• Binance’s CZ Unfollows Solana’s Toly Amid Market Criticism

• Hassett’s Comment on Inflation Stirs Crypto Markets

• PENGU Holds Support at $0.0085 as Rebound Toward $0.0134 Remains Possible

• U.S. Government Shutdown Sparks Economic Uncertainty, Cryptocurrency Markets Remain Steady

• Arthur Hayes Questions Fed Chair’s Impact on Monetary Policy

• US Government Faces Partial Shutdown Amid Budget Crisis

• Federal Reserve Split: Waller Advocates Rate Cut for Stability

• Controversy Surrounds Unverified Poaching Allegations Between Binance and OKX

• Flow Foundation Destroys 87.4 Billion Counterfeit Tokens

• Binance Faces Blame for Crypto Flash Crash Events

Market Overview (Nov 20 – Nov 26): Binance Trouble Unleashed and the return of Sam Altman

6 mins mins

- In last week’s highlights Binance Trouble, CEO stepped down due to anti-money laundering violations, while OpenAI saw the return of Sam Altman as CEO…

- In macroeconomic news, the FED expressed concerns about high inflation and upcoming events include speeches by FED officials, PCE inflation index release, and an SEC meeting with Ripple.

- The crypto market outlook considers leadership changes, Binance leaving the US market, and China’s loosening grip on BTC.

Discover the latest developments in the cryptocurrency market, including Binance Trouble, OpenAI saw the return of Sam Altman as CEO, and the rise of Central Bank Digital Currencies.

Last week’s highlights big news (Nov 20 – Nov 26)

In a surprising move, CZ, the CEO of Binance, announced his decision to step down from his position. This decision comes as a result of Binance violating anti-money laundering rules. Binance has agreed to pay a hefty $4 billion fine to the US Department of Justice. Despite this setback, Binance Trouble will continue its operations by implementing appropriate regulations to ensure compliance with anti-money laundering laws. Richard Teng has been appointed as the new CEO of Binance. Binance trouble is currently facing three criminal offenses.- Firstly, the company is charged with conspiracy to conduct unlicensed money transfers and failure to maintain an effective anti-money laundering program.

- Secondly, Binance is accused of conducting unlicensed money transfers.

- Lastly, the company is charged with violating the International Emergency Powers Act, a US federal law that grants the president the authority to manage international trade during times of national emergency. These charges have put the Binance trouble under significant scrutiny.

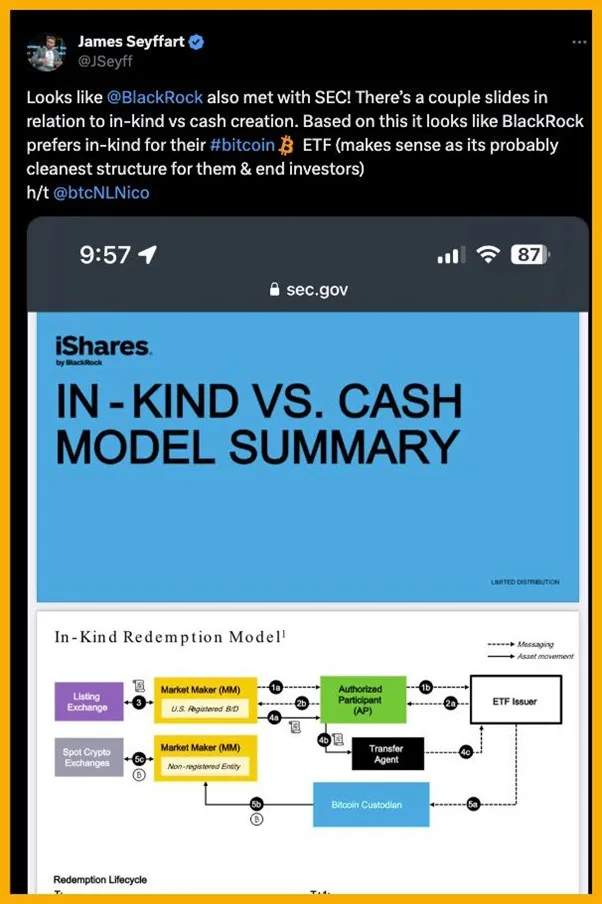

Both Grayscale and BlackRock have recently engaged in discussions with the SEC regarding the possibility of launching a Bitcoin ETF. This indicates the growing interest and recognition of cryptocurrencies by institutional investors. However, these discussions coincided with the news of the Binance trouble and CZ facing charges from the Department of Justice, which has added another layer of complexity to the regulatory landscape.

Kyber Network, a decentralized exchange platform, experienced a severe incident resulting in a loss of nearly $50 million across multiple blockchain networks. This unfortunate event underscores the importance of robust security measures within the decentralized finance ecosystem.

In a significant development, the Bank of Korea (BOK) has announced its plans to launch a Central Bank Digital Currency (CBDC) pilot program. The program aims to involve the participation of 100,000 citizens next year, marking a significant step towards the adoption of digital currencies at the national level.

Ark Invest, a prominent investment management firm, has made headlines by selling over 700,000 shares of the Bitcoin Grayscale Fund since October 23rd. This move indicates a shift in their investment strategy and reflects the dynamic nature of the cryptocurrency market.

Both Grayscale and BlackRock have recently engaged in discussions with the SEC regarding the possibility of launching a Bitcoin ETF. This indicates the growing interest and recognition of cryptocurrencies by institutional investors. However, these discussions coincided with the news of the Binance trouble and CZ facing charges from the Department of Justice, which has added another layer of complexity to the regulatory landscape.

Kyber Network, a decentralized exchange platform, experienced a severe incident resulting in a loss of nearly $50 million across multiple blockchain networks. This unfortunate event underscores the importance of robust security measures within the decentralized finance ecosystem.

In a significant development, the Bank of Korea (BOK) has announced its plans to launch a Central Bank Digital Currency (CBDC) pilot program. The program aims to involve the participation of 100,000 citizens next year, marking a significant step towards the adoption of digital currencies at the national level.

Ark Invest, a prominent investment management firm, has made headlines by selling over 700,000 shares of the Bitcoin Grayscale Fund since October 23rd. This move indicates a shift in their investment strategy and reflects the dynamic nature of the cryptocurrency market.

Macroeconomic (Nov 20 – Nov 26)

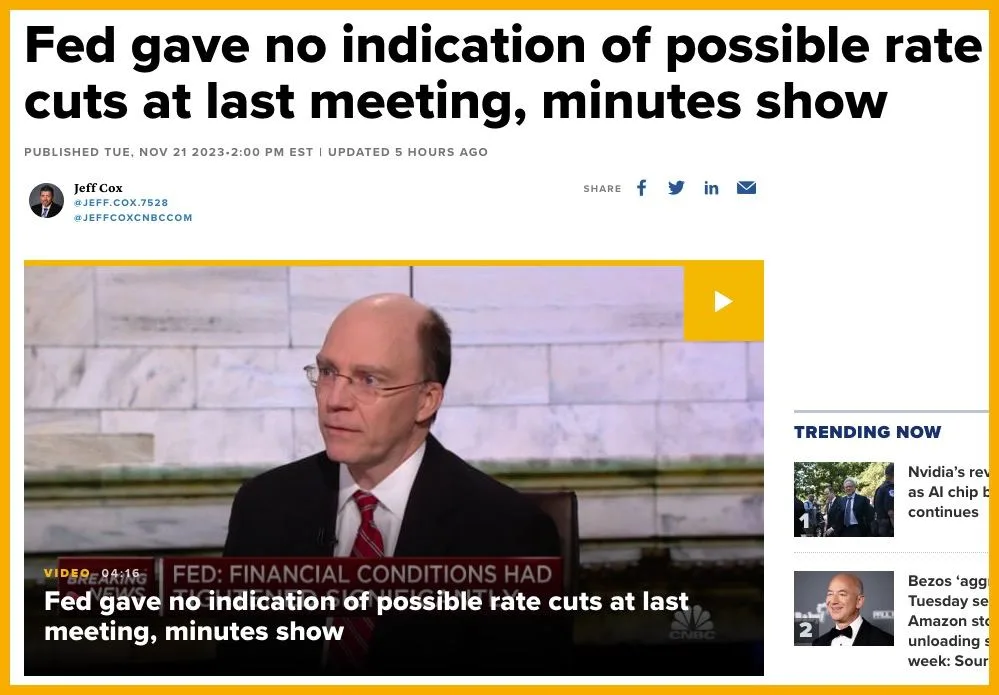

In last month’s FED meeting, officials expressed little support for cutting interest rates in the near future, citing concerns about high inflation compared to their target. They emphasized the need for policy to remain “tight” until data shows inflation returning to its 2% target. There are still concerns among FED members that inflation could persist or even rise further, potentially necessitating interest rate hikes. Turning our attention to the major events happening this week, we have several speeches by FED officials lined up, the release of the PCE inflation index, and an important meeting between Ripple and the SEC. TUESDAY, NOVEMBER 28

TUESDAY, NOVEMBER 28

- S&P Case-Shiller Home Price Index (20 cities).

- Federal Reserve Board Member Christopher Waller speaks.

- Chicago Federal Reserve President Austan Goolsbee speaks.

- Federal Reserve Board Member Michelle Bowman speaks.

- Federal Reserve Board Member Michael Barr speaks.

- Q3 GDP (first revision) – Expectations remain unchanged at 4.9%.

- Cleveland Federal Reserve President Loretta Mester speaks.

- Beige Book by the Fed (economic conditions report).

- SEC meeting with Ripple.

- Personal Consumption Expenditures (PCE) Price Index (Core PCE estimated to decrease to 3.5% from 3.7%).

- New York Federal Reserve President John Williams speaks.

- Federal Reserve Board Member Michael Barr speaks.

- Chicago Federal Reserve President Austan Goolsbee speaks.

- Federal Reserve Chair Jerome Powell speaks.

- Federal Reserve Chair Jerome Powell and Federal Reserve Board Member Lisa Cook speak with local leaders in Atlanta.

Prediction Market Crypto (Nov 20 – Nov 26)

In the world of cryptocurrency, recent events and historical patterns provide valuable insights into the general market outlook. One such case is that of CZ, which bears a resemblance to a similar incident in the past. Arthur Hayes, the founder of BitMEX, faced a similar situation when he had to resign as CEO in October 2020.

Moving forward to Q4/2021, Hayes is currently overseas, and BitMEX had to pay a significant sum of $100 million to resolve various issues. It’s worth noting that BitMEX was a renowned exchange during the previous bull market.

Interestingly, after Arthur Hayes’ resignation on October 8, 2020, Bitcoin (BTC) experienced a remarkable surge from $10.6k to $65k. This trend highlights the potential impact of leadership changes and their influence on market sentiment.

Another factor contributing to a bullish outlook is Binance’s decision to leave the US market. This move is expected to expedite the process of establishing a Bitcoin Spot ETF, which presents a massive opportunity that the US seeks to fully capitalize on. Once approved, this ETF will allow global citizens to invest in BTC through major US funds, thus bringing the price cycle even closer.

Furthermore, China’s recent decision to loosen its grip on BTC signals a trend where more countries are likely to accept and embrace cryptocurrencies. This development opens up new possibilities for the market as a whole.

In the world of cryptocurrency, recent events and historical patterns provide valuable insights into the general market outlook. One such case is that of CZ, which bears a resemblance to a similar incident in the past. Arthur Hayes, the founder of BitMEX, faced a similar situation when he had to resign as CEO in October 2020.

Moving forward to Q4/2021, Hayes is currently overseas, and BitMEX had to pay a significant sum of $100 million to resolve various issues. It’s worth noting that BitMEX was a renowned exchange during the previous bull market.

Interestingly, after Arthur Hayes’ resignation on October 8, 2020, Bitcoin (BTC) experienced a remarkable surge from $10.6k to $65k. This trend highlights the potential impact of leadership changes and their influence on market sentiment.

Another factor contributing to a bullish outlook is Binance’s decision to leave the US market. This move is expected to expedite the process of establishing a Bitcoin Spot ETF, which presents a massive opportunity that the US seeks to fully capitalize on. Once approved, this ETF will allow global citizens to invest in BTC through major US funds, thus bringing the price cycle even closer.

Furthermore, China’s recent decision to loosen its grip on BTC signals a trend where more countries are likely to accept and embrace cryptocurrencies. This development opens up new possibilities for the market as a whole.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.