Key Points:

- Bitcoin surpasses Silver in market cap, reaching $1.757 trillion on November 12, 2024.

- Bitcoin price hits $89,600, up 30% in a week. Total crypto market cap reaches $2.98 trillion.

Bitcoin surpasses Silver in market capitalization, reaching $1.757 trillion. Factors include Trump’s election win, Fed rate cut, and successful Bitcoin ETFs.

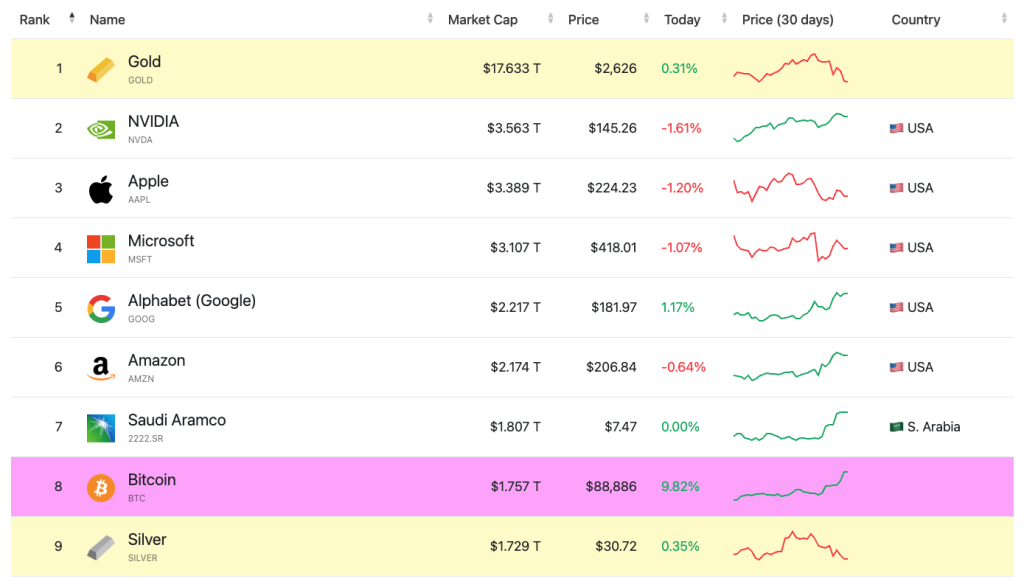

Bitcoin has passed the milestone of overtaking Silver in terms of market capitalization for the second time in 2024. On November 12, 2024, according to data from CompaniesMarketCap, Bitcoin’s market capitalization was $1.757 trillion versus Silver‘s $1.729 trillion. As a result, the digital currency is the eighth biggest asset in the world by market capitalization.

Bitcoin Surpasses Silver in Market Cap

Several factors have contributed to Bitcoin’s incredible rise. The cryptocurrency markets also reached a high after Donald Trump’s win in the 2024 U.S. presidential election and after the Federal Reserve cut interest rates by 0.25 basis points.

The price of Bitcoin has gained significantly, reaching $89,600 – a far cry from the lows of the past year. In the last 24 hours, Bitcoin has climbed 11%, up 30% over the last seven days. The broader market has also gained massively, with the total market capitalization reaching $2.98 trillion after a 9% surge in just one day.

Read more: Will Bitcoin Hit 100K by Year-End as Hopes Rise?

Bitcoin ETFs Fuel Market Growth

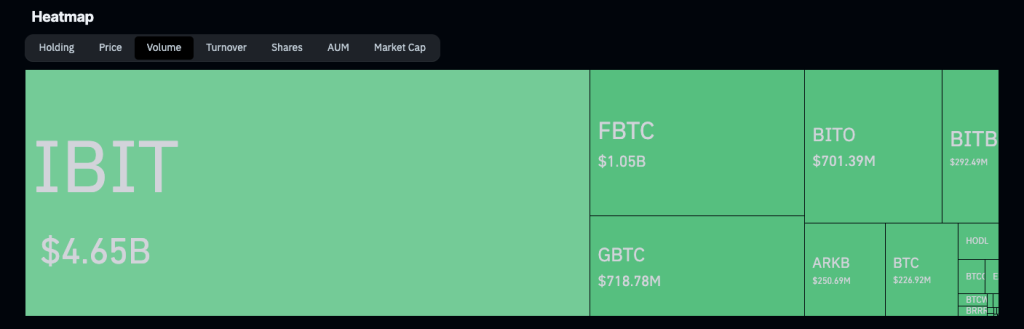

Additionally, the success of Bitcoin ETFs is also shoring up Bitcoin’s growth. Since its launch in January, BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust, or IBIT, has been leading the ETF race.

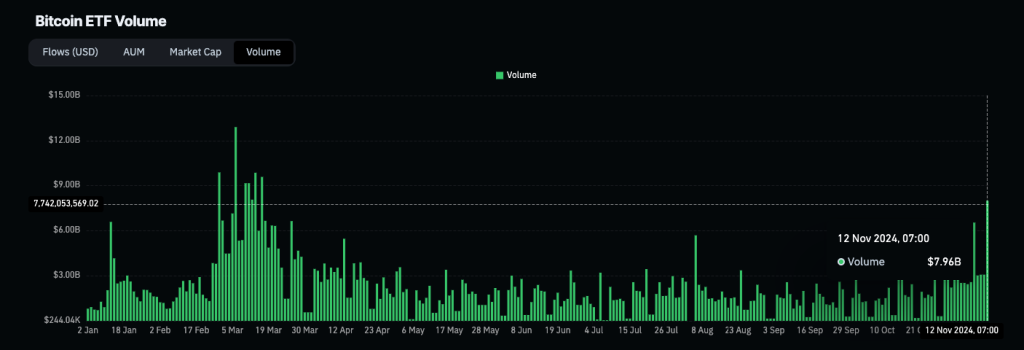

A chart of Bitcoin ETF trading volumes from January to November 2024 shows a series of periods with heightened activity, the most remarkable spike in early March, which saw trading volume more than double to over $12 billion.

As shown by CoinGlass data, the latest figures indicate that volumes once again picked up, with the number reaching $7.96 billion on November 12, which is a good indication of renewed investor confidence in the instruments.

Considering Bitcoin ETFs, IBIT stands out as the most actively traded fund, accounting for $4.65 billion of trading volume. Other popular ETFs, like FBTC and GBTC, are close in terms of spread, with volumes at $1.05 billion and $718.78 million, respectively.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |