Key Points

- Binance faces legal issues and has terminated partnerships, but remains popular for cryptocurrency traders.

- The SEC recognizes Bitcoin Spot ETF from Valkyrie and has begun the review process, potentially opening up new investment opportunities.

- The cryptocurrency market overview has seen continued growth and innovation, with new developments and increasing interest from investors and users.

Discover the latest developments in the cryptocurrency market overview, from Binance’s challenges to the push for a BTC Spot ETF and macroeconomic updates.

Binance

Binance, the world’s largest cryptocurrency exchange, has faced numerous challenges in recent months. In addition to layoffs and reductions in employee benefits, the exchange has had to withdraw from several markets due to legal issues. In June, Binance withdrew or was forced to withdraw from markets in the UK, the Netherlands, Belgium, Cyprus, Austria, and Germany. The exchange is still under investigation in Australia, Brazil, and France.

One of the most recent developments is Binance’s decision to allow users to create 20 wallet addresses on one blockchain. This move is aimed at preventing sybil attacks during airdrops. Binance has also terminated its 5-year partnership with the Argentine Football Association due to a contract violation.

Despite these challenges, Binance remains a popular option for cryptocurrency traders. However, investors should be aware of the legal issues that Binance is currently facing and should carefully consider the risks before investing in cryptocurrency.

Pressure for BTC Spot ETF from Wall Street continues

The SEC recognized the only remaining Bitcoin Spot ETF from Valkyrie and began the review process. The SEC also had until August 13 to respond to the first submission of the ARK Invest Bitcoin Spot ETF. Meanwhile, Nasdaq postponed the launch of its crypto custody service due to legal risks in the US.

These developments in the ETF space could potentially open up new investment opportunities for crypto enthusiasts. However, the legal risks associated with crypto custody are still a concern for major players like Nasdaq.

Macroeconomic

In recent news regarding the world of market overview, there have been several developments worth noting. The US Securities and Exchange Commission (SEC) has denied the ruling that XRP is not a security, which has disappointed Chairman Gary Gensler. The SEC’s decision indicates a desire to appeal, suggesting that the future of XRP remains uncertain.

In the realm of politics, US Presidential candidate Robert Kennedy has promised to exempt crypto taxes if elected. Meanwhile, Republican lawmakers have proposed a new Crypto regulation bill to clarify the authority of the SEC and Commodity Futures Trading Commission (CFTC). Additionally, the US House of Representatives will soon vote on the Technical Market overview Structure Bill, which requires DeFi users to verify their identity.

On the technological side, the Federal Reserve has launched the instant payment system “FedNow”, a 24/7 payment infrastructure. The UK has also launched Digital Sandbox, a testing environment for technology startups. However, the UK Treasury has refused to consider crypto as gambling, maintaining that crypto needs its own laws to manage it.

Lastly, various countries are making strides in the development of Central Bank Digital Currencies (CBDCs). Russia is set to begin CBDC testing on August 1st if approved by President Putin, while Hong Kong is open to cryptocurrency despite banks remaining hesitant.

Last week’s highlights big news

In the world of cryptocurrency, there is always something new happening. Here are some of the latest updates from the market overview:

- Linea, a Consensys Layer 2 mainnet, has been launched, offering faster and more affordable transactions.

- The Ethereum Community Conference (EthCC 6) was held in Paris from July 17-20, bringing together developers, researchers, and enthusiasts to discuss the latest trends and innovations in the Ethereum ecosystem.

- Chainlink has tested its cross-chain protocol (CCIP), which connects different blockchains with traditional finance (TradFi) systems, making it easier for users to exchange value across platforms.

- Polychain Capital and CoinFund have raised $200M and $158M, respectively, for new crypto funds, indicating growing investor interest in the market overview.

- Crypto.com has listed MOON, Reddit’s Community Points token, giving users more options for investing and trading.

- StarkNet, a tool for building Layer 2 solutions, has launched StarkNet Stack, providing developers with a platform to build decentralized applications (dApps) more easily and efficiently.

- LayerZero has integrated with Layer-2 Base mainnet, enabling faster and cheaper transactions for users.

- Manta Network has raised $25M in Series A funding, led by Polychain Capital and Qiming Venture, to develop its privacy-focused DeFi protocol.

- Tesla has held onto its Bitcoin investment for four consecutive quarters, and the company’s website still has Bitcoin payment code, indicating that the electric vehicle maker remains bullish on the cryptocurrency.

- CoinDesk, a leading news site for cryptocurrency, is being acquired for $125M, signaling growing interest in the market overview from traditional media outlets.

- Worldcoin has completed integration with OP Mainnet, making it easier for users to access and use the platform.

- Aptos has seen a 900% increase in new users after integrating the Chingari social media platform from Solana, demonstrating the growing synergy between social media and cryptocurrency.

- Optimism is considering integrating Zero-Knowledge Proof on OP Stack chains, such as Base, to enhance the privacy and security of transactions.

- Arbitrum has passed the proposal for implementing Account Abstraction, which will enable users to use smart contracts and other advanced features on Layer 2 solutions.

These updates demonstrate the continued growth and innovation in the cryptocurrency market overview, as well as the increasing interest from both investors and users. With more developments on the horizon, it’s an exciting time to be involved in this rapidly evolving industry.

Last week’s market overview

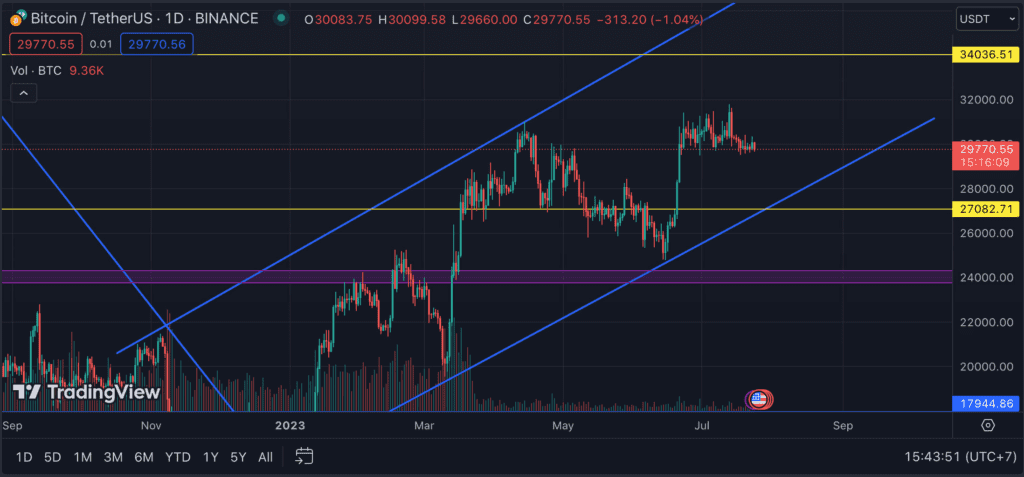

Bitcoin (BTC) saw little price change, trading in the range of $29.8K to $30.4K. While there were some drops to as low as $29.5K, the price quickly rebounded back to the $30K range. Currently, the price of BTC is almost at the same level as last week at $30K.

New coins such as HOOK, SUI, ID, and EDU did not experience much volatility, with weak buying power. Even the prices of SUI, ID, and HOOK have returned to last week’s levels. Old and new Layer 1 coins like Near, DOT, Celo, Rose, APT, and Layer 2 coins such as ARB and OP did not see anything noteworthy last week, with prices following the general sideways trend. Besides, the Terra coin system, which includes LUNA, LUNC, and USTC, saw an increase in prices before Do Kwon’s release from prison in Montenegro.

Looking ahead, the DXY index is currently at 101, and is at a resistance level. However, many forecasters predict that the FED will continue to raise interest rates by +0.25 this week, which could cause the DXY strength index to rebound to 103. This could potentially cause a slight dip in the prices of BTC and Altcoins. However, before a drop, MM may push BTC prices up to around $34K or more, creating FOMO, and then correcting downward.

Currently, the BTC index has a high profit margin. If the price is pushed up like this, it will be too easy for those who are holding coins. Therefore, it could create FOMO, then push the price down to around $27K.

Overall, last week was lackluster for the market overview. However, there are still potential developments to keep an eye on, such as the FED’s interest rate announcement and the potential for BTC prices to experience some volatility.

This week’s prediction

Notable events

Thursday, 27/07:

- FED announces interest rates.

- Q2 GDP announcement.

Friday, 28/07:

- PCE inflation index announcement.

Market overview forecast

The DXY index is currently at 101, and is at a resistance level. However, many forecasters predict that the FED will continue to raise interest rates by +0.25 this week, which could cause the DXY strength index to rebound to 103. This could potentially cause a slight dip in the prices of BTC and Altcoins.

However, before a drop, MM may push BTC prices up to around $34K or more, creating FOMO, and then correcting downward. Currently, the BTC index has a high profit margin. If the price is pushed up like this, it will be too easy for those who are holding coins. Therefore, it could create FOMO, then push the price down to around $27K. DYOR.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.