakers to effortlessly retrieve their assets back to their personal wallets. This feature streamlines user interaction with the platform, ensuring a user-centric experience.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

2. Renzo Protocol

Overview

Renzo Protocol is a pioneering Liquid Restaking Token (LRT) platform within the EigenLayer ecosystem, akin to the innovative Kelp Dao. Designed to streamline operations for EigenLayer users seeking to restake, Renzo Protocol offers a novel avenue for optimizing capital utilization.

Unlike staking directly on EigenLayer, where users do not receive any LRT for continued DeFi engagement, Renzo Protocol facilitates the distribution of ezETH—a liquid restaking token—enabling users to leverage their capital effectively.

EigenLayer is currently in the process of computing Eigen Points, slated to serve as the benchmark for distributing airdrops among users. Renzo Protocol ensures users receive the full value of their Eigen Points alongside additional Renzo Points, enhancing their participation in the ecosystem. The introduction of ezETH broadens users’ profit-seeking avenues within the DeFi landscape.

Features

- Simplifing Staking Operations on EigenLayer

- Streamlined Restaking Process

- Efficient Delegation with Smart Contracts

- Securing EigenLayer Ecosystem

- Sustainable Profit Mechanism

Renzo Protocol introduces innovative features aimed at simplifying staking operations for users within the EigenLayer ecosystem.

Renzo serves as a layer built atop EigenLayer, providing users with a simplified process for restaking their assets. By eliminating the complexities inherent in direct interaction with the protocol, Renzo enhances the user experience while ensuring seamless operations.

Smart contracts underpin Renzo’s functionality, enabling users to delegate to multiple Operator nodes on EigenLayer effortlessly. Through staking assets such as stETH, rETH, cbETH, and ETH, users mint out ezETH, a reward-bearing token, thereby streamlining the staking process and enhancing accessibility.

Renzo plays a pivotal role in securing Autonomous Validation Subcommittees (AVSs) across the EigenLayer network. Acting as an interface layer, Renzo strengthens the network’s security infrastructure, fostering reliability and trust among participants.

Renzo generates profits through fees based on restaking rewards. Half of these fees are allocated to the project’s Treasury, supporting long-term development and sustainability initiatives. The remaining half is distributed among Node Operators, incentivizing active participation and contribution to the network.

3. Restake Finance

Overview

Retake Finance pioneers the implementation of Modular Liquid Staking for EigenLayer, introducing a groundbreaking reform that integrates LST (Liquid Staking Tokens) as a Cryptoeconomic security for Actively Validated Services (AVS) within EigenLayer.

The introduction of Modular Liquid Staking for EigenLayer marks a significant advancement in the realm of decentralized finance (DeFi) and blockchain technology. This protocol enables users to leverage their LST holdings as a form of Cryptoeconomic security within EigenLayer’s ecosystem, enhancing the security and functionality of the network.

Features

- Unprecedented Flexibility in Staking Rewards

- Diverse Functionalities within DeFi

- Pioneering Interoperability and Scalability

Traditional staking mechanisms often require users to lock up their staked Ethereum for extended periods, limiting liquidity and flexibility.

However, rstETH introduces a groundbreaking approach, allowing participants to earn restaking rewards without fully committing their assets. This unique feature provides users with instant liquidity to their tokens while still accruing EigenLayer native interest—an innovative paradigm shift in the world of DeFi.

Beyond its role in staking, the rstETH token serves as a fundamental building block within the DeFi landscape, offering diverse functionalities that empower users to explore a myriad of financial opportunities.

From serving as collateral in lending protocols to fueling yield aggregators, optimizers, and derivatives, rstETH unlocks a realm of possibilities for DeFi enthusiasts. Its versatility allows users to optimize, leverage, and customize their yield creation processes, ushering in a new era of financial innovation and accessibility.

While initially launched on the Ethereum blockchain, the protocol’s roadmap emphasizes a broader vision of omnichain integration. As the protocol evolves, the expansion to additional chains will not only broaden the use cases of rstETH but also enhance its scalability and resilience in the rapidly evolving DeFi landscape. This strategic move towards interoperability underscores the commitment to fostering a more inclusive and robust DeFi ecosystem.

