| Key Points: – BlackRock BUIDL token has surpassed $1 billion in assets, making it the largest institutional-grade tokenized fund. – Initially launched on Ethereum, BUIDL now operates across multiple blockchains with cross-chain interoperability. |

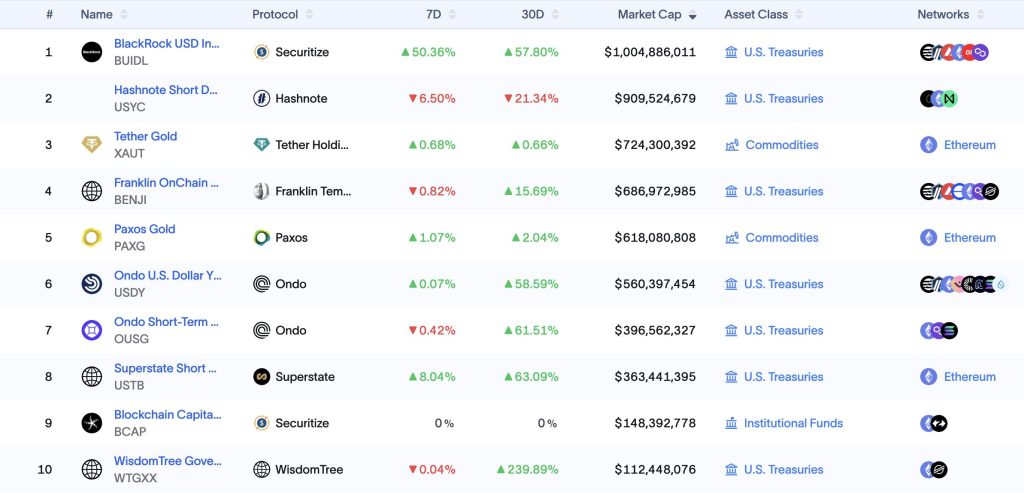

BlackRock’s USD Institutional Digital Liquidity Fund, known as BUIDL, has officially exceeded $1 billion in assets under management (AUM), becoming the first institutional-grade tokenized fund to reach this milestone.

The achievement solidifies BlackRock’s leadership in the rapidly evolving market for tokenized securities.

BlackRock BUIDL Token Becomes First Tokenized Asset to Surpass $1 Billion

Launched in March 2024, BlackRock BUIDL token operates on a public blockchain and provides qualified investors with on-chain U.S. dollar yields through daily dividend payments derived from short-term Treasury reserves. The fund’s token is pegged to the U.S. dollar, offering an alternative to stablecoins like USDT and USDC while generating revenue.

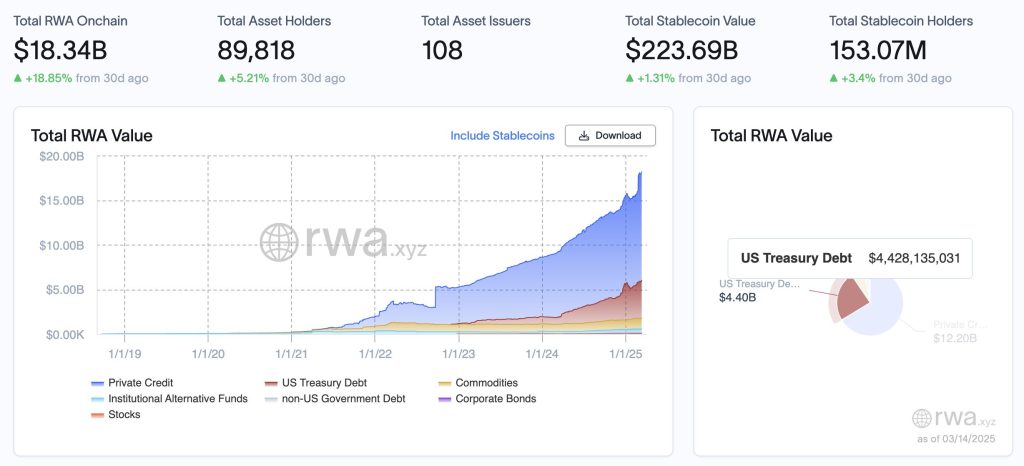

Since its inception, BUIDL has expanded beyond Ethereum to other blockchain networks, including Aptos, Arbitrum, Avalanche, Optimism, and Polygon. The broader tokenized Treasury market is estimated at $4.4 billion, with BUIDL accounting for more than 20% of the total.

