Key Points:

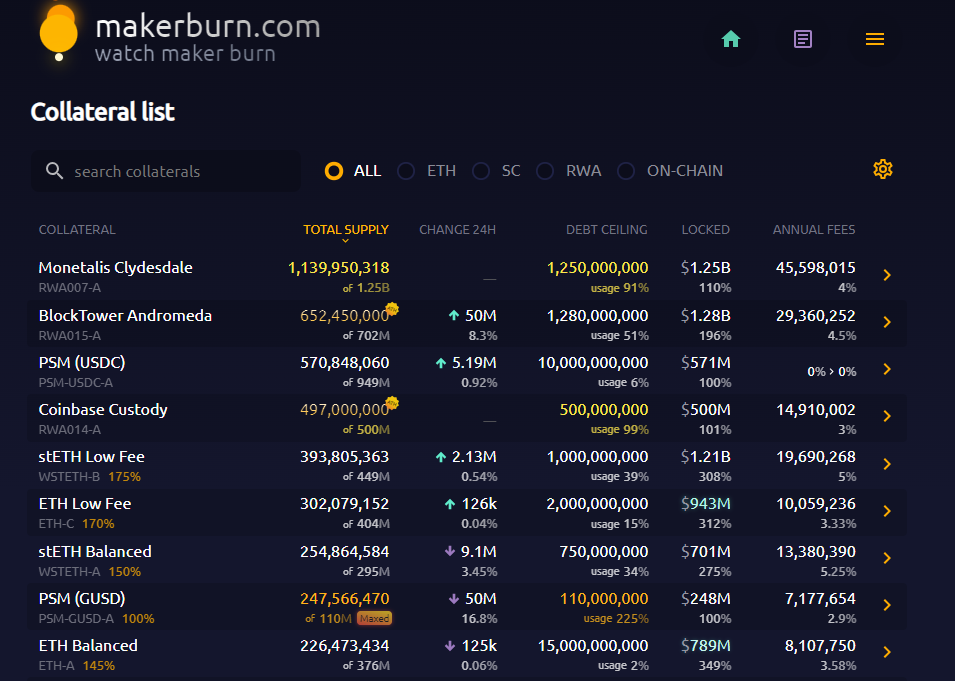

- MakerDAO’s strategic move adds $50 million to RWA assets in just 24 hours, showcasing its prowess in DeFi management.

- BlockTower Andromeda short-term Treasury bonds acquired, boasting a 4.5% annual yield, enhancing financial stability.

- RWA portfolio now stands at $2.537 billion, Monetalis Clydesdale at $1.14B and BlockTower Andromeda at $652M, signaling MakerDAO’s expanding DeFi influence.

MakerDAO’s latest transaction has propelled its Real World Assets (RWA) holdings by an impressive $50 million within a mere 24 hours.

The move comes as part of MakerDAO’s strategic investment initiative, aimed at diversifying its portfolio and securing promising short-term Treasury bonds. The data from Makerburn, a popular analytics platform, revealed that the organization had acquired BlockTower Andromeda short-term Treasury bonds, boasting an alluring annual yield of 4.5%.

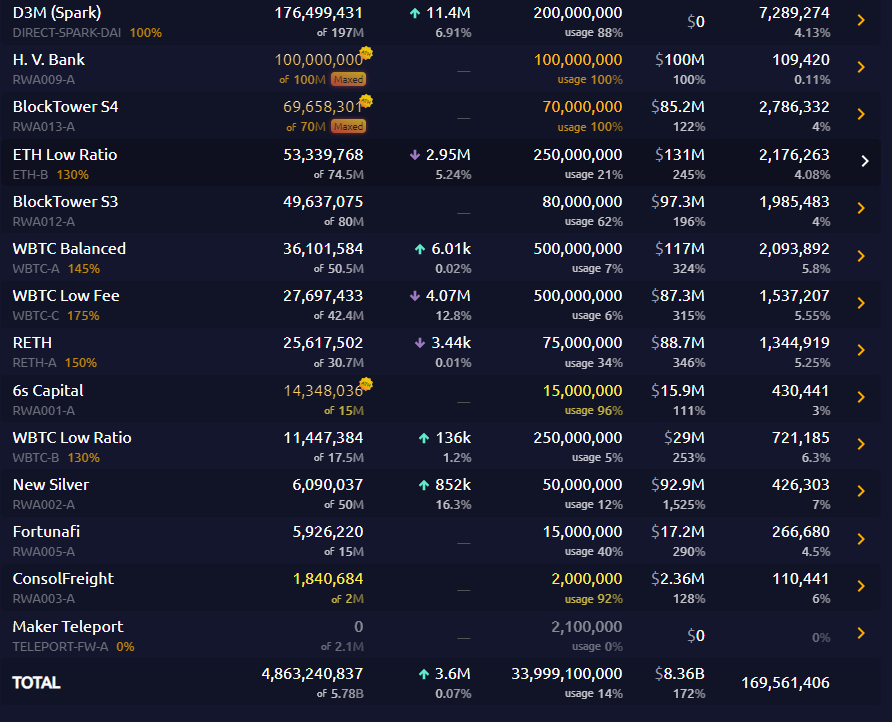

The RWA assets under MD’s purview now stand at a considerable approximate value of $2.537 billion. This figure underscores the organization’s steady progress in managing a diversified portfolio that spans a range of valuable assets. Among these holdings, the crown jewels are undoubtedly Monetalis Clydesdale and BlockTower Andromeda. The former commands a substantial worth of about $1.14 billion, while the latter, BlockTower Andromeda, contributes an impressive $652 million to the burgeoning RWA assets.

This calculated move signals MakerDAO’s proactive approach to financial management, leveraging its capabilities to harness lucrative investment opportunities while bolstering its asset base. The acquisition of the BlockTower Andromeda short-term Treasury bonds reflects MakerDAO’s commitment to securing assets with stable returns, further enhancing the organization’s financial stability.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.