Key Points:

- Valio has launched its public version, offering a new way for users to manage their funds with trustless asset management.

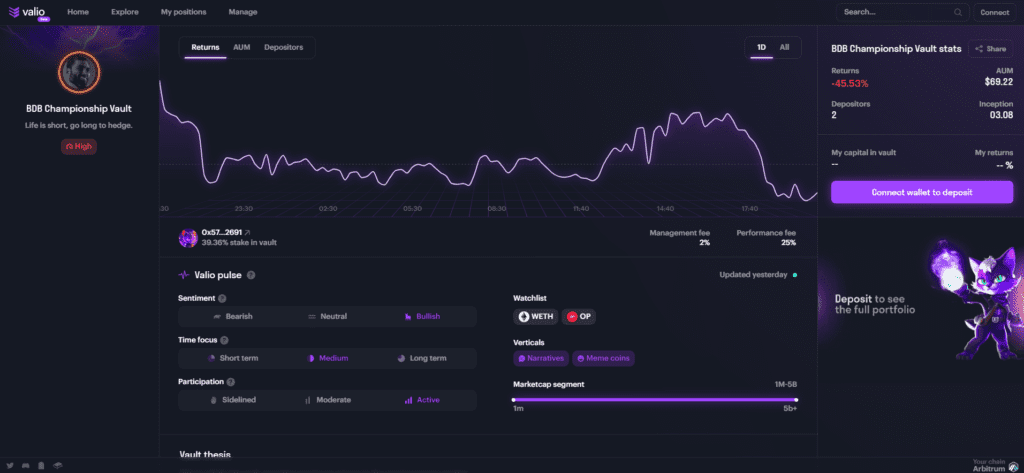

- Investors can explore lists of money managers, assess their performance, and participate in their funds without pre-approval.

- Valio ensures the safety of assets by holding them in smart contracts and limits managers to investing only in a predetermined list of DeFi applications to prevent them from withdrawing funds.

Valio has officially launched its public version, offering users a revolutionary way to have their funds managed by professionals without the need to entrust them as custodians.

The platform’s team announced the launch, highlighting its unique approach to bringing trustless asset management to the crypto community.

Previously available in a whitelisted version since July 24, the new public release, unveiled on August 7, eliminates the need for managers to be pre-approved. Founder Karlis provided insight into the app’s mechanics, explaining that investors can explore lists of money managers and assess their performance via an “explore” page. If an investor chooses to back a specific money manager, they can deposit assets to participate in that manager’s fund.

Valio ensures the safety of assets by holding them in smart contracts, preventing money managers from withdrawing them. Moreover, the platform limits managers to investing only in a predetermined list of DeFi applications. At launch, Valio has integrated with GMX, a perpetuals trading platform on Arbitrum, and 0x, a decentralized exchange protocol on Optimism.

Karlis highlighted Valio’s use of the “cumulative price impact tolerance architecture” to restrict the potential price impact caused by money managers. This mechanism prevents managers from harming investments by betting against their own clients. Karlis emphasized that unscrupulous managers would only be able to take 3%-5% of total funds, discouraging such behavior.

Karlis expressed that Valio’s aim is to level the playing field, enabling anyone to become a money manager. With user-friendly features like easy vault deployment, performance tracking, and the option to use a seedless smart contract wallet, Valio appeals to a broader audience beyond the Web3-savvy crowd.

Karlis positioned platforms like Valio as the future of asset management, attracting not only traditional investors but also those interested in real success, akin to the “Wall Street Bets” ethos. The platform’s user-centric design and simplified features resonate with the growing demand for user-friendly DeFi applications and crypto wallets.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.