Cross-chain interoperability is facilitated by Wormhole, ensuring seamless token transfers. Custodians supporting BUIDL include Anchorage Digital, BitGo, Copper, and Fireblocks, with Bank of New York Mellon serving as the custodian for its cash and securities. Carlos Domingo, Co-founder and CEO of Securitize, highlighted BUIDL’s significance, stating:

“BUIDL has set a new standard, proving to the investment community that this market is here to stay—and the momentum behind that recognition is only growing.”

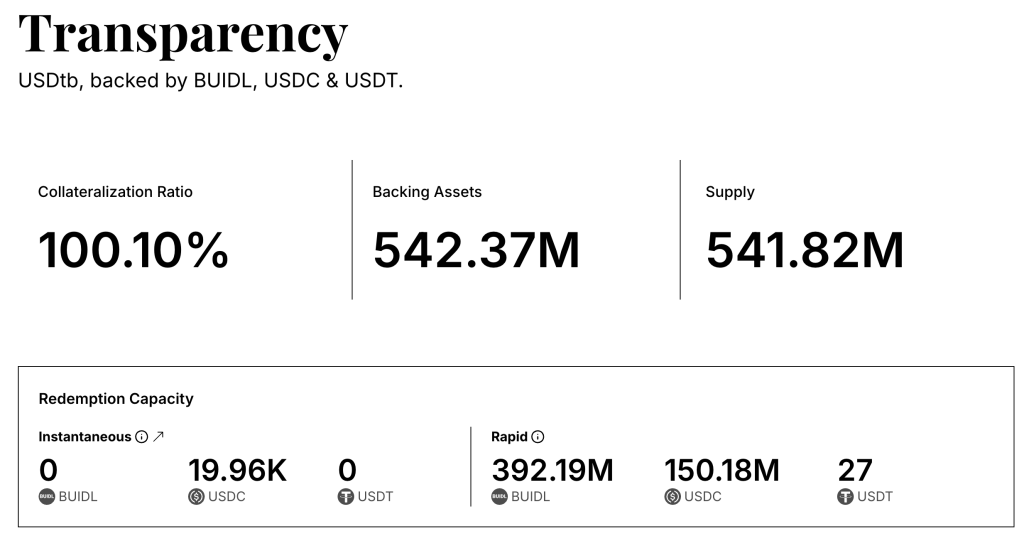

BlackRock BUIDL token plays a key role in the decentralized finance (DeFi) ecosystem. It is widely used as collateral on trading platforms and serves as a reserve asset for Ethena’s USDtb, a yield-generating token with a current supply of $541.8 million. USDtb’s backing consists of USDC, USDT, and $392 million worth of BUIDL tokens.

Previously, Hashnote’s USYC was the leading tokenized money market fund, but it now holds less than $1 billion in AUM, according to data from RWA.xyz.

Tokenized Treasuries Gain Momentum in Global Finance

The rise of tokenized U.S. Treasuries reflects a broader push to integrate traditional financial instruments with blockchain technology. Digital asset firms and institutional investors see blockchain as a way to enhance settlement speeds and improve operational efficiencies.

The trend is gaining momentum globally. Latin America’s Mercado Bitcoin has partnered with Polygon Labs to expand real-world asset tokenization, while firms like Securitize and RedStone are working to enhance tokenized product utility.

Meanwhile, Tether recently launched its Hadron platform, allowing asset managers and corporations to tokenize real-world financial instruments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |