Key Points:

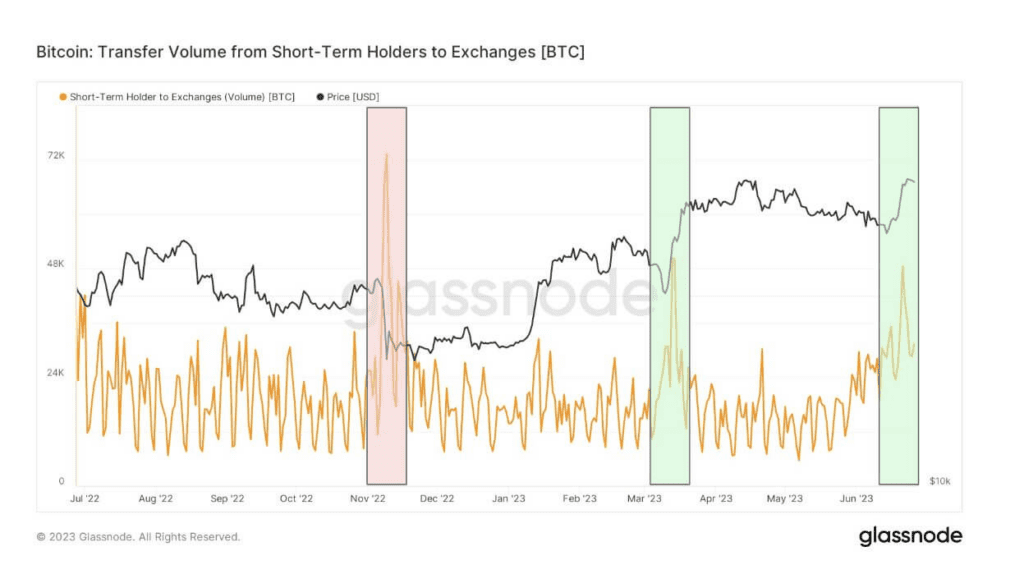

- Bitcoin hits $30k mark, prompting short-term holders to capitalize, sending approximately 48k Bitcoin to exchanges, out of which 41k were sent profitably.

- Short-term holders who had held BTC for less than 155 days were particularly active in realizing their profits, having acquired Bitcoin at prices below $30k.

- Black Swan events have occurred over the past 12 months, such as the collapse of Silicon Valley Bank and FTX, prompting investors to take profits or sell their holdings, respectively.

Bitcoin recently reached the $30,643 mark, many short-term holders took advantage of this milestone and sent their Bitcoin to exchanges.

This resulted in approximately 48,000 BTC being transferred to exchanges, out of which 41,000 were sent with a profitable outcome.

The short-term holders who had held BTC for less than 155 days were particularly active in realizing their profits. These investors had been acquiring BTC at prices below $30,000. This scenario resembles a previous event during the Silicon Valley Bank (SVB) collapse when short-term traders also capitalized on profit-taking as BTC dropped below $20,000.

The past 12 months have seen several Black Swan events that have plagued the crypto markets. During the SVB collapse, most investors chose to take profits, while during the collapse of FTX, a peak fear gripped the market, and most investors opted to sell their holdings.

Despite the recent surge in BTC’s price, there are still some concerns around its long-term stability. Some analysts believe that BTC’s price is currently being driven primarily by speculation, rather than fundamental value. However, others argue that the rise of decentralized finance (DeFi) and the increasing adoption of cryptocurrencies by mainstream financial institutions will continue to drive demand for BTC and other digital assets.

The recent transfer of 48,000 Bitcoin to exchanges may indicate that some investors are beginning to take profits off the table, which could potentially lead to a price correction in the near future. Despite this, many long-term holders remain bullish on Bitcoin’s prospects and are continuing to hold onto their positions.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News