4. etherFi

Overview

EtherFi, a DeFi protocol established by Mike Silagadze and unveiled in 2023, offers a platform for users to stake assets and provide liquidity across Ethereum and multiple other blockchains. Notably, users maintain control of their private keys while staking assets within the protocol, ensuring security and autonomy.

Moreover, EtherFi introduces a novel service enabling users to establish a Node service marketplace. Within this marketplace, individuals can register Nodes that run infrastructure, facilitating the receipt of block rewards as compensation for their services. This innovative feature enhances the ecosystem’s efficiency and incentivizes participation in network operations.

Features

Users can deposit a predetermined amount of ETH into the EtherFi protocol. Upon deposit, the system creates a secure environment with withdrawal capabilities and issues two non-fungible tokens (NFTs): T-NFT and B-NFT. The T-NFT represents a specific and transferable amount of ETH, while the B-NFT serves as a deductible for abatement insurance, offering a higher yield than T-NFT due to the additional risk associated with the insurance deductible process.

Individuals who wish to stake an amount of ETH below the protocol’s specified threshold or those who prefer not to monitor validator nodes directly can engage in staking through the creation of eETH in the NFT liquidity pool. This mechanism provides flexibility for users with varying levels of engagement and resources.

EtherFi allows users to register and operate nodes within the protocol. These nodes facilitate various products and services implemented through a centralized service managed by EtherFi. By enabling users to participate in node operations, EtherFi enhances network robustness and decentralization while expanding the platform’s capabilities and offerings.

5. Puffer Finance

Overview

Puffer Finance is a Liquid Staking Derivatives platform aimed at revolutionizing the staking landscape on Ethereum. Catering to both retail users seeking profitable ETH staking opportunities and node operators, Puffer Finance addresses critical challenges while promoting decentralization.

At its core, Puffer Finance optimizes capital utilization and diminishes bond requirements, offering a robust solution for individuals keen on staking ETH for returns. The platform’s unique Secure-Signer technology bolsters security measures, ensuring a seamless and reliable staking experience for users operating nodes on Ethereum.

Features

Secure Signer stands as a bulwark against potential security breaches by safeguarding validators’ private keys. Employing a hardware device, Secure Signer securely stores private keys and facilitates transaction signing. This technology is fortified to withstand both physical and software attacks, mitigating the risk of private key theft and ensuring the integrity of the staking process.

RAVe (Remote Attestation Verification) functions as a verification mechanism within Ethereum’s Proof of Stake (PoS) framework, bolstering transaction authentication.

Utilizing a network of remote verifiers, RAVe scrutinizes validators’ claims to ensure the honest authentication of transactions. The implementation of RAVe yields tangible benefits, including heightened security, improved performance, and enhanced scalability within the Ethereum ecosystem.

Read more: EigenLayer White Paper: The Most Important Innovation Of Ethereum In 2023

What are the Limitations of Liquid Restaking Projects?

One notable risk involves the potential abuse of leverage by certain node operators within these projects. While leveraging to activate multiple nodes isn’t inherently problematic, inexperienced node operators may face fines or even the loss of their entire ETH stake if they fail to navigate the complexities of the system. This highlights a persistent concern that risks will always shadow node operators, especially those new to the ecosystem.

Moreover, users entrusting their ETH to node operators face the looming threat of losing their assets. The very essence of liquid restaking entails delegating one’s Ethereum holdings to these operators, introducing a vulnerability wherein users may suffer losses if node operators mismanage or improperly handle the entrusted funds.

Additionally, the technologies underpinning liquid restaking protocols are still in the nascent stages of research and development. Consequently, operationalizing these protocols carries inherent risks. The ongoing evolution of the technology means that vulnerabilities and uncertainties persist, raising questions about the reliability and security of these platforms.

Conclusion

Liquid Restaking is expected to have a lot of breakthroughs in the near future. While Liquid Restaking projects offer compelling benefits such as enhanced liquidity and potential yield optimization, investors must tread cautiously in the face of these significant risks. Hopefully Coincu’s article will help you have a clearer view of the top Liquid Restaking tokens worth looking forward to in 2024.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |