Key Insights:

- Ethereum rebounds above $2,000 as daily trading volume exceeds $46B, signaling renewed market interest.

- Trend Research lost $686M after Ethereum drop triggered forced liquidation of 332,000 ETH on Binance.

- Traders closely watch $2,100 level, now acting as resistance after serving as support in Q2 2025.

Ethereum has bounced back above the $2,000 level, giving traders and investors a reason to watch closely. This move comes just days after the price dipped near $1,750, triggering a major liquidation from a large trading firm.

Ethereum Moves Back Above $2,000 Eyeing $2,100

Ethereum has recovered and is now trading around $2,035.98. The price has risen by over 4.5% in the last 24 hours. This price level is seen as a short-term support zone for the cryptocurrency. Analysts are watching the $2,100 level, which served as support during the second quarter of 2025. If the coin moves past this point, it may lead to further gains.

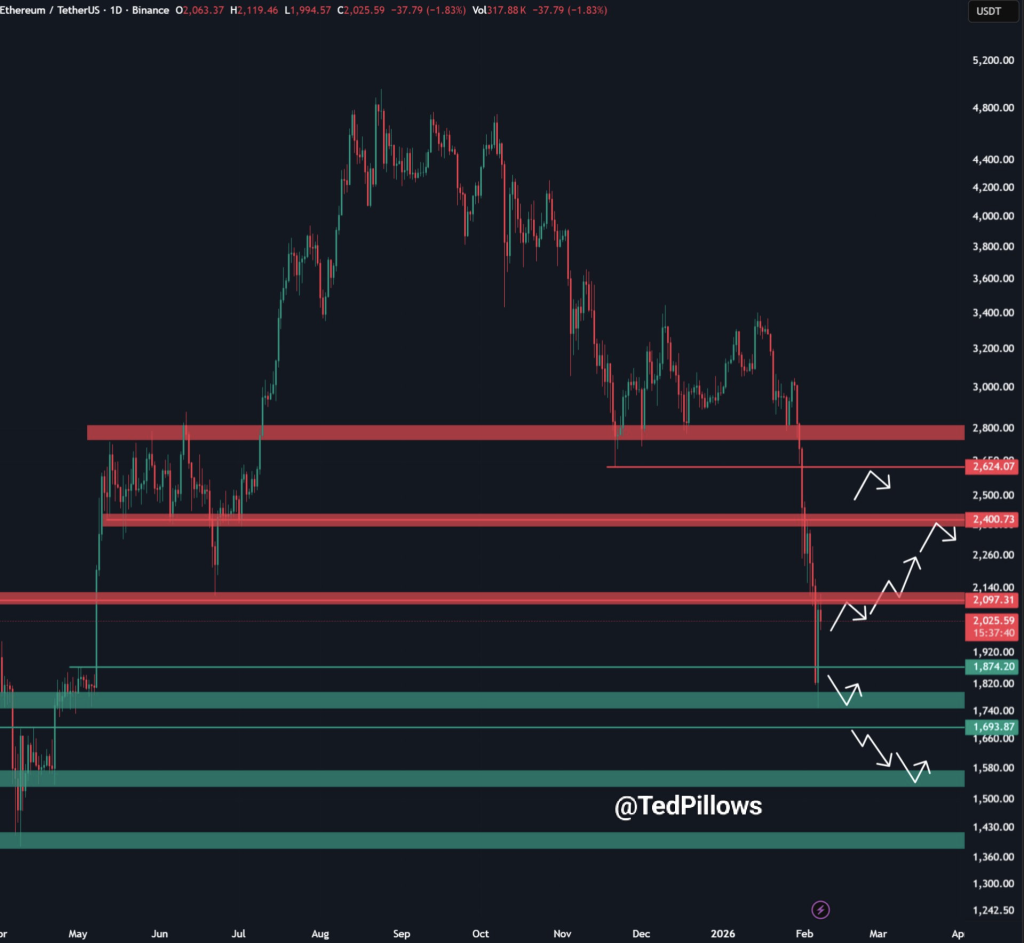

The current market focus is on the $2,100 level. If the cryptoccurency can break through and stay above $2,100, the market may move higher. From the point of view of Ted Pillows, Ethereum needs to break above the $2,100 level, which acted as a support in Q2 2025 and has now flipped into resistance.

Volume has also increased, with Ethereum’s daily trading volume reaching over $46 billion. This may show growing interest in the cryptocurrency after its recent recovery.

Trend Research Suffers $686M Loss After Price Drop

Trend Research, a trading firm, recently lost $686 million due to Ethereum’s sharp drop. The firm used ETH as collateral and borrowed stablecoins through Aave to enter a $2 billion leveraged position.

As the coin’s price dropped, the value of the collateral also fell. But the loan amount stayed the same. This forced the firm to start selling its ETH holdings to cover the loan. According to Coin Bureau, After ETH hit ~$1,750 on Feb 4, they sold 332,000 $ETH on Binance to repay loans. This large-scale sale added pressure to the market and may have contributed to the fast price drop.

For now, Ethereum’s move above $2,000 is being watched as a key sign that the recent bottom might hold. Traders will continue to watch whether it can maintain this level and push higher.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |