Crypto Market Weekly (Sep 1 – Sep 7): BTC & ETH Institutional Inflows, Solana IPO, and Fed Rate Cut

Bitcoin (BTC) and Ethereum (ETH) are seeing strong institutional support, with major acquisitions by firms like Strategy and SharpLink. The positive sentiment is further bolstered by new regulatory approvals in the U.S. and the upcoming IPO of SOL Strategies, which signals a move toward mainstream acceptance.

However, the market isn’t without its risks. A scandal involving the new WLFI token has introduced a degree of uncertainty. Additionally, upcoming economic events, specifically the U.S. CPI release and a potential Fed rate cut, are keeping traders on edge.

Top Market News (Sep 1 – Sep 7)

Bitcoin (BTC) is trading fairly steady at $111,000–$113,000 following the news that Strategy purchased another 4,048 BTC worth $449 million. This brings Strategy’s total BTC holdings to 636,505 BTC ($46.95 billion) at an average price of around $73,765, representing a +25.7% return year-to-date in 2025.

Ethereum (ETH) also saw strong institutional inflows as SharpLink purchased 39,008 ETH, bringing its total ETH holdings to 837,230 ETH (around $3.6 billion). This supports the thesis of institutional adoption of ETH.

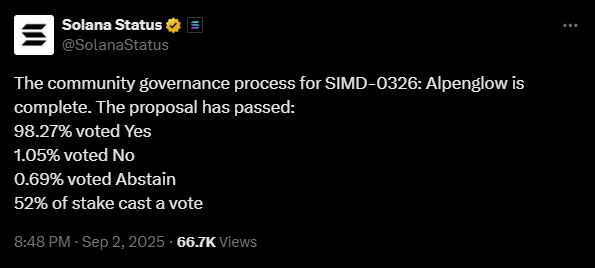

Solana made a splash with the launch of its Alpenglow upgrade, which reduced transaction confirmation times to 150ms, 100 times faster than the current one. Meanwhile, Hyperliquid hit a record $106 million in August, capturing 70% of the DeFi market share permanently with a $400 billion trading volume.

On the other hand, the market experienced a major upheaval with the release of the WLFI (World Liberty Financial) token. The Trump family-affiliated project has been controversial after blocking Justin Sun’s wallet over market manipulation allegations.

Trends and Market Sentiment

Three drivers are currently driving the market: adoption, regulation, and macroeconomics. SOL Strategies is preparing to launch its IPO on Nasdaq (September 9), as it will mark the first time a Solana-related fund will be listed on a mainstream exchange.

Regulatory-wise, the SEC and CFTC have allowed old-school exchanges to list crypto spot and margin products. Significantly, the CFTC approved Polymarket, effectively legalizing crypto-based prediction markets.

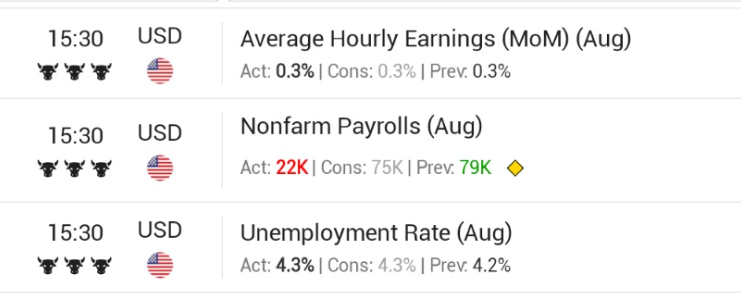

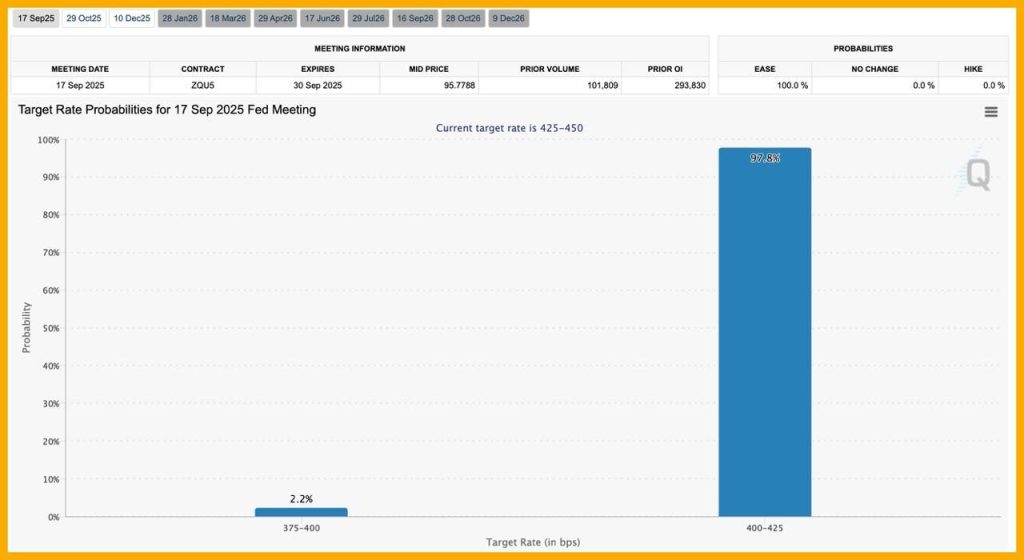

On a macro level, U.S. NFP figures were 22K short of market forecasts of 75K, taking unemployment to 4.3%. The CME now sees 100% probability of a September Fed rate cut with 97.8% implied probability of a -0.25% cut.

Institutional money is flowing well into ETH and BTC, and U.S. regulation is much better. Medium-term is bull, but short-term is neutral-bull because markets are expecting CPI releases (Sep 11) and the WLFI/Sun scandal.

Market Segments

Major Coins

- Bitcoin (BTC): Strong support from institutional strategies reinforces its position as a reserve asset for organizations.

- Ethereum (ETH): Capital inflows from SharpLink strengthen the institutionalization narrative.

- Stablecoins: ENA’s plan to purchase $5–10M daily is expected to increase buying pressure.

Altcoins & Sectors

- Solana (SOL): Benefiting from both its IPO and the Alpenglow upgrade, with expectations of outperformance.

- Linea (LINEA): TGE scheduled for September 10 — supply and demand dynamics should be closely monitored.

- Sonic (S): Unlocking 5.02% of total supply on September 9, raising risks of selling pressure.

- Memecoins/ETF: Rumors of a potential Dogecoin ETF in the U.S. could trigger strong retail FOMO.

- Others: DOT launching a new product, HOME rolling out an airdrop, and Falcon announcing a partnership with WLFI.

Geographic & Regulatory

- United States: SEC and CFTC officially open crypto trading; IPOs from Gemini and SOL Strategies mark a pivotal step toward legalization.

- Asia: No major updates except for continued institutional inflows from SharpLink and Metaplanet.

- European Union: Market awaits the ECB’s interest rate decision on September 10.

Opportunities and Risks: What’s at Stake This Week

| Opportunities | Risks |

|---|---|

| Strong institutional buying of BTC & ETH | U.S. CPI (Sep 11) above forecasts → selling pressure |

| SOL benefits from IPO & Alpenglow | Sonic unlock 5.02% supply + Resolv S2 |

| ENA buyback $5–10M/day | WLFI/Justin Sun drama raising concerns |

| Possible Dogecoin ETF → retail FOMO | Hyperliquid dominance (70% perp market) → systemic risk |

Short-Term Outlook

In the bullish scenario, BTC holds above $112,000 and could target $115,000–$118,000 if U.S. CPI comes in at ≤2.9%. Solana could rally toward $200 thanks to its IPO and upgrade. If the Dogecoin ETF is confirmed, memecoins may see a strong upward wave.

In the base case, BTC moves sideways between $110,000–$115,000. Altcoins will be mixed, with SOL, LINEA, and ENA leading while others remain flat.

In the bearish scenario, CPI >3% could push BTC below $110,000. Unlocking pressure from Sonic and Resolv may further sour retail sentiment.

Trading Strategies

For BTC, long-term holding is recommended owing to the low average cost. Short-term traders can go long above $112,000 with a target of $115,000–$118,000. If BTC falls below $110,000, stop-loss is recommended, and re-entry should be done at $105,000–$107,000.

ETH has strong support at $3,500. If it holds, prices can turn to $3,800–$4,000. It is a core institutional asset. Solana has good catalysts, strongest at $180–$185 and short-term targets of $200–$210. Linea can be a short-term trade when it conducts its TGE: enter small on listing, 50% book profit when it appreciates by 30%, and keep the remainder.

ENA is supported by consistent buybacks and suited for dollar-cost averaging with expected monthly returns of 10–15%. Dogecoin might be employed as a short swing trade if the ETF is confirmed, and taking profit at 20–30%.

Investors need to take close note of Sonic’s September 9th unlock and September 11th U.S. CPI. Do not open long positions ahead of these events and stay out of the market for 24 hours prior to CPI release to minimize volatility risks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |