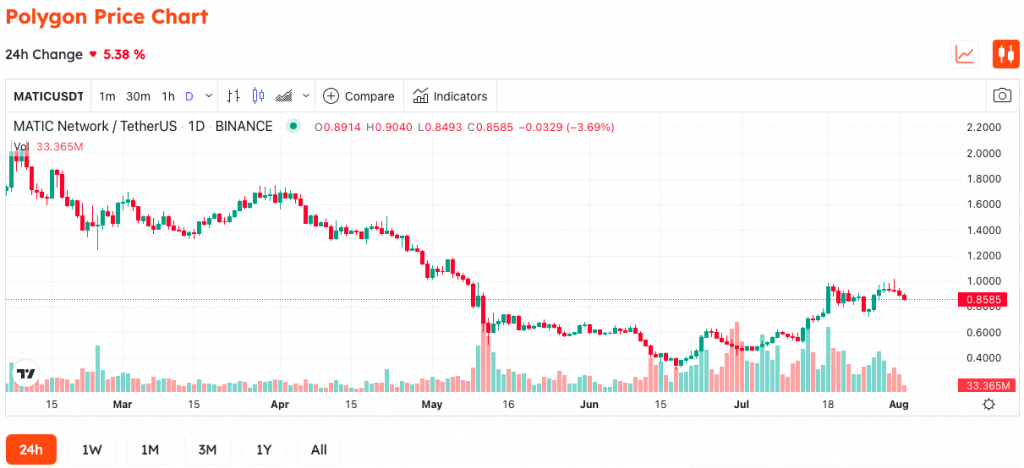

Polygon (MATIC) had a promising July, hitting an impressive 83% in 30 days. The smart contract platform utilizes the Layer-2 scale and aims to be an essential Web3 infrastructure solution. However, investors question whether the recovery is sustainable considering the lackluster active address and deposit data.

Polygon recovered after being selected to the Walt Disney Company’s accelerator program to build augmented reality solutions, NFTs, and AI.

Polygon announced on July 20 its plans to implement a zero-knowledge Ethereum Virtual Machine (zkEVM), which bundles multiple transactions before forwarding them to the Ethereum (ETH) blockchain. The co-founder, Mihailo Bjelic, claimed this solution would reduce Ethereum fees by 90% and increase throughput to 40–50 transactions per second.

Another reason for the rally is that more and more platforms are starting to offer liquidity staking for MATIC, allowing holders to earn additional rewards. Examples include Lido Finance, Balancer, Meshswap, and Ankr Staking, according to DeFi Pulse.

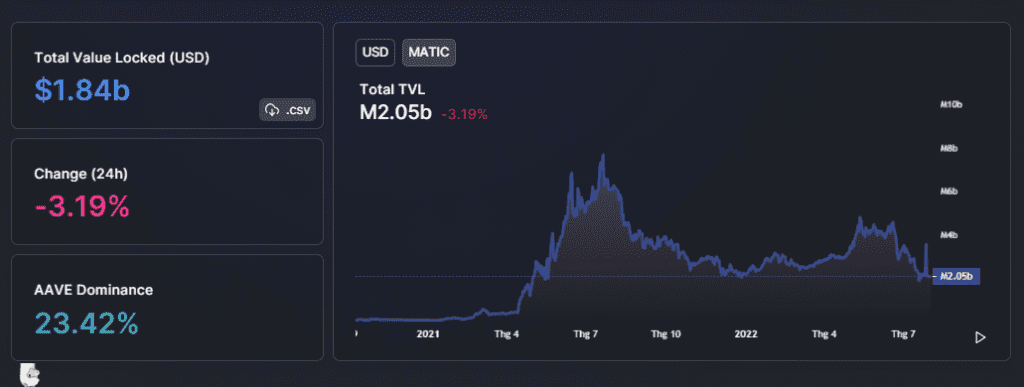

Although it is currently 69% below its previous high, Polygon is still one of the top 12 tokens by capitalization rating. Furthermore, the network holds $1.72 billion worth of deposits locked on smart contracts, known as total value locked (TVL).

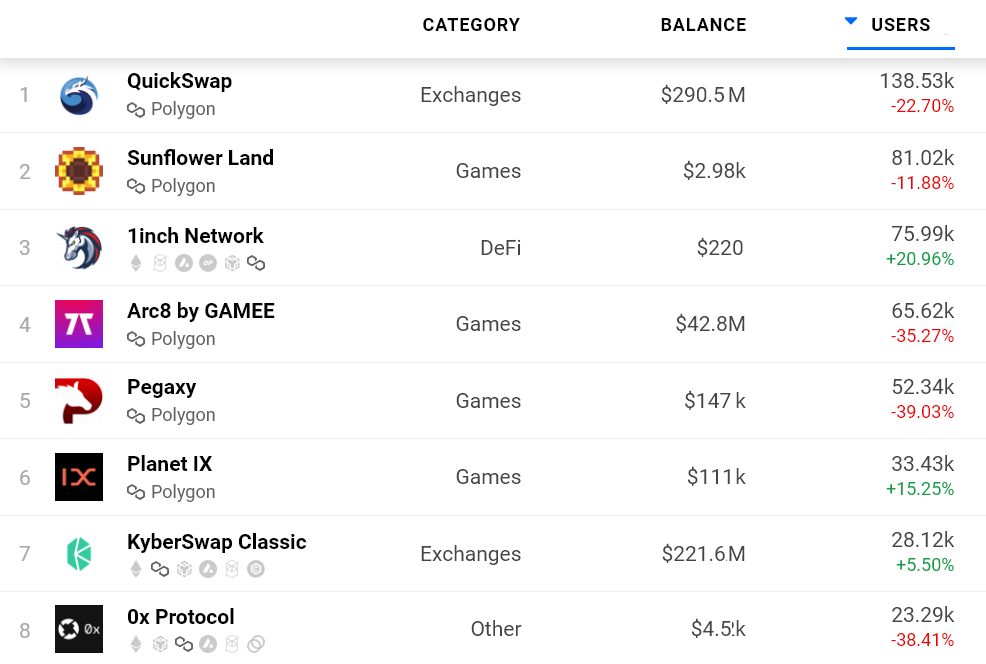

Polygon’s Ethereum-compatible scalability is fully functional, hosting a variety of dApps ranging from decentralized exchanges (DEXs), mortgage lending services, profit aggregators, NFT marketplaces, and games.

Despite 83% rally in 30 days, the network’s TVL equals MATIC, down 42% over the same period. For comparison, scaling solution Fantom (FTM) is down 14% in 30 days, and Klaytn (KLAY) is up 11%.

Polygon’s current TVL is $1.82 billion, 67% lower than at the beginning of the year. However, that’s not far from Solana’s $2.08 billion (SOL) or Avalanche’s $2.52 billion (AVAX).

To confirm whether Polygon’s TVL decline is due to a drop in adoption, we analyze dApp usage metrics. However, some dApps, such as games and NFT marketplaces, do not require large deposits, so the TVL index is irrelevant in those cases.

As shown by DappRadar, on August 1, the average number of Polygon network addresses interacting with the dApp fell by 19% from the previous month.

Considering Polygon’s TVL has dropped 42%, the network lacks more substantial user base growth to support further MATIC price momentum. The network’s top DApp Quickswap has 138,530 active addresses in the last 30 days, while the top Ethereum app OpenSea has 299,910 users during the same period.

The data above shows that Polygon has lost some traction in the scaling solutions market. With the recently announced zero-knowledge project yet to be implemented, MATIC is still likely to surpass $1.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News