NFTperp Review: The First A Perpetual Futures Dex With Profitable Blue-Chip NFT

NFTPerp is a Perputal platform built and developed on the Arbitrum ecosystem for blue-chip NFT projects. In the context that NFT’s profit-making strategies are still quite limited, the project was born to solve this problem of NFT. So let’s learn more about the project in this NFTperp review.

About NFTPerp

NFTPerp is the first NFT derivatives exchange using the vAMM (Virtual Auto Market Maker) mechanism on the Layer 2 Arbitrum platform. The vAMM model will eliminate liquidity providers on the platform, replacing traders head-to-head (PvP).

Today, Blue-chip NFTs cost up to tens of dollars and this is a huge number for retail investors. This has created a big barrier that makes it impossible for small investors to access Blue-chip projects. NFTPerp was born to solve this problem. NFTPerp allows users to do Long/Short NFT Blue-chip collections like CryptoPunks, Bored Ape Yacht Club, Doodles… with up to 5x leverage.

Purpose of the project

According to their documentation, Nftperp was created to solve three problems faced by NFT investors:

- To make Blue Chip NFTs accessible: Blue chip NFTs like BAYC and Crypto Punks cost 50-100 ETH and are out of reach of 99% of retail investors. This resulted in the NFT market becoming a “whale-only” asset class, leaving retail investors with no investment opportunities.

- To Buy or Sell on NFT: Previously, there was no way to sell NFT to those who were bearish or who just wanted to hedge their positions.

- To reduce fees: High fees on OpenSea make it harder for traders to make a profit. OpenSea has a 2.5% service fee and 2.5% royalties for creators, so traders need to raise at least 5% to break even.

How it works?

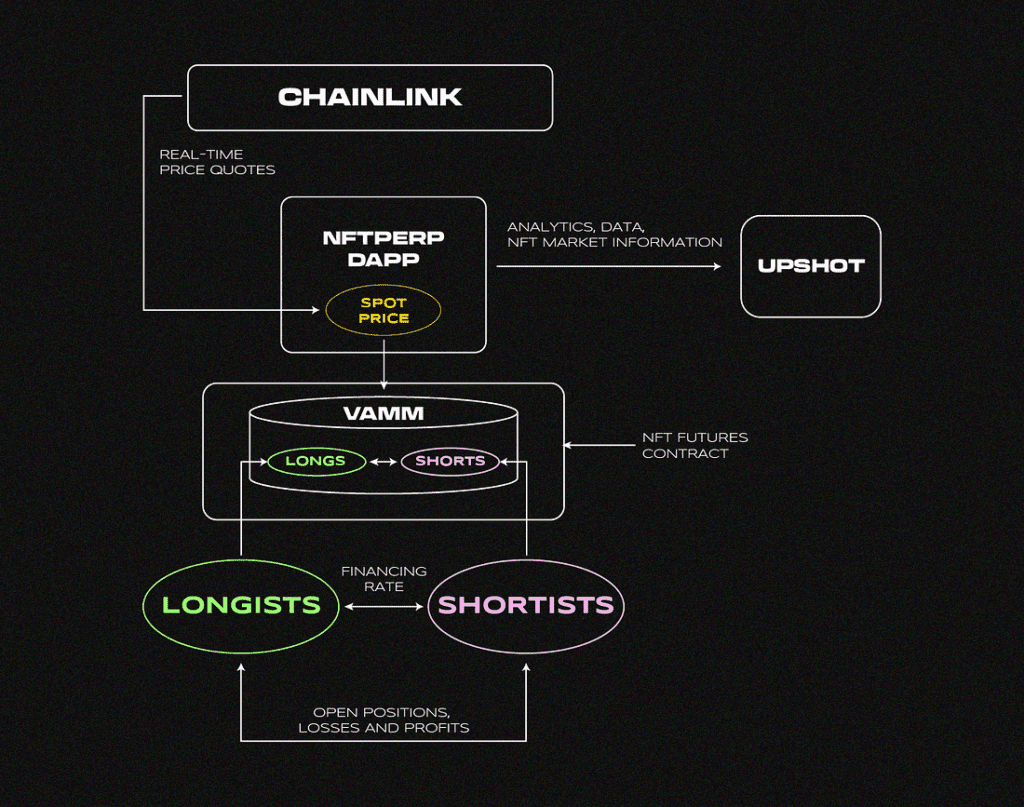

Simply put, nftperp allows users to take long or short positions on the floor of select blue-chip NFT collections using ETH as collateral. The protocol uses a virtual AMM (vAMM) modeled on the Perpetual Protocol for price discovery, storing all collateral in a smart contract vault. With vAMM, one trader’s loss is another trader’s profit and the quote is determined by a dynamic linking curve based on open interest. This model allows nftperp to facilitate trading without a liquidity pool, while minimizing slippage.

