Bitcoin Dominates Non-US Exchanges With A 10% Increase In Reserves

Key Points:

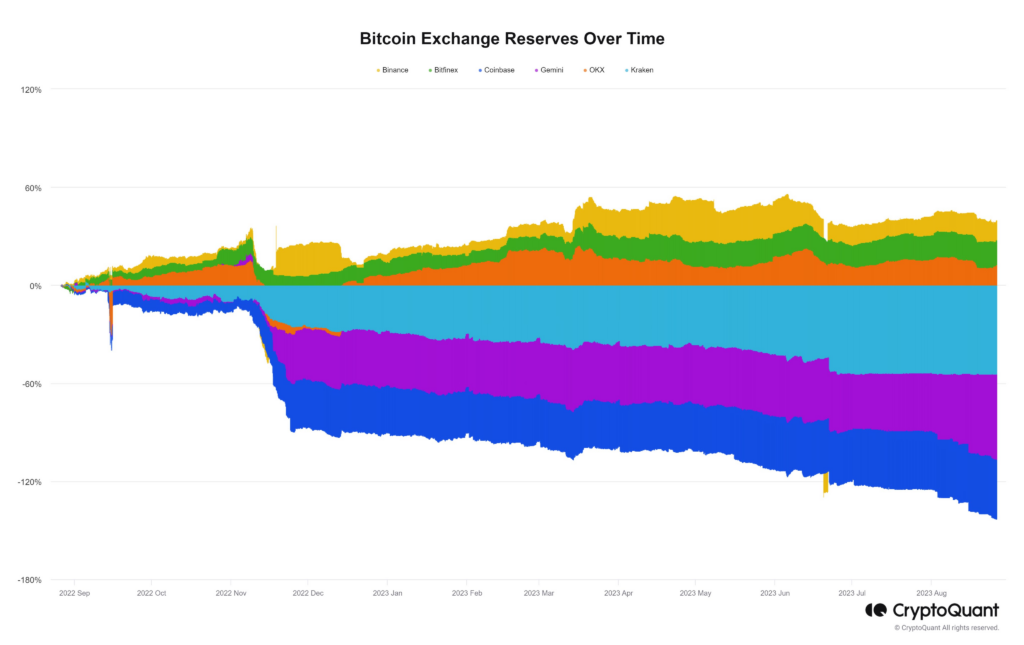

- Non-US exchanges are up 10%, and US exchanges are down 30–50% in Bitcoin reserves, according to CryptoQuant.com.

- 20K BTC was withdrawn from Gemini in August, suggesting strong institutional buying amid market instability.

- Bitcoin futures surge, but the highest long liquidation since 2022 leads to setbacks.

A recent analysis by CryptoQuant.com has unveiled intriguing shifts within the Bitcoin (BTC) market over the past year. Notably, Bitcoin reserves on non-US centralized exchanges (CEX) like Binance, OKX, and Bitfinex have surged by over 10%.

In contrast, US CEXs such as Coinbase, Gemini, and Kraken have witnessed a sharp decline of no less than 30%, with some even plummeting by over 50%.

During August alone, a remarkable 20,000 BTC—approximately a quarter of the total—were withdrawn from the Gemini exchange. This mass withdrawal and wallet transaction data suggest a persistent trend of institutional BTC purchases.

The futures market also paints a compelling picture. Participants have significantly escalated their involvement in derivatives, propelling Bitcoin contract positions to levels not seen since November 2022.

However, August did see a poignant market setback as the BTC price endured its highest long liquidation tally since the FTX collapse in November 2022, sparking a substantial market retreat.

Conversely, US-based exchanges have faced a distinct trajectory. BTC reserves have dwindled by 30%, with some exchanges suffering even steeper declines of up to 50% or more.

The recent BTC price turbulence has impacted stakeholders—investors, traders, and even miners. Network validators, particularly those validating blocks, were bearing the brunt of the market upheaval, leading to unprecedented losses and prompting some to offload assets.

Following the substantial decline on August 17, Bitcoin, the flagship cryptocurrency, has weathered nearly two weeks of intense volatility. The ongoing bearish sentiment is reflected in the long-wick rejections in daily candles, underscoring the uncertainty in the market’s current trajectory.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.