Key Points:

- BlackRock had its 3rd meeting with the SEC to discuss the potential for a Bitcoin spot ETF.

- The Division of Trading & Markets and the Division of Corporate Finance were involved in these meetings.

- Other companies, including Grayscale, Franklin, and Fidelity, also met with the SEC to discuss Bitcoin ETFs.

BlackRock’s 3rd meeting with SEC to discuss the possibility of a Bitcoin spot ETF. Other issuers like Grayscale, Franklin, and Fidelity also had meetings with the SEC regarding their ETF proposals.

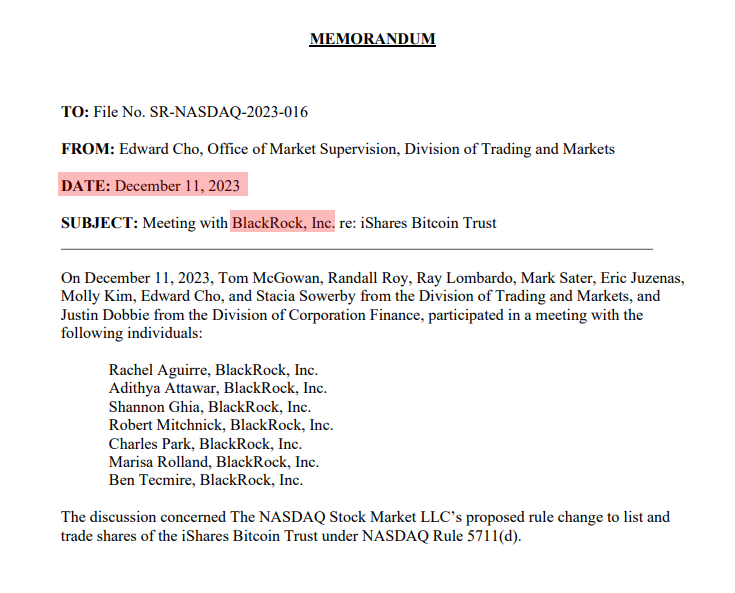

According to Bloomberg analyst James Seyffart, BlackRock recently had its third meeting with the U.S. Securities and Exchange Commission (SEC) to discuss the possibility of a Bitcoin spot exchange-traded fund (ETF). Bloomberg analyst James Seyffart revealed that all four ETF issuers, including BlackRock, had met with the SEC in the past few days.

Both the Division of Trading & Markets and the Division of Corporate Finance were present at these meetings, and they are the two divisions responsible for approving or denying the 19b-4’s & S-1’s related to the ETF applications.

The SEC’s Division of Corporation Finance aims to ensure that investors receive material information to make informed investment decisions and provides interpretive assistance to companies regarding SEC rules and forms. On the other hand, the Division of Trading and Markets establishes and maintains standards for fair, orderly, and efficient markets, regulating key participants such as broker-dealers, self-regulatory organizations, and transfer agents.

BlackRock’s 3rd Meeting With SEC

In addition to BlackRock, Grayscale, Franklin, and Fidelity also had meetings with the SEC. CoinCu reported that Fidelity’s Spot Bitcoin ETF was under active discussions with the SEC as well.

During a discreet meeting, Fidelity Investments presented the intricacies of its Bitcoin ETF application, focusing on “Bitcoin ETF Workflows” and emphasizing the significance of “in-kind” creation and redemption models.

Franklin Templeton also engaged in discussions with the SEC regarding its proposed Bitcoin spot ETF on December 8. CEO Jenny Johnson emphasized that clients are keenly monitoring Bitcoin for investment opportunities, noting the distinction between Bitcoin and blockchain technology.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.