Key Points:

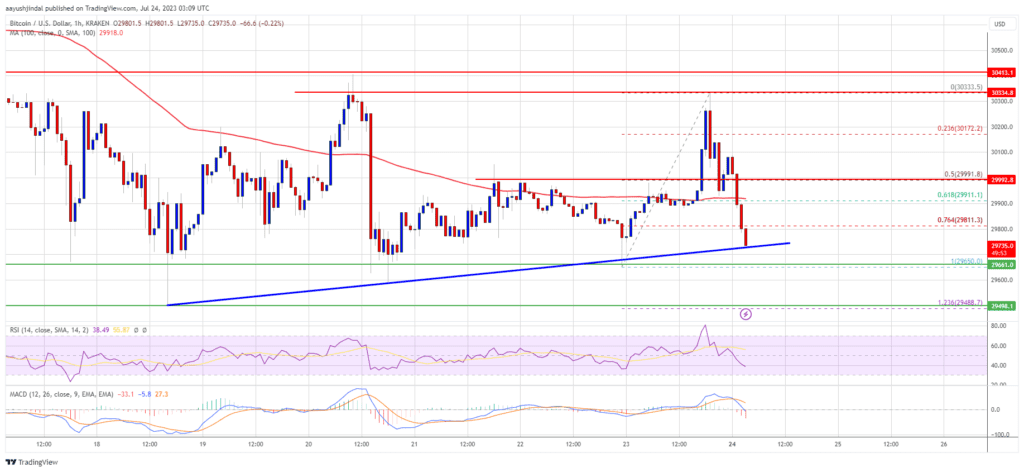

- Bitcoin price attempted to rise above $30,400 resistance but struggled to clear $30,350 and started declining.

- There was a bearish reaction below $30,000 support and the 100 hourly Simple Moving Average.

- BTC is trading below $30,000 and has key resistance levels at $30,150, $30,350, and $30,400. A close above $30,400 might initiate a fresh increase.

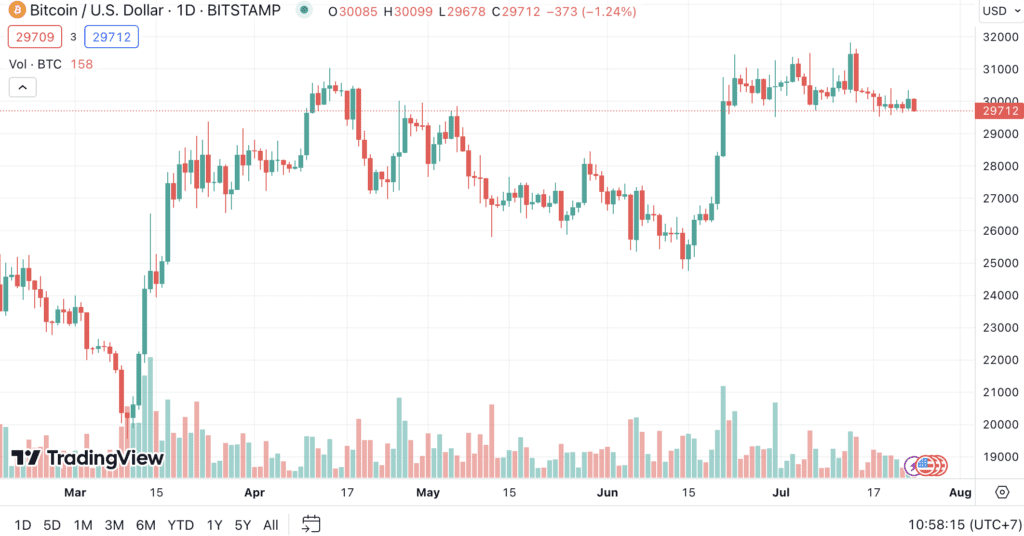

Bitcoin, the world’s most well-known cryptocurrency, made an attempt to climb beyond the $30,400 resistance zone.

However, despite its efforts, BTC was unable to settle above the $30,350 level and instead began a fresh decline.

The bearish reaction pushed Bitcoin’s price below the $30,000 support zone and the 100 hourly Simple moving average. As a result, the price dropped below the 61.8% Fib retracement level of the upward move from the $29,712 swing low to the $30,333 high.

Bitcoin is trading below the $30,000 level and the 100 hourly Simple moving average. However, there is still hope since a key bullish trend line is forming with support close to $29,720 on the hourly chart of the BTC/USD pair.

The immediate resistance is currently near the $30,000 level and the 100 hourly Simple moving average, with the first major resistance near the $30,150 level. The $30,350 and $30,400 levels are the next major resistances. If BTC can close above the $30,400 level, it may begin a new increase.

It could reach up to the $30,850 level. Any additional gains could open the way for a move towards the $31,200 resistance zone. It’s important to keep in mind that the price of Bitcoin is highly volatile and may change based on various factors such as market conditions and other factors, so investors should always do their own research and exercise caution when making investment decisions.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.