Key Points:

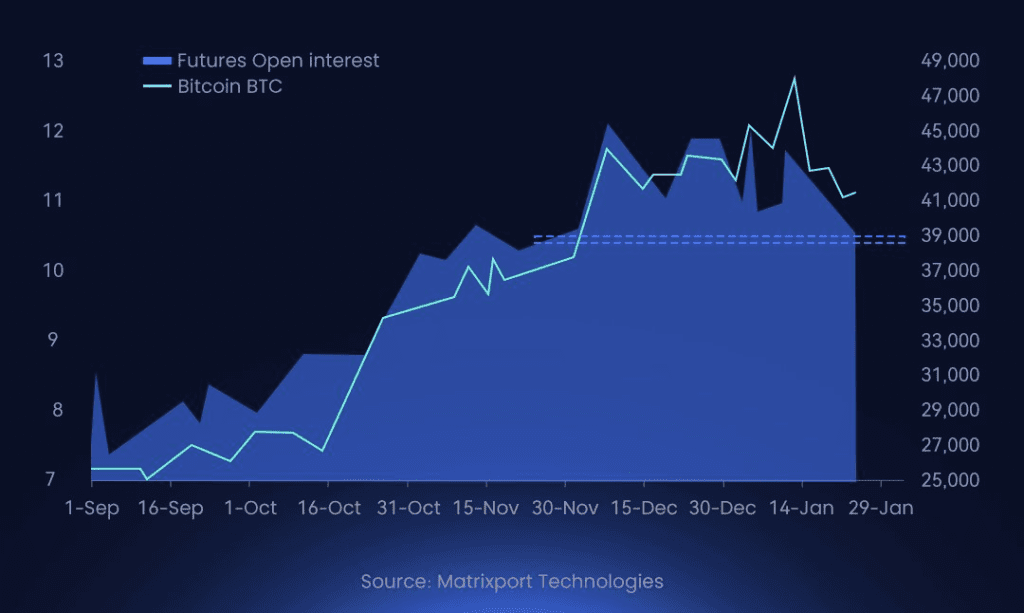

- Matrixport reports Bitcoin futures positions surged after the post-spot Bitcoin ETF debut, peaking at $12 billion before settling at $10 billion.

- Chaos ensues in the ETF’s first trading session, with investor uncertainty and market maker challenges due to varied liquidation timelines.

In a recent update, crypto service company Matrixport revealed a fluctuation in Bitcoin futures positions, indicating the impact of the debut of the spot Bitcoin exchange-traded fund (ETF) on January 12.

Read more: In Which Countries Is Spot Bitcoin ETF Currently Approved?

The surge in Bitcoin futures positions from $7 billion to $12 billion following the ETF listing was notable, but the figures have since adjusted to around $10 billion.

The inaugural trading session of the spot Bitcoin ETF was marked by uncertainty, with investors grappling to determine the actual inflow, while market makers faced challenges associated with differing liquidation timelines for each instrument.

Bitcoin futures, which mirror the price movements of the world’s largest digital asset, provide investors with a means to gain exposure to Bitcoin without holding the underlying cryptocurrency. These legal contracts enable buying or selling Bitcoin at a predetermined future date, akin to traditional futures contracts.

Amid the developments, criticism arose concerning the Grayscale GBTC, previously structured as a trust fund and managing over $27 billion worth of Bitcoin. In just the first three trading days post-ETF debut, this instrument witnessed significant net outflows, amounting to $1.17 billion.

The surge in Bitcoin futures positions on the top U.S. marketplace, observed on January 10, reflected institutional enthusiasm ahead of the anticipated approval of a spot Bitcoin ETF. However, this trend was short-lived, as the Securities and Exchange Commission’s (SEC) approval triggered selling pressure, leading to a subsequent adjustment in Bitcoin futures positions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |