Invest in Bitcoin through Spot Bitcoin ETFs, which provide indirect exposure to Bitcoin without owning it. Learn about the advantages, history, major financial institutions filing for Spot Bitcoin ETFs, and how they work. Find out the potential impact of approving a Bitcoin ETF on the market.

Bitcoin ETF Overview

History of Bitcoin ETF

Bitcoin ETFs have seen significant progress since the Winklevoss Bitcoin Trust submitted the first proposal in 2013. Despite facing rejections, the first Bitcoin ETF was listed on the Bermuda Stock Exchange in 2020. Canada launched its first Bitcoin ETF in 2021, followed by the approval of two more.

The ProShares Bitcoin Strategy ETF became the first U.S.-listed Bitcoin ETF in 2021. Europe joined the market 2023 with Jacobi Asset Management launching Europe’s first Bitcoin ETF. Grayscale won an appeal against the SEC to convert their Bitcoin Trust into an ETF. More recently, Franklin Templeton filed for a Bitcoin ETF with the SEC in September 2023.

Understanding Bitcoin ETFs

Spot Bitcoin ETFs

A Spot Bitcoin ETF, also known as a Bitcoin Physical ETF, is an investment fund that operates similarly to traditional ETFs. Its purpose is to provide investors with access to Bitcoin without owning it.

Instead, the fund management company buys Bitcoin and issues shares in the ETF, representing ownership of the underlying Bitcoin. This allows investors to benefit indirectly from the value of Bitcoin while avoiding the risks associated with the crypto market.

Difference from Bitcoin Futures ETFs

Unlike Bitcoin Futures ETFs, which are linked to futures contracts traded on exchanges like the Chicago Mercantile Exchange (CME), Spot Bitcoin ETFs hold physical Bitcoin. This means that each share in the ETF represents a portion of actual Bitcoin, providing a direct exposure to the cryptocurrency.

Spot Bitcoin ETFs closely track the price of Bitcoin. As the value of Bitcoin fluctuates, the value of the ETF will also increase or decrease accordingly. Although several Bitcoin-related ETFs have been approved by the U.S. Securities and Exchange Commission (SEC), most are Bitcoin Futures ETFs. Spot Bitcoin ETFs have not received approval to trade on U.S. stock markets.

Who is filling for Spot Bitcoin ETF?

Major financial institutions such as BlackRock, Fidelity, and VanEck are competing to launch the first spot-traded Bitcoin exchange-traded fund (ETF) in the United States.

While the U.S. Securities and Exchange Commission (SEC) initially approved a Bitcoin-linked Futures ETF in October 2021, the current focus is on spot Bitcoin ETFs. Additionally, the recent legal victory by Grayscale against the SEC’s review of its spot Bitcoin ETF proposal has raised hopes for the approval of these investment funds.

- BlackRock: The world’s largest asset manager filed for a spot Bitcoin ETF in June 15, partnering with Coinbase for crypto custody and spot market data. BNY Mellon will serve as its cash custodian. The SEC formally accepted BlackRock‘s application for review on July 15.

- WisdomTree: A New York-based asset manager initially filed for a spot Bitcoin ETF in December 2021 but faced SEC rejection in 2022. Following BlackRock’s entry, WisdomTree refiled its application in July 2023.

- Valkyrie Investments: Valkyrie filed its first spot Bitcoin ETF application in January 2021 but faced rejection from the SEC. However, the renewed interest in spot Bitcoin ETFs led Valkyrie to refile its application in June 2023. They plan to use the Chicago Mercantile Exchange’s reference price for Bitcoin and trade on NYSE Arca with Xapo as the crypto custodian.

- ARK Invest: ARK Invest filed an application for its ARK 21Shares Bitcoin ETF in June 2021, partnering with Swiss-based ETF provider 21Shares. If approved, this ETF will launch on the Chicago Board Options Exchange (Cboe) BZX Exchange under the ticker symbol ARKB.

- VanEck: VanEck made its first Bitcoin ETF filing in 2018 but withdrew the application in 2019. The firm attempted again in December 2020 and in July 2023 filed a new application. They plan to trade on the Cboe BZX Exchange.

- Fidelity Investments: Fidelity applied for a spot Bitcoin ETF in 2021 and refiled for the Wise Origin Bitcoin Trust in July 2023. Fidelity Service Company will serve as the administrator, while Fidelity Digital Assets will be the BTC custodian.

- Invesco Galaxy: Invesco Galaxy initially filed an application for a Bitcoin ETF in September 2021, jointly with Galaxy Digital. The joint venture refiled its application in July, planning for a “physically backed” Bitcoin ETF with Invesco Capital Management as the sponsor.

- Bitwise: Bitwise first filed for a spot Bitcoin ETF in October 2021 but was rejected by the SEC. The asset manager refiled its application in August 2023.

- GlobalX: Fund manager GlobalX entered the ETF race in 2021, filing for a spot Bitcoin ETF and refiled its application in August 2023. Coinbase was named as its surveillance-sharing partner.

- Hashdex: Hashdex, a crypto asset management company, has submitted an application to the SEC for a Bitcoin futures ETF that will contain spot Bitcoin. Hashdex will purchase spot Bitcoin through physical exchanges on the CME market and aims to include spot Bitcoin in its Bitcoin futures ETF, changing the name to Hashdex Bitcoin ETF.

- Franklin Templeton: A $1.45 trillion asset manager filed for a Bitcoin ETF with the SEC for the first time on September 12, 2023. Franklin Templeton CEO Jenny Johnson has previously expressed her views on Bitcoin and blockchain.

Tow Months To Second Final Spot Bitcoin ETF Deadline

Cryptocurrency Market Anticipation for Bitcoin Spot ETF Approval

The cryptocurrency market eagerly anticipates the SEC’s decision to approve the Bitcoin spot ETF, with a deadline set for the fourth quarter of 2023.

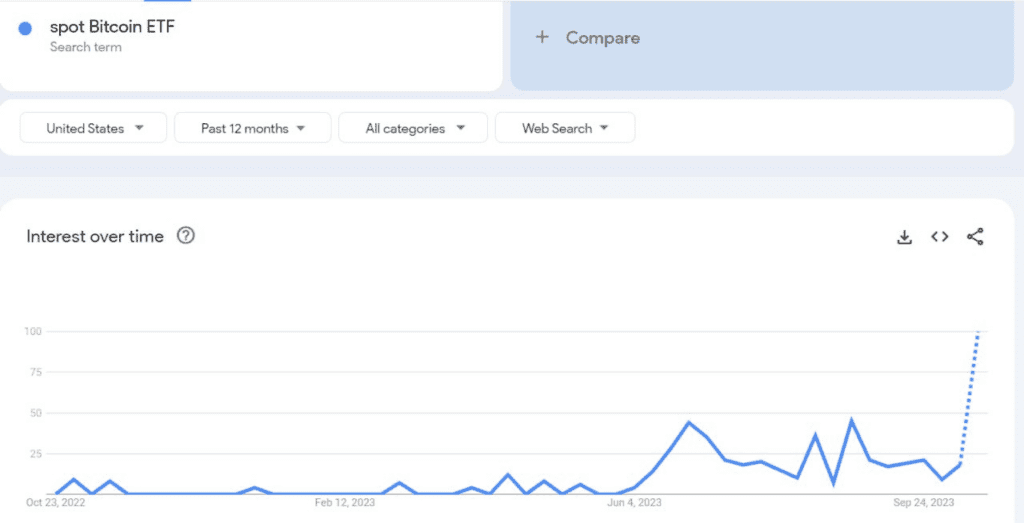

Despite repeated delays and extensions, investors remain hopeful for a positive outcome. This is reflected in the high Google search volume for “spot Bitcoin ETF,” indicating that ETFs have gained popularity among individual investors, not just large organizations.

Although the SEC scrutinizes the proposal, experts predict a high approval rate of up to 95%, including prominent figures in the financial industry, such as BlackRock.

This has generated curiosity among the public, leading to increased Google searches related to Bitcoin and ETFs. Investors eagerly await a final decision, as approving a Bitcoin ETF would be a significant milestone for the cryptocurrency market.

Experts Prediction and Potential Impact

Cointelegraph‘s recent false report claiming the SEC had approved BlackRock’s Bitcoin Spot ETF Proposal underscores the pent-up interest and anticipation among investors waiting for a final catalyst to trigger a surge.

If the BlackRock ETF is approved, a conservative estimate is that the price of Bitcoin will rise to $42,000; an optimistic estimate is that with an inflow of $50 billion money, Bitcoin may rise to $56,000, according to service provider Matrixport.

Next Dates to Watch

November 2023 is set to be a significant date for spot Bitcoin ETFs. Additionally, the second final approval deadline will be on January 10, 2024. However, it is likely that there will be delays in approving these ETFs due to the complex and time-consuming regulatory process for these investments.

Advantages of Bitcoin ETFs

Investing in Bitcoin ETFs can be an excellent way for new investors to diversify their portfolios and gain exposure to the cryptocurrency market without the complexities of owning actual Bitcoin.

These ETFs simplify the buying and selling process, which can optimize returns and reduce risks. With Bitcoin ETFs, investors can even short them if they think Bitcoin’s price will decline.

One of the main advantages of Bitcoin ETFs is that they save time for investors interested in investing in cryptocurrencies but need more time to conduct thorough research. Instead of dealing with the complexities of buying and storing Bitcoin securely, investors can focus on trading an instrument they are more familiar with, such as a Bitcoin ETF.

For many investors, Bitcoin and cryptocurrencies can be unfamiliar and risky. Owning Bitcoin involves managing private keys and dealing with crypto exchanges, which can be daunting for newcomers.

Additionally, reporting Bitcoin sales for taxes can be complicated, especially if profits are involved. This is where a Bitcoin ETF becomes appealing. With a Bitcoin ETF, investors can bypass the need to handle private keys, storage, and security concerns. They can simply buy shares of the ETF, similar to buying regular stocks, making it a straightforward way to invest in Bitcoin.

How Bitcoin ETFs Work

The way a Bitcoin ETF works is by a company purchasing and holding actual Bitcoin, with the value of the ETF tied to the amount of Bitcoin held. The ETF is then listed on a stock exchange, allowing investors to buy and sell shares of the ETF just like any other stock. It also enables investors to take positions against Bitcoin if desired.

However, Bitcoin ETFs differ from other ETFs in several ways. Unlike ETFs composed of stocks from companies, Bitcoin ETFs do not provide dividends since Bitcoin is decentralized and not a company. Additionally, investors need to consider fees associated with managing the ETF. Some of these fees cover the costs of purchasing and securely storing the actual Bitcoin represented by the ETF.

Conclusion – Spot Bitcoin ETF

Spot Bitcoin ETFs have created a lot of interest in the cryptocurrency market. They offer a way for investors to gain exposure to Bitcoin without owning it directly. This reduces risks and simplifies the buying and selling process, making it appealing to new and experienced investors.

It also bypasses the complexities of managing private keys, storage, and security concerns, simplifying the tax reporting process. However, Bitcoin ETFs differ from traditional ETFs in several ways, and investors need to consider the fees associated with managing the ETF.

The SEC’s decision on the Bitcoin spot ETF is eagerly awaited by the market. The approval of a Bitcoin ETF could be a significant milestone, providing institutional and retail investors with a regulated and accessible avenue to invest in Bitcoin, potentially leading to increased adoption and investment in the cryptocurrency.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.