Galaxy Digital Partners With DWS To Promote Digital Asset ETPs In Europe

Key Points:

- Galaxy Digital collaborated with asset manager DWS to create a suite of exchange-traded products (ETPs) for European listing.

- The collaboration will combine DWS’s portfolio management and product structuring with Galaxy’s technical infrastructure.

- It also comes just days after the European Union passed the ground-breaking MiCA regulation.

Galaxy Digital, a financial services and investment management innovator in the digital asset and blockchain technology sector, and DWS, one of the world’s leading asset managers, have formed a strategic alliance to develop a comprehensive suite of exchange-traded products (ETPs) on specific digital assets in Europe. The strategic partners intend to investigate other digital asset solutions in the future.

The German asset manager, which is majority owned by Deutsche Bank, stated that the two would collaborate to create a comprehensive suite of ETPs for the European market.

Galaxy Digital’s Global Head of Asset Management, Steve Kurz, stated:

“By allying with DWS, one of the most successful and innovative asset management firms in the world, we are excited to enhance our ability to deliver comprehensive solutions to European investors, empowering them to tap into the vast potential and promise of blockchain technology and digital assets in a safe and convenient manner.”

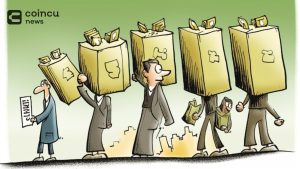

This is the latest example of a traditional finance titan collaborating with a crypto company to gain access to the roughly $1 trillion digital assets market.

It also comes just days after the European Union passed its landmark Markets in Crypto Assets (MiCA) regulation, which experts predict will put additional pressure on UK and US regulators.

While the Securities and Exchange Commission’s (SEC) repeated rejections of applications to list spot bitcoin ETFs in the United States have been a source of annoyance in the industry, similar products are now well established in Europe and Canada.

Fiona Bassett, Global Head of Systematic Investment Solutions at DWS, commented:

“This alliance brings together two firms with unparalleled collective experience in building and pioneering innovative investment solutions across both traditional and digital asset markets.”

Hundreds of crypto-focused ETPs have emerged in recent years, the majority of which are offered by digital asset firms such as Coinshares and ETC Group. DWS’s strong portfolio management, product structuring, and distribution expertise across liquid and illiquid asset classes will be combined with Galaxy’s technical infrastructure and asset management and research capabilities for digital assets. It aims to serve as a catalyst for both companies to profit from emerging digital asset opportunities.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News