Upbit Stop CRV Deposit/Withdraw To Avoid Volatility From Hack

Key Points:

- In order to ensure asset safety for users, Upbit exchange has suspended CRV deposit and withdrawal services.

- The action comes after Curve Finance announced a serious hack that affected several pools.

- As of this morning, the hack is still in progress. The damage is estimated at $70 million.

Upbit made a temporary announcement to withdraw CRV deposits after Curve, a stablecoin exchange at the heart of decentralized finance (DeFi) on Ethereum, was the victim of a mining attack. Upbit said it will continue to monitor this situation and that members should pay attention to the increase in Curve price movement (CRV).

“A vulnerability was discovered today in some of the Curve stablecoin pools. As a result, the digital assets curve (CRV) is affected and shows great volatility, so be careful when investing. In addition, to support secure digital asset deposits and withdrawals, Curve deposits and withdrawals (CRVs) are temporarily suspended.” Written notice.

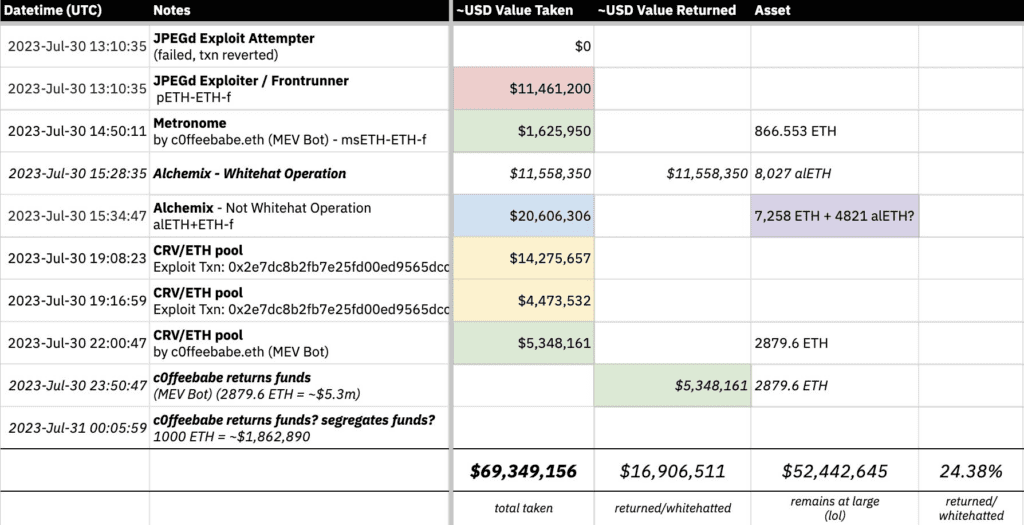

Yesterday, a series of pools on Curve were attacked, causing damage to Alchemix, JPEG’d, MetronomeDAO, deBridge, Ellipsis Team, and CRV/ETH.

On the morning of July 31, information continued to appear that the CRV/ETH pool had been hacked, draining 7 million CRV ($4 million) and $14 million WETH. Notably, the attack occurred just minutes before white hat hackers launched an operation to rescue liquidity pools affected by the reentrancy vulnerability discovered on the evening of July 30.

According to the announcement from the project, a series of stable pool pools (alETH/msETH/pETH) using the Vyper 0.2.15 programming language have been subjected to a repeated attack.

According to statistics, the damage from Curve’s reentrancy vulnerability has reached nearly $70 million, but $16.9 million has been refunded, meaning that there is still $52.4 million at risk of loss.

Previously, Aave recently approved an urgent proposal to turn off the CRV borrowing function on Ethereum. According to the AIP-125 proposal adopted on Aave, in the event of certain emergency situations, the protocol could prohibit the borrowing functionality of certain assets.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.