Key Points:

- Spot Bitcoin ETFs inflow reached $247 million on the 13th trading day.

- Grayscale GBTC sees a notable $221 million outflow, but the rate has slowed since the ETF launch, dropping to $192 million on Monday.

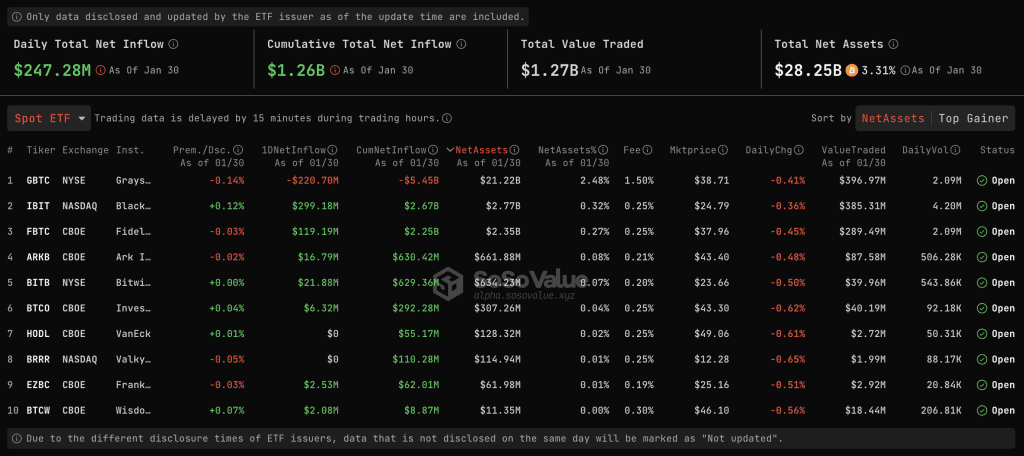

In a recent market update provided by SoSoValue, data reveals that on the 13th trading day, a total spot Bitcoin ETFs inflow of $247 million was recorded across all funds.

Read more: Bitcoin Spot ETF and Futures ETF: Differences To Make The Right Investment Choice

Bitcoin Spot ETFs Inflow See Varied Fortunes with $247M

Notably, Grayscale GBTC observed a significant fund outflow of approximately $221 million, whereas BlackRock IBIT attracted a fund inflow of about $299 million.

Other key performers in the market include Fidelity FBTC with a net inflow of $119 million, Bitwise’s BITB with $22 million, Ark 21Shares’ ARKB with $17 million, CSOP BTCO with $6 million, Franklin’s EZBC with $3 million, and WisdomTree’s BTCW with $2 million in net inflows.

Remarkably, the trend in outflows at GBTC has been slowing since the ETFs were introduced, decreasing from an average of $470 million in the initial six days to $192 million as of the latest data on Monday, as reported by research firm BitMEX.

Over the last week, daily flows exhibited consistent negativity, with approximately 20,000 Bitcoins leaving the funds from January 23 to January 26. The last day of spot Bitcoin ETFs inflow was recorded on January 22, when the spot funds collectively added just over 1,200 Bitcoins.

In the broader market context, Bitcoin‘s price, which dipped below $39,000 last week amid increased selling pressure, has rebounded. As of the latest update, it has surged to $43,400, marking a notable 9% increase from levels observed a week ago. Investors continue to closely monitor the evolving dynamics of the spot Bitcoin ETF landscape amidst these fluctuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |