Huobi’s Asset Reserve Certificate Skyrockets 53.3%, Linked to Justin Sun and Poloniex

Key Points:

- Huobi’s BTC asset accumulation has surged by 53.3% since June 1st, with 8,300 BTC added in just one month.

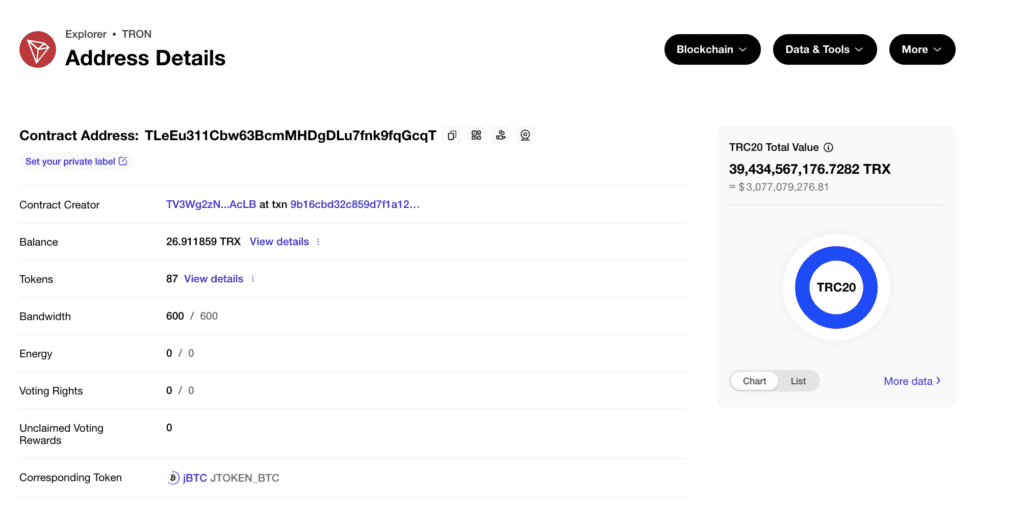

- The majority of this increase can be attributed to the accumulation of TRC20-BTC, a type of Bitcoin token based on the TRON network.

- The transfer-in address associated with the increase is closely linked to prominent figures in the crypto industry, including Justin Sun and Poloniex.

Huobi has recently released its latest asset reserve certificate, providing valuable insights into the company’s holdings.

The snapshot date for the certificate is July 1st, and the findings reveal a substantial increase in BTC asset accumulation compared to the previous month (June 1st).

According to the certificate, Huobi‘s BTC asset accumulation has surged by an impressive 53.3% since June 1st. This represents an increase of approximately 8,300 BTC in just one month. The majority of this increase can be attributed to the accumulation of TRC20-BTC, a type of Bitcoin token based on the TRON network.

Interestingly, the transfer-in address associated with this significant increase in BTC assets is closely linked to prominent figures in the cryptocurrency industry, including Justin Sun, the founder of TRON, and Poloniex, a well-known cryptocurrency exchange.

The transparency provided by Huobi’s asset reserve certificate offers valuable insights into the exchange’s strategies and holdings. Such information can be crucial for investors and market participants seeking to better understand the dynamics of the cryptocurrency market.

By closely monitoring the movements and holdings of major players like Huobi, investors can gain a deeper understanding of market trends and potential investment opportunities. Additionally, the involvement of influential figures like Justin Sun further adds to the significance of this development.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.