Key Points:

- Ondo Finance is creating a stablecoin alternative that will pay out interest to holders using a tokenized money market fund.

- OMMF, a new stablecoin-like token, is exclusively offered to approved buyers and accredited investors.

- During business days, investors will be able to manufacture and redeem OMMF tokens, as well as earn interest in the form of additional the tokens.

Ondo Finance, a decentralized platform founded by two former Goldman Sachs Group employees, is introducing a new product that combines money-market funds invested in US government securities to create a stablecoin alternative that generates a dividend.

According to a blog post published on Thursday, investors in the tokenized money-market fund would get a digital currency called OMMF. The fund’s structure was not published, but Ondo said it would exclusively invest in low-risk money market funds, including US government assets.

According to Ondo, the OMMF coin would be tied to one dollar and backed by money market funds traded on regular exchanges. During business days, investors will be able to manufacture and redeem OMMF tokens, as well as earn interest in the form of additional OMMF tokens. Nathan Allman, Founder and CEO of Ondo Finance, stated:

“As the world moves towards a more digital and decentralized future, OMMF represents a longer-term opportunity to provide savers with a superior way to store and transfer wealth.”

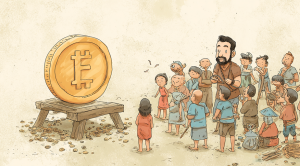

Stablecoins, tokens meant to maintain a constant value in contrast to the price volatility found in Bitcoin and other crypto assets, have been the focus of some of the recent market turbulence in crypto.

In early March, USDC’s value fell below its intended one-dollar peg when its issuer Circle disclosed its connection to collapsed Silicon Valley Bank. In February, the New York Department of Financial Services ordered Paxos to halt issuing new tokens of BUSD, a stablecoin branded by the cryptocurrency exchange Binance.

Even in a rising-rate environment, leading stablecoins such as Tether’s USDT and USDC do not pay out interest to investors since doing so would bolster the allegation that such stablecoins are unregistered securities.

That is why, according to Ondo, the company is solely targeting institutional investors that are both accredited investors and qualified buyers, a strategy that allows Ondo to avoid registering the product with the Securities and Exchange Commission (SEC).

Stablecoins are commonly utilized as a preferred collateral asset in crypto lending, and Ondo is targeting OMMF for usage as an alternative here as well. According to CoinGecko statistics, the entire market value of stablecoins is more than $130 billion.

Security tokens, such as Ondo’s OMMF, have experienced a rise in interest as startups and institutional investors alike look for methods to tokenize conventional financial assets.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News