Bitcoin is considered the first and largest cryptocurrency, which, since being created by the mysterious Satoshi Nakamoto, has changed the world. With a market value of over $2.1 trillion, Bitcoin seems to be one of the most attractive means for investors, institutions, and enthusiasts nowadays. But among all that, one question remains: Who owns the most Bitcoin?

In this article, we go deep into the biggest Bitcoin holders, discussing their implications in the landscape and what this enormous holding means for the future of Bitcoin.

Key Takeaways

- Satoshi Nakamoto, the anonymous creator, holds about 1.1 million BTC, making them the largest Bitcoin holder.

- Binance, BlackRock, and MicroStrategy collectively own significant amounts, with Binance holding over 617,000 BTC.

Who Owns the Most Bitcoin?

Satoshi Nakamoto, the mysterious creator of Bitcoin, expected the world’s first and largest cryptocurrency network, which is now valued at more than $2.1 trillion. Though Nakamoto’s invention changed the world, his identity remains unknown.

Quick Take

The anonymity of Nakamoto has inspired many speculations over the years, and some recent claims, including an HBO documentary, tried to unmask the identity. Whatever the identity, Nakamoto was credited to have amassed a fortune in Bitcoin through early mining efforts.

Based on tracked wallet addresses like the “genesis block” with the first 50 mined Bitcoins, Nakamoto likely owns between 600,000 and 1.1 million Bitcoins. At current prices ($101,163.11), as shown by CoinMarketCap data, this equals between $60 billion and $110 billion – though this wealth only exists digitally until converted to regular money.

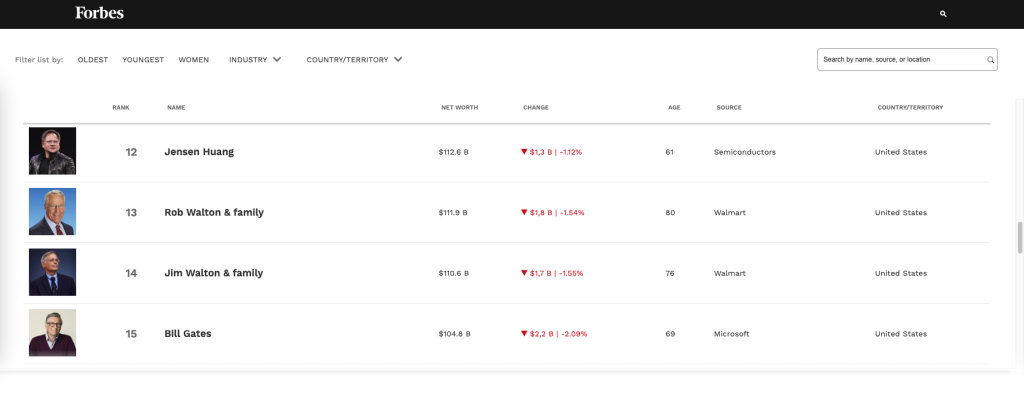

If these estimates hold true, at $100,000 per Bitcoin, Nakamoto’s wealth would surpass Bill Gates’ net worth of $104.8 billion if their holdings were closer to the upper estimate of 1.1 million BTC ($110 billion). This would place Nakamoto at the 15th spot, just above Gates and closely trailing figures like Jim Walton and Rob Walton.

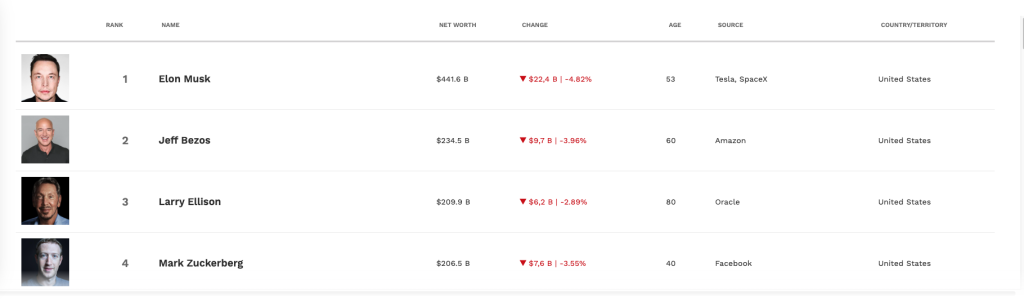

For comparison, if we consider the latest Forbes ranking in the image provided, at $400,000 per Bitcoin, even the lower estimate of Satoshi’s holdings ($240 billion) would place Nakamoto well above the 12th richest person, Jensen Huang, who has a net worth of $112.6 billion.

If Nakamoto’s holdings are closer to the higher estimate of 1.1 million BTC, their $440 billion wealth would bring them within striking distance of Musk, potentially reshaping the global billionaire rankings.

Read more: Top 10 Crypto Casino UK & Bitcoin Sites Reviewed

Top Bitcoin Holders as of December 2024

| Rank | Name | Bitcoin Holdings |

|---|---|---|

| 1 | Satoshi Nakamoto | ~1,100,000 BTC |

| 2 | Binance Exchange | 627,745 BTC |

| 3 | BlackRock iShares Bitcoin Trust | 549,916 BTC |

| 4 | MicroStrategy | 439,000 BTC |

| 5 | Grayscale Bitcoin Trust (GBTC) | 209,428 BTC |

1. Satoshi Nakamoto

While not an investor in the traditional sense, Satoshi Nakamoto, the anonymous creator of Bitcoin, is widely believed to hold the largest Bitcoin fortune.

- Estimated Holdings: Nakamoto is rumoured to own approximately 1.1 million BTC, valued at more than $110 billion as of December 19, 2024.

- Genesis Address: The first Bitcoin address used by Nakamoto, known as the Genesis address, holds the first 50 Bitcoins ever mined. It has also received over 49 BTC donations from enthusiasts since Nakamoto’s disappearance.

2. Binance Exchange

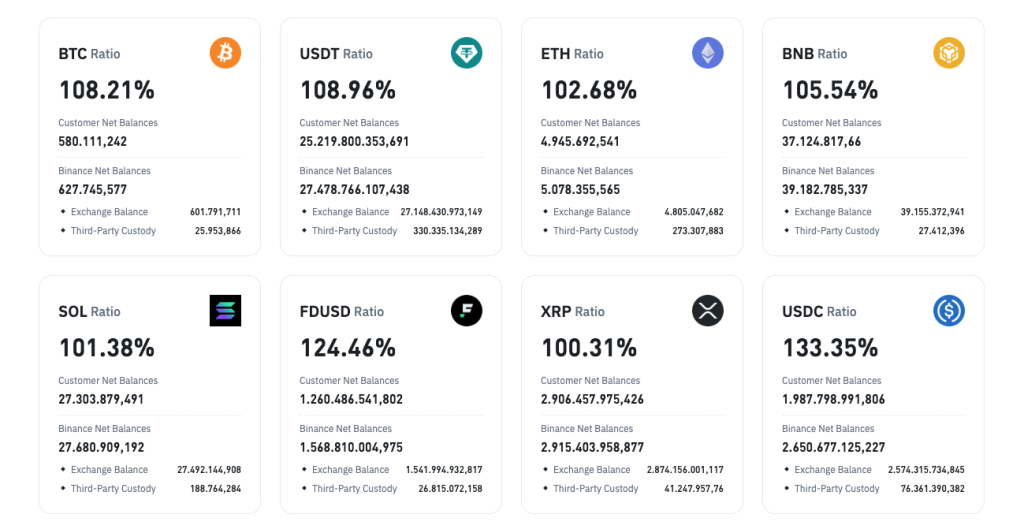

- Bitcoin Holdings: As of December 19, 2024, Binance holds 627,745.577 BTC, representing 108.21% of customer deposits, according to its Proof-of-Reserves report.

- Proof-of-Reserves Policy: According to Binance’s Proof-of-Reserves page and report, the exchange maintains a bitcoin-to-client deposit ratio of at least 1:1, with holdings equating to 106.06% of customer deposits.

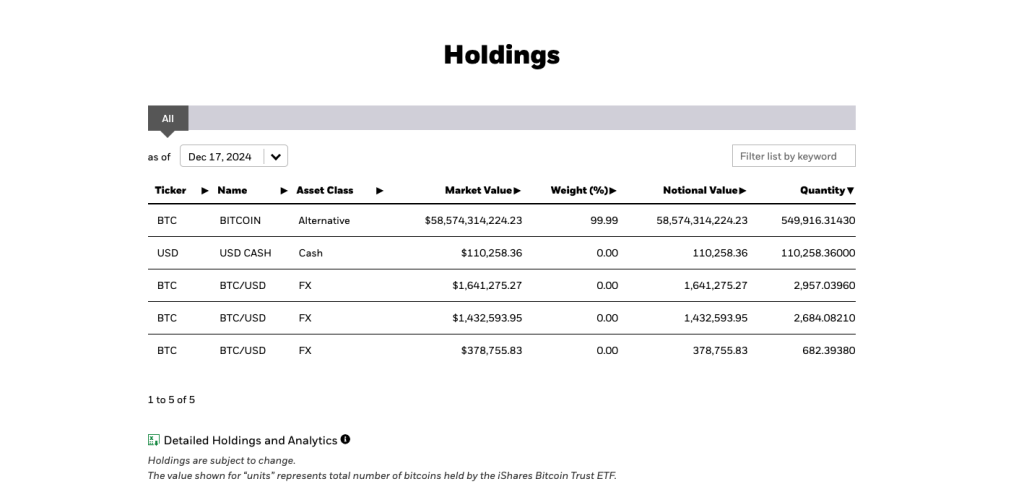

3. BlackRock iShares Bitcoin Trust (IBIT)

BlackRock entered the Bitcoin market with its iShares Bitcoin Trust, approved by the SEC in January 2024.

- Bitcoin Holdings: By May 2024, IBIT accumulated 549,916.31430 BTC.

- Mainstream Influence: IBIT’s success underscores BlackRock’s significant role in bringing Bitcoin into traditional finance.

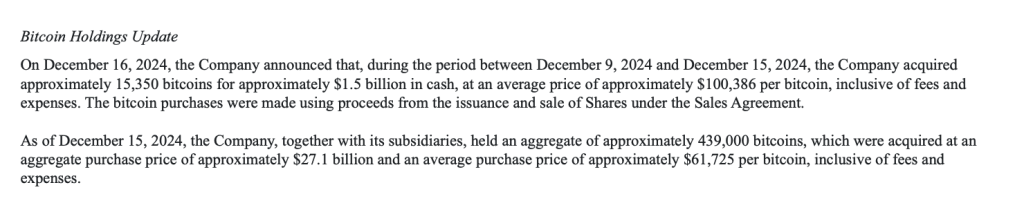

4. MicroStrategy

- Bitcoin Holdings: As of May 2024, the company held 439,000 BTC, showcasing its long-term belief in Bitcoin’s potential.

- Advocacy: Michael Saylor is a vocal proponent of Bitcoin, frequently promoting its adoption through public appearances and social media. MicroStrategy’s strategy of using Bitcoin as a treasury reserve asset has influenced other corporations to adopt similar approaches.

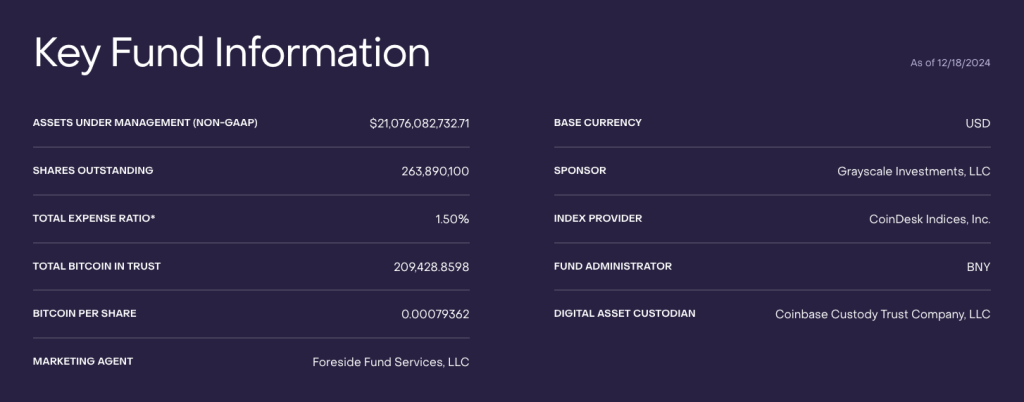

5. Grayscale Bitcoin Trust (GBTC)

- Bitcoin Holdings: As of May 8, 2024, GBTC held 209,428.8598 BTC, offering investors direct exposure to Bitcoin’s price changes.

- Institutional Role: Originally structured as a trust, GBTC transitioned in January 2024 following SEC approval of spot Bitcoin ETFs. Despite competition, it remains the largest Bitcoin holder among brokerages.

Quick Take

Grayscale is part of the Digital Currency Group, which also owns or invests in major blockchain projects like Polygon, Ripple, and Lightning Labs.

Will Satoshi Nakamoto Ever Move His Bitcoin

So far, there is no indication that Satoshi Nakamoto’s Bitcoin has been moved or spent. The estimated 1.1 million BTC attributed to Nakamoto’s addresses have never been touched since they were mined back in the early days of Bitcoin.

Community Theories

Speculations abound, from Nakamoto intentionally preserving the integrity of the Bitcoin supply to the possibility that the keys to those wallets have been lost or destroyed. Others speculate Nakamoto might no longer be alive or active in the Bitcoin community.

The movement of any of these Bitcoins by Nakamoto, if it ever happens, would send ripples throughout the cryptocurrency market, perhaps even causing great volatility in the price of Bitcoin because of the volume involved and the sensitivity of such a historical event.

Read more: Certified Bitcoin Professional And The Benefits Of Crypto Certification

Is Bitcoin Right for You?

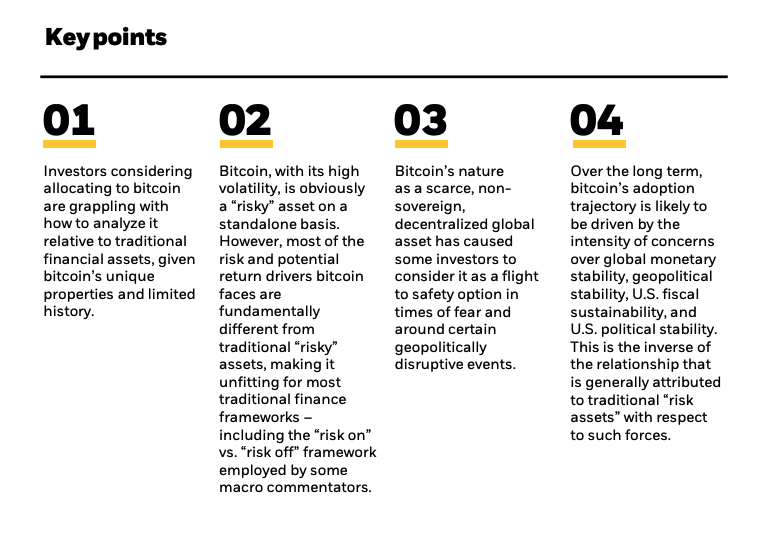

Among all assets, Bitcoin is exceptional in that it offers two of the most highly desirable features: high long-term growth potential combined with protection against downside risk. The king of cryptocurrency novelty has left even the brightest financial minds struggling to comprehend its full implications.

For instance, Bitcoin was emphasized in a recent white paper by BlackRock, which explained how Bitcoin was both a “risk-on” and “risk-off” asset. Similarly, Cathie Wood of Ark Invest has been vocal about Bitcoin’s ability to thrive in both inflationary and deflationary economic scenarios, making it a rare and versatile investment.

Given these attributes, it’s not hard to see why Bitcoin belongs in a diversified portfolio. Whether one is looking at its growth potential or using it as a hedge, the availability of spot Bitcoin ETFs today makes including Bitcoin in your portfolio easier than ever, perhaps even quicker than reading this article.

Frequently Asked Questions (FAQs)

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |