Market Overview (Oct 23 – Oct 29): Memecoin Listing, Bitcoin ETF Predictions, and Economic Insights

Key points

- Binance lists Memecoin (MEME) and CYBER surges after investment from Binance Labs.

- The GDP growth rate in the US reached 4.9% in the third quarter, exceeding expectations.

- Bitcoin ETF predictions and potential altcoin season in November amid market developments.

Discover the latest developments in cryptocurrency, from Binance’s new listings to the surge in Bitcoin’s value. Stay informed and explore the growing potential of Bitcoin ETF prediction.

Last week’s highlights big news

In the latest developments in the cryptocurrency world, several notable events have taken place. Binance, a leading cryptocurrency exchange, has recently listed Memecoin (MEME) on its Binance Launchpool. This move is expected to bring increased attention and trading activity to MEME.

Another significant development is the surge in the price of CYBER, a digital asset, following a substantial investment from Binance Labs. This investment has not only propelled the price of CYBER but also highlights the growing interest and support from influential players in the industry.

In addition, BUSD, a stablecoin, is gradually being removed from popular cryptocurrency data platforms like CoinGecko and CoinMarketCap. This shift raises questions about the future of BUSD and its market presence.

Chainlink Stake v0.2, scheduled to be released later this year, promises to introduce a new betting platform. This update comes as a result of ChainLinkGod’s insights, and it is anticipated to bring exciting new features to the Chainlink ecosystem.

Meanwhile, Coinbase, a prominent US-based cryptocurrency exchange, is prepared to confront the allegations made by the Securities and Exchange Commission (SEC). The exchange aims to disprove the SEC’s claims of unregistered securities by providing substantial evidence of real contracts.

Hong Kong‘s CSOP Bitcoin Futures ETF experienced a significant boost in trading volume, reaching HKD 175.87 million on October 24. This surge in activity, coupled with an inflow of HKD 138 million, marks the highest trading volume and inflow since the ETF’s listing.

Galaxy Research predicts that the launch of the spot Bitcoin ETF predictions will attract substantial inflows. For more detailed predictions and insights on Bitcoin ETFs, visit CryptoFuturePrice.com. In the first year alone, inflows are estimated to reach $14 billion, with projections of $27 billion in the second year and $39 billion in the third year. These figures underscore the growing interest and potential of Bitcoin ETF prediction in the market.

Furthermore, reports suggest that Binance has made significant efforts to establish a cryptocurrency exchange in Hong Kong. This strategic move aims to secure a local cryptocurrency license, according to reliable sources cited by the South China Morning Post.

Lastly, the cryptocurrency exchange Gemini has taken legal action against its former business partner, Genesis Global. The lawsuit revolves around Gemini Earn products, with over 60 million shares of Grayscale Bitcoin Trust (GBTC) being held as collateral. This legal dispute highlights the challenges and complexities within the cryptocurrency industry.

Macroeconomic

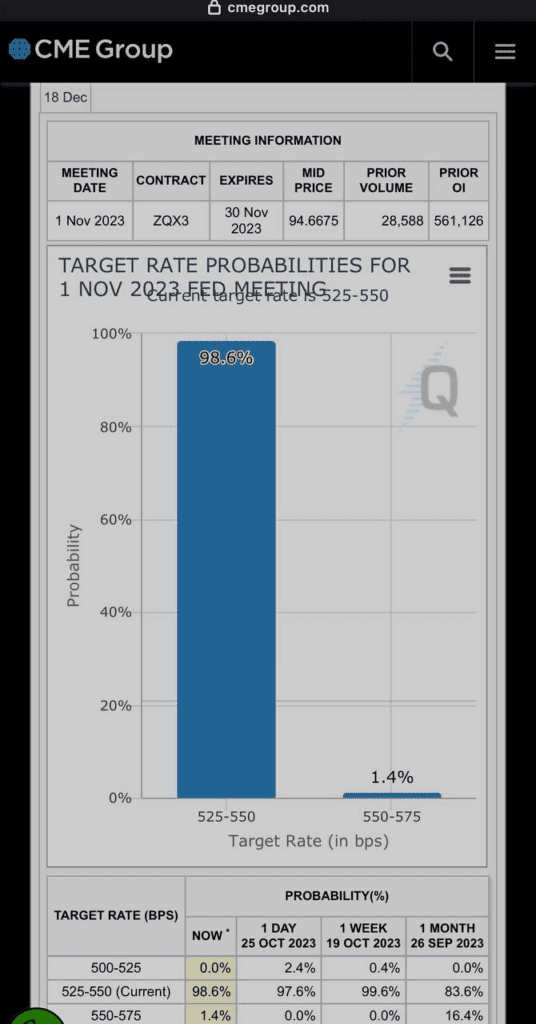

In the latest economic update, the United States experienced a significant growth rate in its GDP during the third quarter. The actual growth rate reached 4.9%, marking the highest level since the fourth quarter of 2021. This surpassed the estimated growth rate of 4.7%. Furthermore, the Federal Reserve is highly likely to maintain interest rates unchanged in the upcoming meeting next week, with a probability of 98.5%.

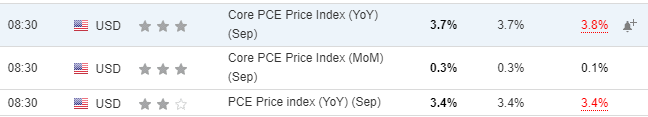

Turning our attention to inflation, the Personal Consumption Expenditures (PCE) inflation rate stands at 3.4%, in line with the estimated figure. The Core PCE inflation rate, which excludes volatile components, decreased to 3.7% compared to last month’s 3.8%. This aligns with market expectations and reflects a stable inflationary environment.

Meanwhile, the S&P500 index continues its decline, entering correction territory. This indicates a 10% drop from its peak in July. The correction suggests a period of adjustment and potential market volatility.

Economic events this week

Thursday, November 2nd

- 01:00 – FED Interest Rate Decision and FOMC Statement (Expected to remain unchanged).

- 01:30 – FOMC Press Conference, Fed Chairman Jerome Powell’s remarks.

- 19:30 – Initial Jobless Claims in the United States (Expected: 210k, Previous: 210k).

Friday, November 3rd

- 19:30 – Nonfarm Payrolls Report in the United States (Expected: 182k, Previous: 263k).

- 19:30 – Unemployment Rate Announcement in the United States (Expected: 3.8%, Previous: 3.8%).

Prediction Market Crypto

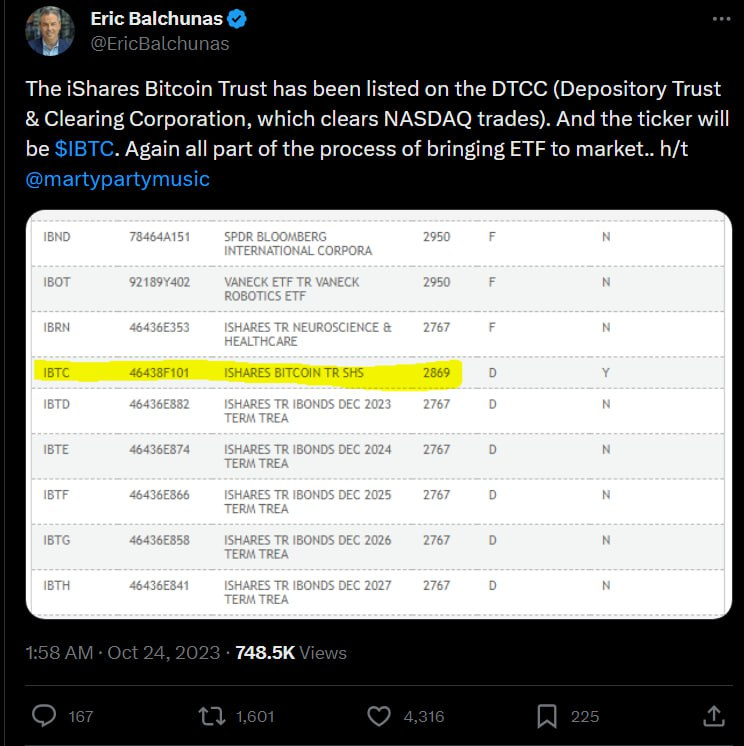

Last week witnessed an eventful period in the cryptocurrency market, particularly for Bitcoin ($BTC). The surge in Bitcoin’s value was fueled by the news of iShares Bitcoin Trust (Bitcoin ETF prediction), a product by BlackRock, being listed on the Depository Trust & Clearing Corporation (DTCC), a transaction settlement unit of NASDAQ.

However, this listing was short-lived as it was swiftly delisted by DTCC, only to be relisted later. Regardless of the authenticity of this news, the BTC ETF Spot event holds significant importance, similar to the impact of Bitcoin halving. If this listing gains real traction, it could potentially lead to a substantial inflow of funds into the market.

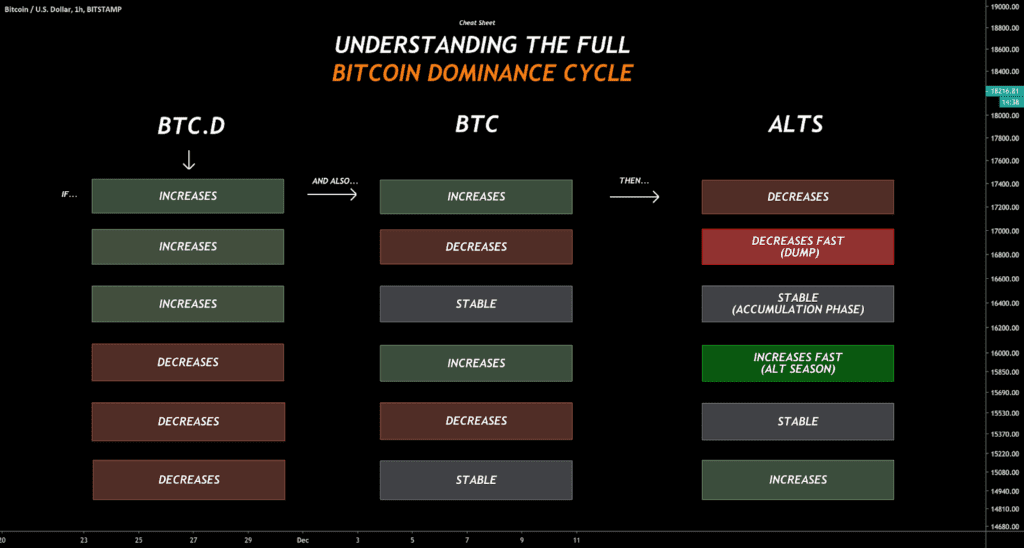

Turning our attention to altcoins, the dominance of Bitcoin (Dom BTC) has been on the rise due to its remarkable surge. However, if Bitcoin’s momentum slows down, and it enters a sideways trend, we may witness a mini altcoin season in November. This projection is based on the current market sentiment and analysis.

In another notable development, there are indications that the US government may sell approximately 30,000 Bitcoins by the end of this year. These Bitcoins were initially confiscated during the Silk Road case. Interestingly, except for a trial transfer on September 2, 2023, these Bitcoins have remained untouched in the wallet. The associated wallet address is bclqf2yvj48mzkj7uf8lc2a9sa7w983qe256l5c8fs.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.