Development Orientation Of Lending Category Leaders. What Is Worthy In 2022-2023?

Core knowledge:

- Leading lending protocols continue to pursue a multi-chain lending strategy.

- Aave will launch GHO to compete with Maker DAO and DAI.

THE DEVELOPMENT DIRECTION OF LENDING & BORROWING

Two prominent development trends in the category of Lending & Borrowing:

Leading Lending Protocol Pursues The Multi-chain Lending Strategy

Interestingly, Aave and Compound pursue the same development strategy to expand and capture market share, they believe the future of lending protocols will be multi-chain lending. However, the implementation and implementation of Aave and Compound are different:

Aave’s implementation

Looking back at Aave’s product development and upgrading, they tell us a lot.

This project was launched in November 2017 as a P2P lending platform called ETHLend and was later renamed Aave in September 2018.

- Changing the operating model from Peer to Peer to Peer to Pool, Aave v1 goes live on mainnet in Jan 2020 with 16 assets supported.

- In December 2020, Aave v2 launched with a series of updates and new features to optimize efficiency for the Aave market such as swap yield & collateral, flash Loans & flash liquidations, batch flash loans, gas optimization fees,… At the same time, the vision of the multi-chain future was formed during this period. Aave continuously expands its lending and borrowing markets to prominent EVM chains in the market.

- March 2022, continue to upgrade the product through the V3 version, further concretize its multi-chain vision into the multi-chain lending and borrowing market with the Portal feature. In addition, Aave v3 also adds some other unique features such as High-Efficiency Mode (eMode), and Isolation Mode.

Across key timelines, we can see Aave’s rapid product innovation, coupled with an aggressive expansion strategy, demonstrated by the continued increase in the number of support tokens and the number of markets. borrow and lend on different blockchains.

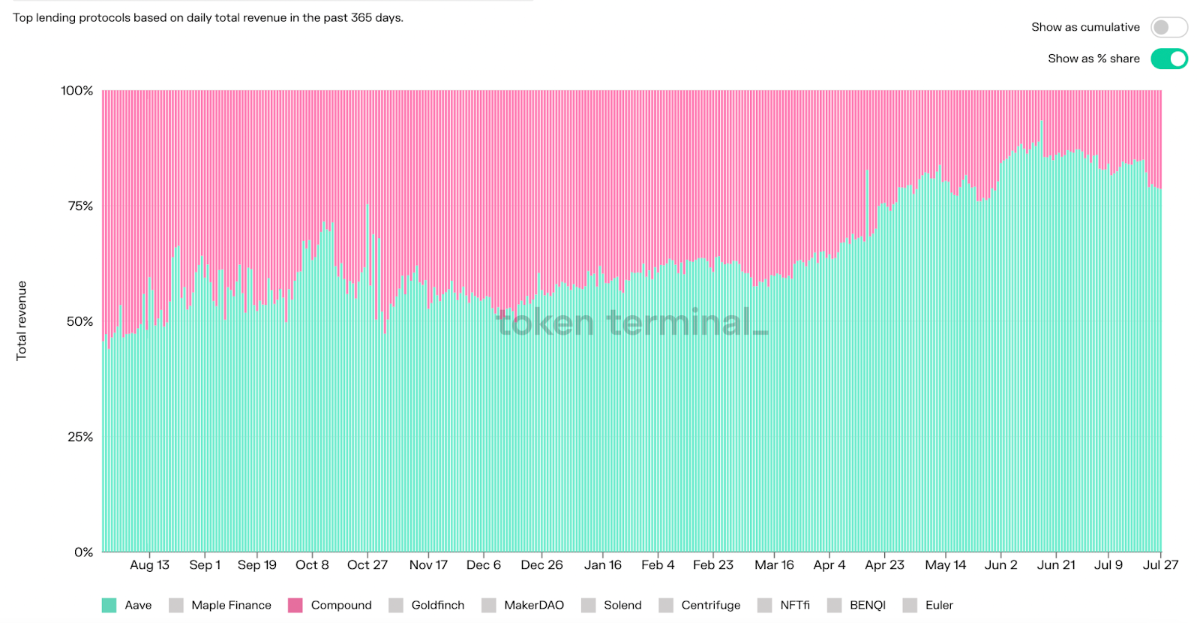

After about a year of development, Aave has more than 13 markets operating on 7 different blockchains, counting only the name Ethereum, Aave has supported 30 tokens. As a result, Aave is currently the lending protocol with the leading performance in the lending segment.

Compound’s implementation

By announcing Compound Chain (Gateway or Compound v2), Compound became one of the first lending protocols to announce the direction of multi-chain product development. In addition, Compound also has the advantage of being a “pioneer”, so their community is very large.

However, the problem with Gateway is that its technical difficulty is very great, while Compound still has a lot of difficulties in building gateways, the multi-chain space has grown very quickly. As a result, Aave has taken over lending which is holding the majority of market share in the market today.

Compound stands between the two options “uncertain future of Gateway” and “change the direction of development to match”. They chose the second option.

The compound still has a vision of a multi-chain future, just their implementation is different in Gateway, Comet (Compound v3) focuses on simplicity for easy scaling to EVM chains and easy total liquidity accounts between different on-chain markets.

CDP Protocol – The Right Product For The Market

Despite being the top protocol of the CDP protocol project group. However, Maker DAO and DAI will soon compete with Aave in the field of CDP protocols, as Aave announced the project will soon launch its own stablecoin of the Aave ecosystem. This stablecoin is called GHO.

GHO is backed by collaterals sourced from the Aave ecosystem. Basically, Aave will build a CDP protocol to create collateralized debt positions to mint GHO. From a technical perspective, Aave CDP and GHO do not have many special points, when it is quite similar to the model of Maker DAO.

The interesting point may lie in GHO’s expansion & distribution strategy. Aave has a vast ecosystem of 13 markets spanning 7 different blockchains. With the advantage of a huge ecosystem, there is a high probability that GHO will grow very quickly.

SUMMARY

Borrowing and lending are one of DeFi’s most popular use cases, along with DEXs, which are the base application layers on which more complex DeFi projects can be built. However, the decline of the Lending & Borrowing project team is evident in the numbers, numbers do not lie, and the lending and borrowing market on DeFi has its own cons and limitations.

Therefore, before going any further, we will need time for the market to “purify” itself and develop in a more sustainable direction.

VERDICT

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Marcus

Coincu Venture