The protocol uses an internal Chainlink oracle for price feeds, filtering out washes and outliers to create a true price floor. This is the markup price for a given collection. The other key component of perpetual futures is the funding rate, which works to balance open interest and minimize the deviation between the index and the price perps. The funding rate works by requiring the buyer to pay the seller a small fee or vice versa, depending on whether the funding rate is positive or negative.

Improved vAMM model

The Perpetual Protocol pioneered the vAMM model and later iterated by the Drift Protocol, which later became the basis for NftPerp. Whereas a traditional AMM like Uniswap uses a liquidity pool to facilitate transactions, vAMMs settle transactions inside a smart contract vault that holds the collateral of all traders for a particular asset body.

As helpful as the original vAMM model is for perp trading, some changes were necessary to enforce equilibrium more strongly. In previous iterations, the fixed nature of virtual liquidity (amounts of x and y assets) put the system at risk of large long vs. short and funding payment imbalance and high slippage on trades. Nftperp has introduced more flexibility to the vAMM model, with the main adjustments being:

- Convergence Events — when the price of a perpetual futures contract deviates from the oracle price of the underlying asset by over 5% for more than 8 hours (length of 1 funding period), a convergence multiplier is introduced to match the execution price of the contract to the oracle price. Once a convergence event is triggered, virtual liquidity resets to the center of the bonding curve.

- Dynamic k contraction/expansion – dependent on the level of open interest, the constant k is allowed to contract or expand while maintaining the same ratio of x to y. This allows NftPerp to handle varying levels of open interest with low slippage

- Dynamic Funding Rate — whereas a standard funding rate takes into account position size, contract mark price, and oracle price, NftPerp takes into account the total ratio between longs and shorts as well to better balance open interest.

- Fluctuation Limiting — this sets a limit of +-2% change in contract price per block, safeguarding the protocol against manipulation via flash loan attacks and insurance fund draining during periods of high volatility. Drift v1 experienced an exploit of this nature where large fluctuations in LUNA price led to an imbalance of unrealized losses and gains within the system, and the excess profits were able to be withdrawn from the insurance fund unchecked.

Functions

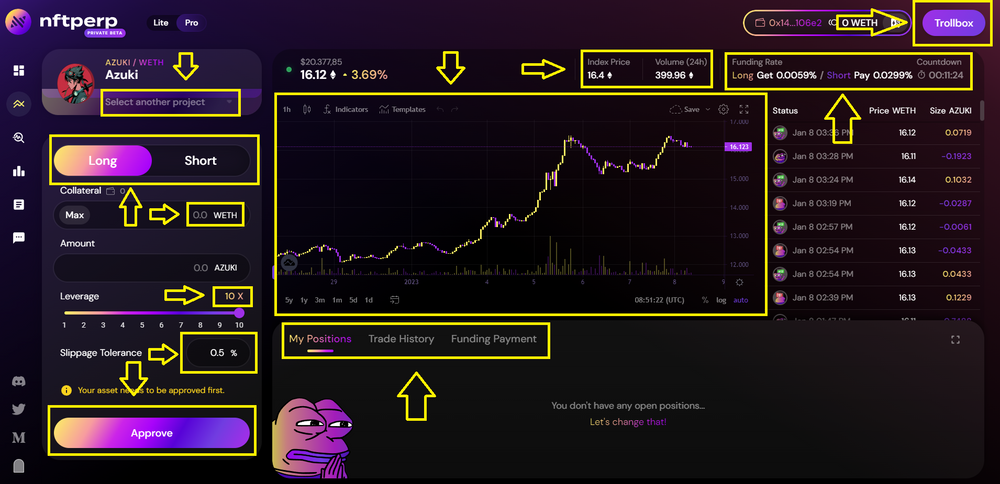

Although, currently the features on NFTPerp are in the Private Beta stage, so they are quite simple, but still equally useful, making it easier for traders to control positions. Features include:

- Open a Long/Short . position

- Lever adjustable up to 5x

- Funding rate

- Minimum Slippage 0.5%

- Volume of position creation according to investor’s needs (paid in WETH)

- Trollbox chat frame

- The frame displays the position, transaction history and Funding rate history.

The difference of NFTPerp

Optimizing the trading experience for users

NFTPerp has been audited by PeckShield and brings some of the following advantages and products to users including:

- A smooth, fast and low-cost transaction experience on the Arbitrum network with the security of Ethereum.

- Always ensure full liquidity for the protocol even if there are no liquidity pools.

- Oracle integration to provide accurate NFT pricing in real time.

- Enabling retail investors to access NFT Blue-chip collections based on a small amount of capital without having to own NFT.

Unique transaction fee model

NFTPerp’s revenue is earned from a trader’s liquidated position. Every time there is a transaction, NFTPerp will charge a transaction fee of 0.3% and this transaction fee will be divided as follows:

- Insurance Fund: 0.15%

- Project Pool: 0.075%

- Those who Stake the project’s tokens: 0.075%

- If Index Price is higher than True Floor Price by 2.5 – 5%: NFTPerp will charge 1% for Long position and 0.1% for Short position

- If Index Price is more than 5% higher than True Floor Price: NFPerp will charge 5% fee for Long position and no fee for Short position

NFTPerp also applies a Funding fee to adjust the price of the Index Price as close to the True Floor Price as possible in the spot market.

- If the True Floor Price is greater than the Index Price, then those who open a long position will pay those who are opening a short position.

- If the True Floor Price is less than the Index Price, those who are short will pay those who open long.

Developers and investors

Currently, NFTPerp still needs to reveal the identity of the development team.

On November 25, 2022, NFTPerp completed a Seed round and raised $1.7 million, bringing the project’s valuation to $17 million with the participation of Dialective, Maven 11, Flow Venture, and VCs other.

NFTPerp’s Tokenomics

Currently, NFTPerp is in Private Beta and has not announced the Tokenomics design yet. However, according to official information, the project is having incentive rewards for traders on the platform through VNFTP Vouchers. In the future, users can use these Vouchers to exchange for the platform’s token, NFTP. Some features of VNFTP Vouchers:

- Non-transferable

- Completely On-chain

- Join NFTPerp governance before tokens and have a chance

Development roadmap in 2023

- V1 public mainnet launch

- L2 solution reevaluation

- NftPerp token distribution

- NFT index derivatives

- Permissionless markets

- Structured products

What is the prospect of the project?

It will depend on: what collections the protocol’s derivatives will pass and how these collections are selected. When only BAYC, MAYC and CryptoPunks are listed, the product will be used primarily to hedge its spot positions.

When listing the top 10/20 projects including Azuki, Moonbirds, etc., the product can become an official exchange for traders to make money, because there is no similar product currently. The plan is to execute stop loss, limit orders, lend and borrow.

NFT Long/Short Instruction On NFTPerp

Keep in mind, this only works if you get accepted into their Private Beta which you can apply for on the website homepage. If you’re not accepted yet, you can try Paper Trading in the meantime. Here is what to do once you’re whitelisted:

Step 1: Connect Your Wallet

Visit Nftperp and connect your wallet in the top right corner.

Step 2: Select The NFT You Want To Trade

Pick the NFT you want to trade and decide if you want to go long or short. Choose how much you want to trade and the leverage you’d like to take (between 1x and 10x).

Then, “Approve” your trade, confirm it on your wallet, and wait for it to execute. You will have to pay a small gas fee.

Step 3: Monitor Your Trade

You will then be able to view details of your trade as you can see in these images.

Conclusion – NFTperp review

NFTPerp is initially creating a derivatives field for NFTs. This could very well be a potential market in the future as more and more popular NFTs come to the community. The platform’s user approach is also smart when it comes to creating a trading marketplace for a wide range of users including Whale, Retailers, Newbie to NFTs.

Besides that, there are still some security concerns. Although it has been audited by PeckShield, the risk of smart contract attack can still occur. Risk of NFTs being manipulated by large institutions (market cap for NFTs is quite small).

However, NFTPerp is still a platform worth following because of the new mechanism applied to trading NFTs. Besides, there are also many predictions about the NFTfi segment that can grow strongly in the next cycle of the Crypto market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News