Key Points:

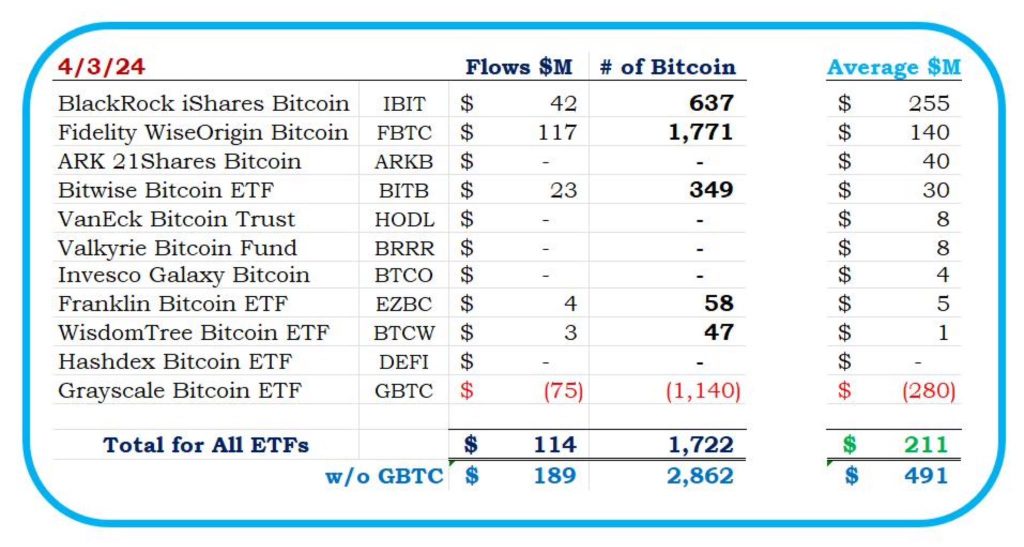

- On April 3, Bitcoin spot ETF observed a net inflow of $114 million.

- Despite a general market correction, BlackRock’s IBIT fund maintained dominance with an inflow of $150 million on April 2.

On April 3, Bitcoin spot ETF inflow reaches $114 Million. BlackRock’s IBIT and Fidelity’s FBTC had major inflows. Trading volume spiked in March and Bitcoin is currently at $66,400.

On April 3, a net inflow of US$114 million was observed in Bitcoin spot ETF. Earlier, on April 1, BlackRock’s IBIT and Fidelity’s FBTC recorded inflows of $165.9 million and $44 million, respectively.

These spot Bitcoin ETFs had an impressive assets under management (AUM) of about $18 billion and $10 billion in March 2024.

Bitcoin Spot ETF Inflow Kicks Off April With New Highs

There was a significant increase in trading volume for spot Bitcoin ETFs in March, spiking to $111 billion, three times the volume recorded in January and February. BlackRock’s IBIT led the trade volume, accounting for nearly half of the total, followed by Grayscale’s GBTC and Fidelity’s FBTC.

Interestingly, for the first time, a Bitcoin ETF other than Grayscale’s GBTC had an outflow. With $88 million in net outflows on April 2, 2024, Ark Invest/21Shares’ ARKB fund outdid GBTC’s $81 million. These were the only two of the 11 ETFs to experience investor withdrawals.

Since the SEC approved the Bitcoin spot ETF in January 2024, ARKB has seen its largest outflow. The total amount withdrawn from Grayscale since the Bitcoin spot ETF products began is over $15 billion.

Readmore: Memecoins On Base Are Driving Network Growth: Report

Top Bitcoin Spot ETFs and Current Market Condition

However, BlackRock’s IBIT fund continues to dominate, with an inflow of $150 million on April 2. The total net capital flow reached $40 million, marking a substantial increase from the previous day’s withdrawal of $80 million.

As a result of this capital inflow and the record trading volume seen in March 2024, BlackRock’s IBIT fund manages over 328,000 BTC, valued at $21.3 billion. Grayscale’s GBTC holds 256,702 BTC ($16.6 billion), and Fidelity’s FBTC ranks third with 146,023 BTC ($9.4 billion).

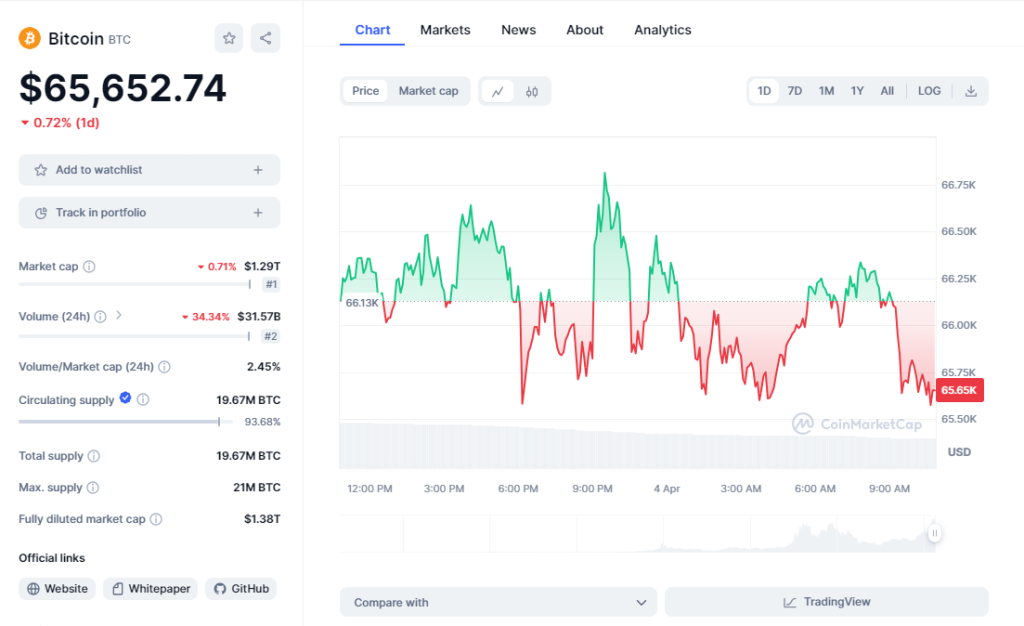

Currently, Bitcoin is trading around $65,600, down 5% in the last week due to a general market correction trend.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |