Key Points:

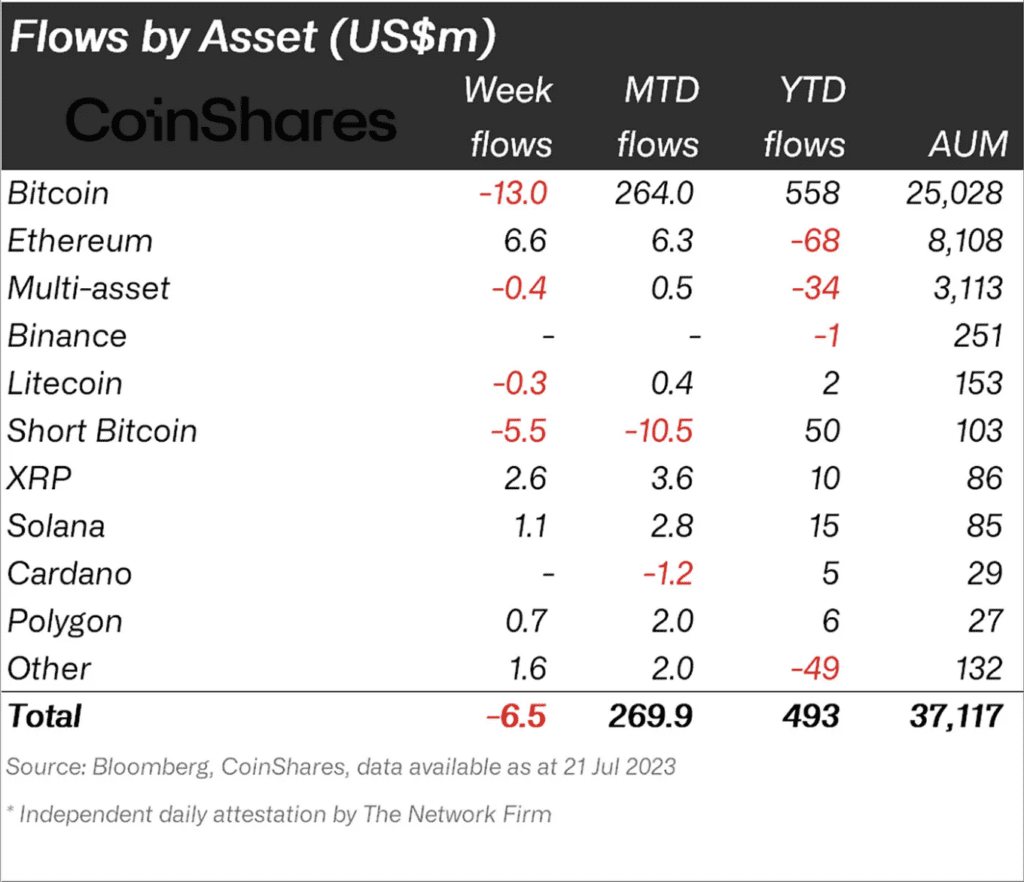

- Digital asset investment products experienced a net outflow of $6.5 million last week, ending four weeks of net inflows.

- Bitcoin sees a net outflow of $13 million in investment products, while Ethereum records $6.6 million in inflows, indicating a potential shift in sentiment.

- Solana, Uniswap, and Polygon attract inflows of $1.1 million, $0.7 million, and $0.7 million, respectively, signaling growing interest in alternative digital assets.

Last week, digital asset investment products recorded a net outflow of $6.5 million, marking the end of four consecutive weeks of net inflows, according to data from CoinShares’ weekly report.

The total trading volume of digital asset investment products during the week amounted to $1.2 billion, which was notably lower than the weekly average for the entire year. In the previous week, the trading volume had reached $2.4 billion. Notably, Solana, Uniswap, and Polygon emerged as the top performers in terms of inflows, witnessing total inflows of $1.1 million, $0.7 million, and $0.7 million, respectively.

The recent minor outflows of $6.5 million came after four weeks of substantial inflows that had reached a cumulative $742 million. The negative sentiment primarily impacted the North American market, where outflows accounted for 99% of the total outflow amounting to $21 million. However, Switzerland and Germany showed resilience, attracting inflows of $12 million and $1.9 million, respectively.

Bitcoin continued to be a focal point for investors, as evidenced by the $13 million outflow. Moreover, short Bitcoin investment products sustained outflows for the 13th consecutive week, resulting in a total outflow of $5.5 million. Interestingly, the total assets under management (AuM) of short Bitcoin products have dwindled from their peak of representing 1.3% of total Bitcoin investment products to a mere 0.4%, the lowest level since June 2022.

On the brighter side, Ethereum displayed encouraging signs, leading the way with $6.6 million in inflows. This influx of capital suggests a potential shift in sentiment surrounding Ethereum, which has experienced a challenging year so far.

Investors also displayed increasing confidence in XRP, with inflows totaling $6.8 million over the last 11 weeks, representing 8% of AuM. This renewed interest in XRP comes both before and after the conclusion of the recent SEC lawsuit, indicating a more optimistic outlook for the digital asset.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.